- Today, it’s all about the stimulus; the dollar remains under pressure

- Mnuchin and Pelosi kick off the first round of talks for the next stimulus package this afternoon; it’s another quiet day in terms of US data; Canada reports May retail sales

- EU finalized its recovery package; UK reported June public sector net borrowing; Hungary is expected to cut rates 15 bp to 0.60%

- Japan reported June national CPI and department store sales; RBA minutes were released; Korea reported weak trade data for the first 20 days of July

Today, it’s all about the stimulus. The EU finally finalized its recovery package, while US officials begin talks on the next round of fiscal stimulus. Economic data continue to come in on the weak side and global virus numbers continue to rise, but these negative developments have yet to dent markets sentiment.

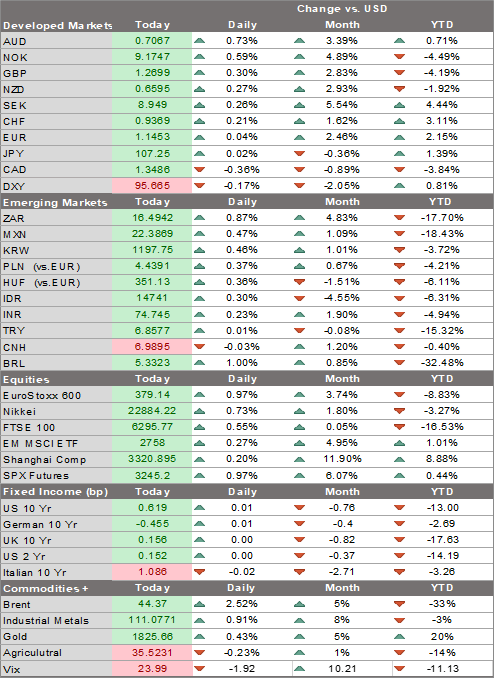

The dollar remains under pressure. DXY is trading at new lows for this move around 95.61 and is on track to test of the March low near 94.65. The euro is testing yesterday’s high for this move near $1.1470 and is on track to test the March high near $1.15. Recent price action whereby markets sell into dollar strength rather than buy the dollar dip supports our view that the market bias for the dollar is further broad-based weakness ahead.

AMERICAS

Treasury Secretary Mnuchin and House Speaker Pelosi kick off the first round of talks for the next stimulus package this afternoon. These two led talks for previous rounds, which means they know how to get a deal done. That said, the two sides remain far apart for what it is likely the last package before the November elections. Senate Democratic leader Schumer and White House Chief of Staff Meadows will also attend the talks. Mnuchin said this package will focus on “kids and jobs and vaccines. He and Meadows will meet with Senate Republicans earlier in the day to discuss strategy.

It’s another quiet day in terms of US data. June Chicago Fed National Activity Index will be reported, and it is expected at 4.00 vs. 2.61 in April. Due to the media embargo, there are no Fed speakers until Powell’s post-decision press conference.

Canada reports May retail sales. Headline expected to rise 20.0% m/m vs. -26.4% in April, while ex-auto are expected to rise 11.8%m/m vs. -22.0% in April. June CPI will be reported Wednesday. Headline is expected to rise 0.2% y/y vs. -0.4% in May, while common core is expected at to rise 1.3% y/y vs. 1.4% in May. Bank of Canada just met last week and left policy steady. It sounded relatively upbeat but warned of downside risks that likely require low interest rates for a very long time. Next policy meeting is September 9 and no change is expected then.

EUROPE/MIDDLE EAST/AFRICA

The EU finalized its recovery package. Final details matched reports yesterday that the two sides had compromised on the portion of the EUR750 bln total that would consist of grants at EUR390 bln. France and Germany had wanted this amount at EUR500 bln while the frugal nations had wanted EUR350 bln. It seems that the clincher was increased rebates for the frugal nations that reduced their net contributions by more than EUR50 bln over seven years. The money for the package will come out of the EU budget and loans will have to be repaid by 2058. Some taxes will be raised to help defray the costs, including a new tax on non-recycled plastic wasted and a possible digital tax.

