- Today marks a relatively quiet start to what is likely to be one of the most eventful weeks we’ve seen in a while; the dollar remains within recent well-worn ranges

- The US continues to ratchet up trade tensions; the only US data report today is the June budget statement

- ECB published intervention bands for Bulgaria and Croatia; incumbent President Duda will win in Poland

- Oil prices are under pressure from reports that OPEC+ may ease supply cuts; India reports June CPI

Today marks a relatively quiet start to what is likely to be one of the most eventful weeks we’ve seen in a while. Much of the action takes place later in the week, with BOJ and BOC meeting Wednesday and the ECB on Thursday.

Empire survey Wednesday gives markets the first snapshot for July, while June retail sales Thursday will provide an important look at the US consumer. OPEC+ meets Wednesday, followed by the first Q2 GDP reading from China Thursday. The EU summit Friday and Saturday caps off the week.

All of these potential drivers come as markets are grappling with still-rising virus numbers in the US. Taken in conjunction with resurgent numbers in many other countries, recent developments call into question the durability of the global economic recovery. With so many events impacting virtually all assets, we expect a volatile week ahead for the markets.

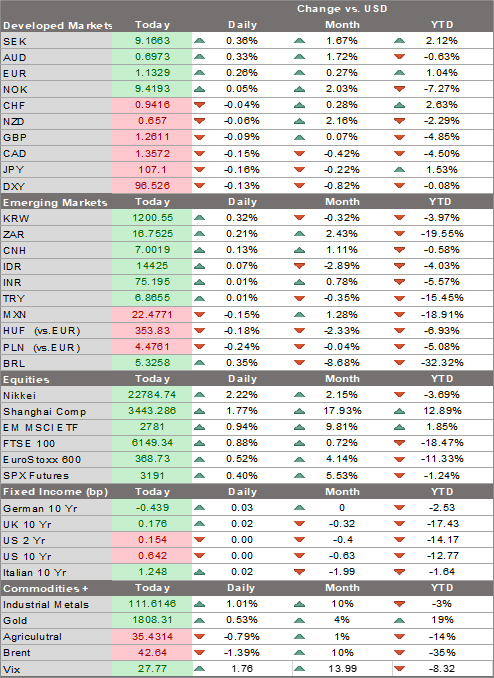

The dollar remains within recent well-worn ranges. DXY has for the most part traded between 96 and 98 since early June. Similarly, the euro has traded between $1.12 and $1.14 and sterling between $1.22 and $1.27 since early June. USD/JPY has traded within a 106-108 range since mid-June. Right now, the dollar is pretty much in the middle of all these trading ranges. We look for continued swings in market sentiment this week as markets grapple with the conflicting drivers of improved economic data and the likely impact of rising virus numbers.

AMERICAS

The US continues to ratchet up trade tensions. Officials confirmed the US would go ahead with the $1.3 bln tariffs against French goods as retaliation against the “internet tax” that would disproportionately hurt US companies (FANGS). This was widely expected and comes ahead of likely tariffs coming from the Boeing-Airbus dispute. On the China front, we continue to see strong comments about banning the Chinese social media app TikTok, characterizing it as “information war.”

Moreover, President Trump seemed to dismiss the possibility of a Phase Two trade deal with China because the relationship has been “severely damaged.” This should be no surprise as we don’t think many investors expected another substantial trade deal, let alone one on this side of the US elections. Also, China has retaliated against the US sanctions on officials related to the Xianjian tensions, targeting US Senators Marco Rubio and Ted Cruz and a couple of House representatives.

The only US data report today is the June budget statement. Consensus sees a -$863 bln deficit vs. -$398.8 bln in May. If so, this one month would nearly eclipse the deficit for all of FY2019 and would bring the 12-month total to another record high of nearly -$3 trln. The deficits are likely to get larger, as lawmakers are set to discuss the next $1 trln round of stimulus when they return from recess next Monday. For now, US Treasury market has been able to absorb the increased issuance, with more than a little help from the Fed. Elsewhere, Fed speakers today include Williams and Kaplan.

