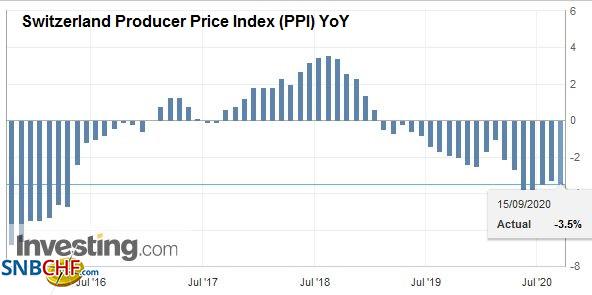

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued?

| 15.09.2020 – The Producer and Import Price Index fell in August 2020 by 0.4% compared with the previous month, reaching 97.9 points (December 2015 = 100). This decline was due in particular to lower prices for chemical and pharmaceutical products. Compared with August 2019, the price level of the whole range of domestic and imported products fell by 3.5%. These are the results of the Federal Statistical Office (FSO).

In particular, lower prices for pharmaceutical preparations were responsible for the decrease in the producer price index compared with the previous month. Basic chemicals and petroleum products also became cheaper. In contrast, rising prices were observed for paints, varnishes and similar coatings, printing ink and mastics as well as for raw milk. The import price index registered lower prices compared with July 2020, particularly for organic products of the chemical industry. Plastics in primary forms, petroleum and natural gas, petroleum products and other chemical products also showed falling prices. Non-ferrous metals and products made therefrom, basic iron, steel, plastic products and computers, on the other hand, became more expensive. |

Switzerland Producer Price Index (PPI) YoY, August 2020(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge |

Tags: Featured,newsletter,Switzerland Producer Price Index