The Expert Group is expecting GDP adjusted for sporting events to fall by 3.8 % in 2020 and unemployment to average 3.2 % over the year as a whole. Prospects for 2020 are therefore less negative than feared in the middle of the year. The momentum is likely to weaken as time goes on.

| Due to the relaxation of the health policy measures, the Swiss economy started to swiftly make up lost ground at the end of April, with both consumerand investment demandex-ceeding expectations in the second quarter. Short-time working was used much less than anticipated in June. Overall, the first half of 2020 is less negativethan assumed in the June forecast.

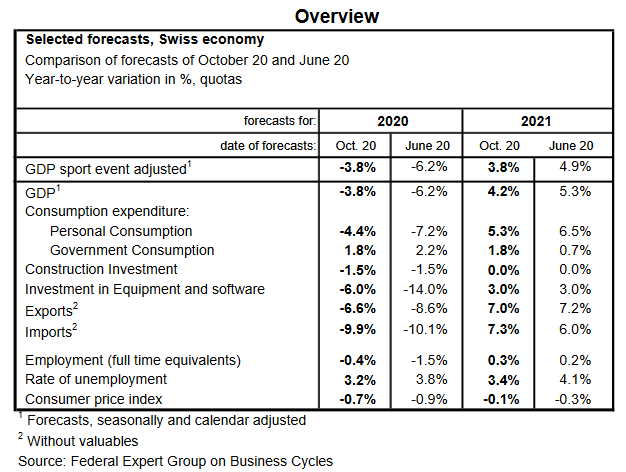

The Expert Group is expecting the Swiss economy’s recovery to have continued in the third quarter. Some sectors of the economy, including parts of the accommodation and food ser-vices, were supported by the low numbers of Swiss people travelling abroad. Other industries have not recovered as much due to greater dependence on the global economic cycle(such as parts of the manufacturing sector) or being more directly affected by the coronavirus pan-demic and the measures implemented (such as international tourism and major events). The economic recovery therefore remains incompleteand the previous year’s levels have not been reached in most sectors. In September, almost 50000 more people were unemployed than a year earlier. For 2020 as a whole, the Expert Group is anticipating a decline in GDP of 3.8% (June fore-cast: –6.2%).This would be the strongestdecrease in GDP since 1975.The labour market is expected to see further drops in employment and the average unemployment rate for 2020 is likely to be 3.2% (June forecast: 3.8%). As time goes on, the Swiss economy should continue to recover at a moderate pace. The Expert Group is expecting GDP adjusted for sporting eventsfor 2021to grow by 3.8%(June forecast: 4.9%). Switzerland’s economic output would therefore return to its pre-crisis level only towards the end of 2021, assuming that no further widespread lockdown is imposed in Switzerland or in key trading partner countries. Consumption expenditure and spending on investments within Switzerland should then recover gradually, despite the adverse effects of losses of income and the persistently high level of uncertainty. |

Comparison of forecasts of October 20 and June 20 |

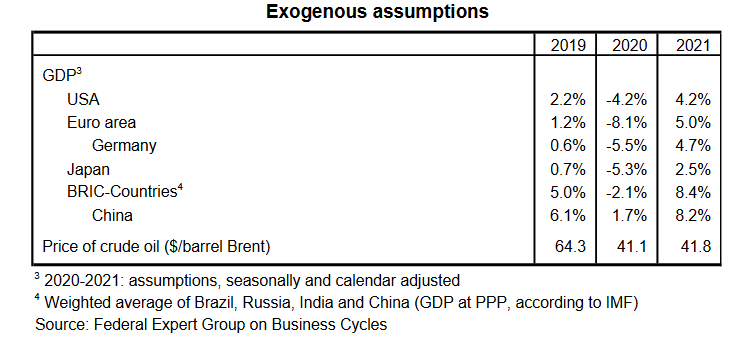

| In 2021, the international environment is set to be fairly varied. For example, the tourism-fo-cused southern European countries are likely to be hit particularly hard by the coronavirus crisis, while other countries, including the USA and Germany, are expected to recover more swiftly. Overall, the global economy should experience a halting return to pre-crisis levels, slowing the Swiss export segments that are sensitive to the economic cycle. Any improvement in the situation on the labour market is expected to be slow at best: unemployment is set to rise to an annual average of 3.4% in 2021 (June forecast: 4.1%), with employment only likely to see a minimal rise. |

Exogenous assumptions |

Economic risksThe most significant economic risks are still those linked to the coronavirus pandemic and the responses of economic players and politicians to the situation. On the one hand, the uncertainty could have a less negative impact on consumer and invest-ment behaviour than the forecast assumes, or could reduce considerably due tothe authori-sation of vaccines, for instance. A much more rapid economic recovery would then be ex-pected. On the other hand, the recovery would be interrupted in the event of renewed widespread business and border closures around the world. This would significantly increase the probabil-ity of second-round economic effects such as large numbers of job cuts and corporate insol-vencies. The risks linked to the continued rise in government and company debt would also grow. The international trade conflict posesfurther risks to the global economy. A «hard»Brexit, which appears more likely based on recent events, would be another blow to the fragile econ-omy. The risk of upheaval on the financial markets and further upward pressure on the Swiss franc also remains high. Finally, there is still a risk of more major corrections in the Swiss real estate sector. |

Monetary assumptions, Labor market forecasts |

Download press release: Forecast: 2020 economic slump less serious than feared

Tags: Featured,newsletter