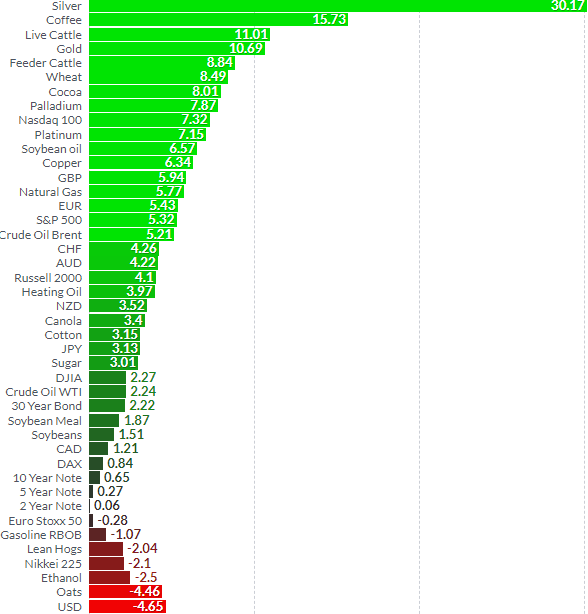

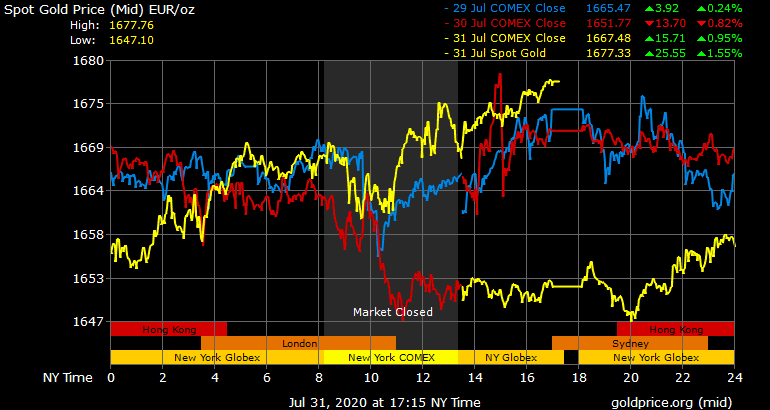

| Gold and silver are set for a 5% and 6% gain this week and a significant 11% and 30% gain in the month of July (see table below). Weakness is likely to be short term and shallow From MarketWatch: Gold prices ended lower Thursday, with bullion retreating from a record rally that had seen the precious metal notch nine consecutive days of gains. |

|

| The precious metal found support Wednesday following the Federal Reserve signaling it planned to keep the low interest rate environment in place for the foreseeable future as the U.S. economy recovers from COVID-19. Benchmark federal-funds futures rates stand at a range between 0% and 0.25%.

However, some analysts make the case that gold prices may be entering a period of consolidation following a historic run-up that has been at least partly prompted by the public-health crisis, but also exacerbated by a recent bout of weakness in the U.S. dollar and the low yields being offered by government debt. One measure of the dollar, the ICE U.S. Dollar Index is hanging around its lowest level in two years and the yield for the 10-year Treasury note is around 0.55%. As expected and forecast, gold has reached record highs near $2,000 an ounce and silver reached multi-year highs near $26 an ounce, but prices were “due a sharp correction,” said Mark O’Byrne, research director at GoldCore, based in Dublin. “Short-term weakness is very likely prior to a massive short squeeze that propels the precious metals to much higher levels,” he told MarketWatch Thursday. Gold is “quite likely” to climb to $3,000 in the next 12 months, and silver could rise to between $50 and $100. “Focus on value and not price—it is important investors focus on gold and silver’s value as hedging and safe haven assets rather than their nominal price highs in dollars,” said O’Byrne. |

Asset Performance in July 2020 (Finviz) |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,Featured