| A resurgent coronavirus pandemic in the United States and the prospect of improving growth abroad are souring some investors on the dollar, threatening a years-long rally in the currency.

The dollar index is off 6% from its recent highs, while net bets against the currency in futures markets stand near their highest level since 2018. A decline in the dollar earlier this week set off a technical formation known as a “Death Cross,” which occurs when the 50-day moving average crosses below the 200-day moving average, according to analysts at BofA Global Research. The U.S. currency’s weakness comes amid criticism over the government’s response to the coronavirus pandemic and protests over racial inequality that has eroded support for President Donald Trump months before the Nov. 3 presidential election You can read the full article here |

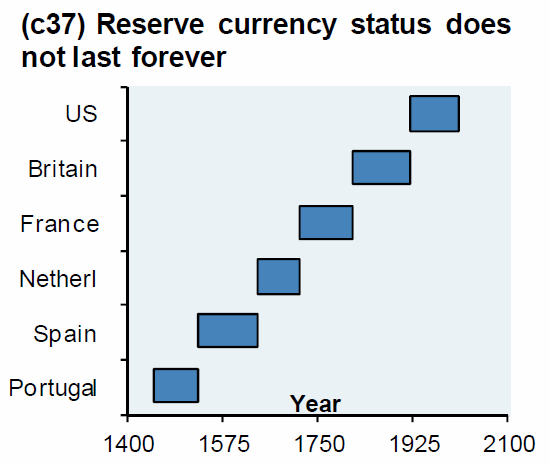

Reserve currency status does not last forever Source: Reuters - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,Featured,newsletter