Lack of a final deal yesterday led to some volatile trading in the euro. After making a new high for this move near $1.1470, the single currency lost nearly a cent before stabilizing and closing higher on the day. It has built on those gains today but has not yet made new highs. We get the sense that the euro wants to break higher but so far, recent efforts have been turned back. This is frustrating for euro bulls, but we do think the euro tests that $1.15 high from March in the coming days and goes on to test the January 2019 high near $1.1570.

The UK reported June public sector net borrowing. The budget deficit rose to -GBP35.5 bln, slightly lower than expected but still taking the total for the first three months of FY20 up to -GBP127.9 bln. Debt climbed to 99.6% of GDP, the highest since 1961. According to the Office of Budget Responsibility, the deficit will exceed -GBP370 bln for the entire fiscal year, or around -19% of GDP. Despite the likelihood of a flood issuance, much of the UK curve (1-year out to 7-year paper) is yielding negative and 10-year gilts are yielding 15 bp, near the lows of the year.

Bank of England Chief Economist Haldane sounded dovish yesterday. He noted that the bank still has room to ease and is reviewing the case for lower rates. The short sterling strip is pricing in very small odds of negative rates. We simply don’t think the UK goes negative, at least while the market is already doing the heavy lifting. That said, we do think that the need to prevent increased issuance from pushing gilt yields higher will lead the BOE to increase its asset purchases again by year-end.

National Bank of Hungary is expected to cut rates 15 bp to 0.60%. At its last meeting June 23, the bank unexpectedly cut the policy rate 15 bp to 0.75% but framed it as fine-tuning policy. Minutes show it was a unanimous decision. Since then, June inflation accelerated to 2.9% y/y, the highest since March but still below the 3% target and within the 2-4% target range. If price pressures continue to rise, we do not the bank will be able to ease much more after this week.

ASIA

ASIA

Japan reported June national CPI and department store sales. Headline inflation came in as expected and remained steady at 0.1% y/y, while ex-fresh food came in a tick higher than expected at flat y/y vs. -0.2% in May. Nationwide department store sales contracted 19.1% y/y vs. -65.6% in May, led by an improvement in Tokyo sales to -24.3% y/y from -71.6% in May. The BOJ does not see inflation returning to the 2% target until FY23 at the earliest and warned that consumption and exports are likely to come in weaker than expected. Data today pretty much underscore this outlook and suggests further stimulus may be needed. Preliminary July PMI readings will be reported tomorrow and will likely set the tone for other countries’ PMI readings later in the week.

RBA minutes were released. At the July 7 meeting, the RBA agreed there was no need to change its policy settings but did not rule it out if circumstances warranted. However, it said that negative rates remain “extremely unlikely.” The bank also saw no need to intervene in the FX market, noting limited effectiveness when currency moves are in line with the fundamentals. Elsewhere, Prime Minister Morrison announced that wage subsidies will be extended six months until the end of March but at a lower rate to the 3.5 mln workers currently in the program. Governor Lowe also spoke today and said he welcomed the extension, as they provide important support to workers and businesses. Lowe said that the outbreak in Melbourne is “very concerning” and that the RBA is watching it “very carefully.” He added that the fluid situation there has not yet worked through the full impact on the bank’s macro forecasts, but the full set will be updated next month.

Korea reported weak trade data for the first 20 days of July. Exports contracted -13.7% y/y vs. -10.9% in June, while imports contracted -12.8% y/y vs. -11.2% in June. If sustained over the course of the full month, the deterioration in the trade numbers from last month would be very disappointing. Despite the recovery in the mainland China economy, the region will still struggle to achieve stronger growth. Further stimulus measures are likely if the recovery continues to lag.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter