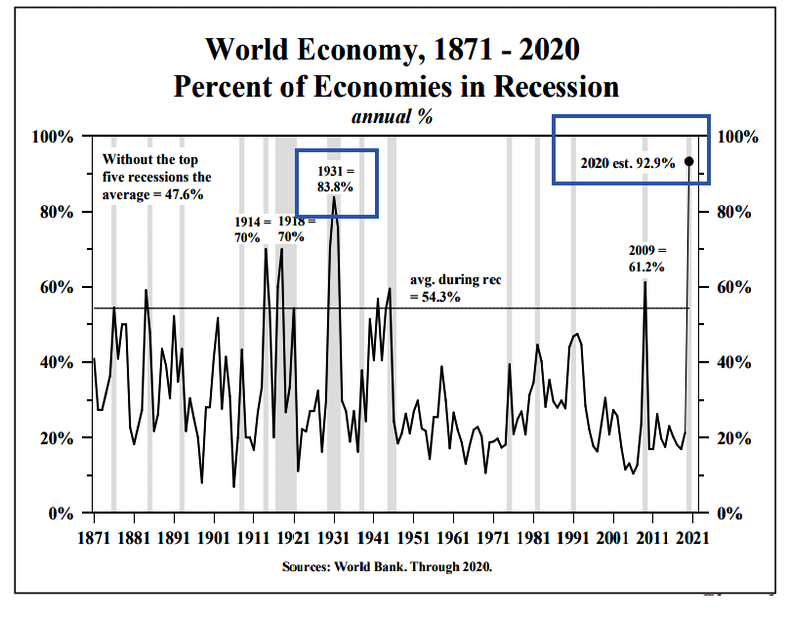

The global recession is an unprecedented recession synchronization.

Deflationary ConsequencesLacy Hunt at Hoisington Management explains the deflationary consequences of the current global situation in its Second Quarter 2020 Review. Hunt commented on the four economic challenges central bankers face as noted below. Four Economic Challenges

Here are ten key ideas (my estimation) condensed from the article. |

Percent of Economies in Recession, 1871-2021 |

Key Concepts

- Recessions are either deeper or longer lasting when a very high percentage of the world’s economies are contracting rather than when they are centered on a limited number of countries.

- Except for the very short run, the Federal Reserve’s lending operations for the corporate bond market are a negative for economic growth. The BOJ (Bank of Japan), ECB (European Central Bank) and the People’s Bank of China (PBOC) have all been buying corporate debt of failing entities for more than a decade with the BOJ doing so for more than 25 years. These operations have provided a fleeting lift to economic activity, but at the end of the day they resulted in misallocation of credit, poor economic growth and disinflation/deflation.

- By keeping failing players in the game, this prevents the process Joseph Schumpeter called “creative destruction” as well as “moral hazard”, thereby eliminating these critical factors that make free market economies successful.

- The adverse consequences of an unsurpassed increase in new debt will remain for years to come. Four great past economists – Eugen Bohm Bawerk, Irving Fisher, Charles Kindleberger and Hyman Minsky – all captured the two-edged nature of debt being an increase in current spending in exchange for a decline in future spending unless the debt generates an income stream to repay principal and interest.

- The relationship between debt and economic growth is non-linear, just as is the law of diminishing returns. Significant research indicates that the adverse consequences start as low as a 67% gross debt to GDP ratio.

More Key Concepts

- A recent Brookings Institute study posits the pandemic will lead to 300,000- 500,000 less births next year. For 2019, population growth in the U.S. and the world, was already the slowest since 1918 and 1952.

- In the first quarter, corporate debt jumped to a record 48.7% of GDP, more than 300 basis points higher than during the Lehman crisis

- In 1934, Irving Fisher wrote that the velocity of money falls in heavily indebted economies. We believe that Fisher’s finding will be correct because his view is supported by the evidence and the rationale that the huge additional debt added this year will not generate an income stream to repay principal and interest. Accordingly, the reopening rebound in the economy underway will falter, leaving the economy with a huge output gap.

- At the end of the three worst recessions since the 1940s, the output gap was 4.8% in 1974, 7.9% in 1982 and 6.4% in 2009. The gap that existed after the recession of 2008-09 took nine years to close. This was the longest amount of time to eliminate a deflationary gap.

- Considering the depth of the decline in global GDP, the massive debt accumulation by all countries, the collapse in world trade and the synchronous nature of the contracting world economies the task of closing this output gap will be extremely difficult and time consuming. This situation could easily cause aggregate prices to fall, thus putting persistent downward pressure on inflation which will be reflected in declining long-dated U.S. government bond yields.

Conclusion

Nearly all economists expect a huge jump in inflation associated with the Fed’s massive balance sheet expansion and government fiscal stimulus.

However, I side with Lacy Hunt.

My Reasons

- The demand destruction from Covid will last for years.

- Demand destructuction is greater than Covid stimulus.

- Buildup up debt is inherently deflationary.

- Demographics are deflationary.

- By bailing out failed corporations, the Fed is creating more and more zombies.

Unwanted Inflation Easy to Find

Actually, inflation is easy to find. Look no further than the stock and bond markets.

The Fed’s balance sheet expansion coupled with trillions of dollars of fiscal stimulus (both unprecedented) has resulted in stock market speculation also at unprecedented levels exceeding the housing bubble boom in 2008.

Six Related Articles

- Banks Double Loan Loss Reserves ‘Everybody Is Struggling’

- Housing Starts and Permits Improve But Not Enough

- Cass Transportation Index “Not Good By Any Measure”

- China’s Unexpectedly Strong Growth Isn’t What it Seems

- All Continued Unemployment Claims Top 32 Million Again

- Work-From-Home Will Reduce Driving by 270 Billion Miles Per Year

Conclusion

Inflation is not where the Fed wants it.

The Fed can print money and Congress can hand it out, but neither can dictate where the money goes.

In 2020, money has found a home in rampant speculation in stocks and bonds. In 2008 money primarily went into a housing bubble.

But bubbles burst. Thus, speculation too is inherently deflationary.

The post Shedlock: Unprecedented Recession Synchronization appeared first on RIA.

Full story here Are you the author? Previous post See more for Next post

Tags: Economics,Featured,newsletter