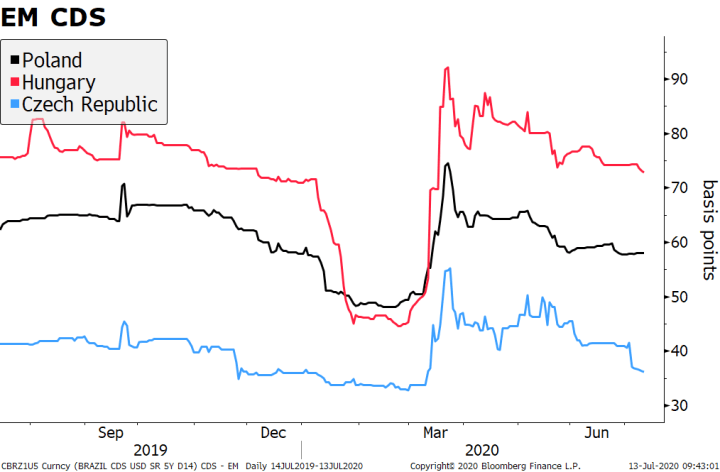

EUROPE/MIDDLE EAST/AFRICAThe ECB published the intervention bands for Bulgaria and Croatia. The two have joined ERM-2, which compels them to maintain their exchange rates within the +/- 15 percentage point intervention band around their central parities o f1.95583 and 7.53450 per euro, respectively. After a successful year in ERM-2, Bulgaria and Croatia would become the 20th and 21st members of the eurozone. In contrast to the pending loss of the UK from the EU, the eurozone has yet to lose any member and in fact continues to grow. It looks as if the incumbent President Duda will win in Poland. While not official, the right-wing Populist is set to get 51% of the votes. This means continued friction with the EU going forward, and (from a market’s point of view) a missed opportunity for a more moderate Polish government. There has been no sustained market reaction, with the main Polish equity index up 0.6%, in line with the broader market trend, and zloty is little changed against the euro. CDS prices have also not budged, with Poland trading in between Hungary and Czech Republic for the last couple of months. |

EM CDS, 2019-2020 |

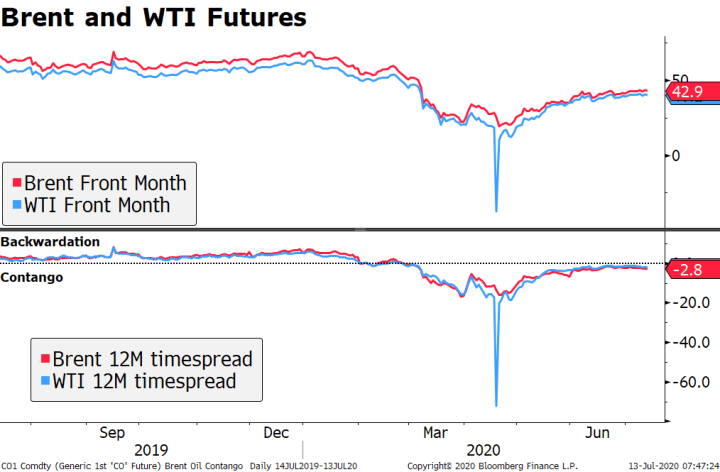

| Oil prices are under pressure from reports that OPEC+ is considering easing its supply cuts. More ample supply could come as soon as August, with some delegates reportedly unwilling to extend the cuts for the second straight month at its meeting this Wednesday. The original plan agreed to in April was to taper the cuts at the end of June to 7.7 mln bbl/day at the end of 2020. In June, OPEC+ decided to extend the cuts through the end of July. Brent and WTI futures are down over 1% today, though oil prices are up some 5% over the last couple of weeks and the curve has largely normalized – i.e. no longer in the deep contango seen earlier in the year. |

Brent and WTI Futures, 2019-2020 |

ASIAIndia reports June CPI. Headline inflation is expected at 5.30% y/y vs. 5.84% in May. If so, it would be the lowest since October and move further within the 2-6% target range. This will be followed by June WPI tomorrow, which is expected to fall -2.40% y/y vs. -3.21% in May. Next RBI meeting is August 6 and another cut is expected then after cutting 40 bp at the last meeting May 22. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter