- Concerns about still rising infection numbers and a second wave ofCovid-19 have contributed to today’s downdraft in risk assets; for now, the weak dollar trend is hard to fight

- Despite delivering no change in policy, the Fed nonetheless sent an unequivocally dovish signal; stocks have not reacted well to the Fed; weekly jobless claims and May PPI will be reported

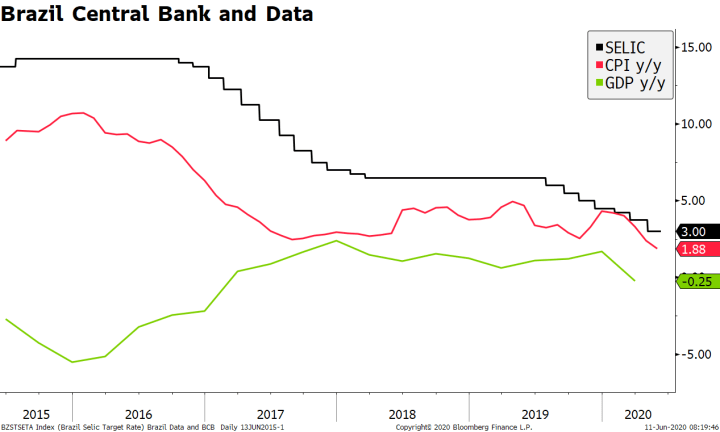

- Peru is expected to keep rates steady at 0.25%; Brazil inflation data supports a 75 bp cut next week

- The Brexit outlook remains grim; Italian April IP fell -19.1% m/m

- Reports suggest the Bank of Japan is likely to remain on hold next week; officials can’t be happy with recent yen strength

The dollar is firmer against the majors as risk-off sentiment picks up in the wake of the FOMC decision. Swissie and yen are outperforming, while Aussie and Nokkie are underperforming. EM currencies are mostly weaker. MYR and THB are outperforming, while MXN and ZAR are underperforming. MSCI Asia Pacific was down 1.8% on the day, with the Nikkei falling 2.8%. MSCI EM is down 1.1% so far today, with the Shanghai Composite falling 0.8%. Euro Stoxx 600 is down 2.1% near midday, while US futures are pointing to a lower open. 10-year UST yield is down 3 bp at 0.70%, while the 3-month to 10-year spread is down 2 bp at +54 bp. Commodity prices are mostly lower, with Brent oil down 3%, WTI oil down 3%, copper down 0.9%, and gold down 0.4%.

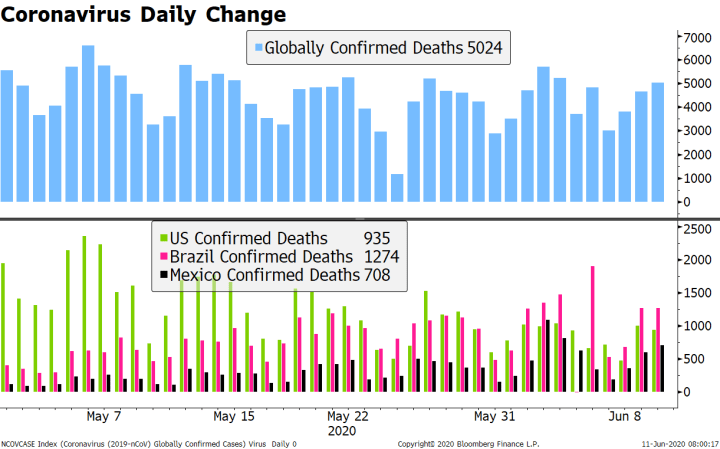

| Concerns about still rising infection numbers and a second wave of Covid-19 have contributed to today’s downdraft in risk assets. The case count continues to rise globally and in several US states that have reopened, though the causal relationship here is still unclear. The global death count has picked up in the last few days but remains roughly close to the 5,000 level. Still the, locus of concern has shifted from developed to EM countries, with Brazil and Mexico still facing a dire outlook.

For now, the weak dollar trend is hard to fight. DXY is stabilizing around 96 but given the recent momentum, it looks likely to test the March low near 94.65. Likewise, the euro appears likely to test its high from March 9 near $1.15, while sterling appears likely to test its high from the same day near $1.3200. USD/JPY is trading at the lowest level since May 14 and is on track to test the May low near 106. |

Coronavirus Daily Change, 2020 |

| AMERICAS

Despite delivering no change in policy, the Fed nonetheless sent an unequivocally dovish signal. Fed Chair Powell summed up the Fed’s stance in one succinct sentence: “We’re not thinking about raising rates or thinking about thinking about raising rates.” We discuss what the Fed could have done, did do, and could do in the future in our piece This Is What It Sounds Like When Doves Cry. True to form, the dollar sold off yesterday. Further losses are likely near-term, please see Our Latest Thoughts on the Dollar. Stocks have not reacted well to the Fed. The Dow Jones fell 1% yesterday and futures are pointing to 2% down open. In turn, the Nikkei fell nearly 3% overnight while the DAX and FTSE 100 are both down around 2% near midday. What gives? It probably goes back to our view that while the liquidity story remains overwhelmingly positive, the fundamental outlook remains cloudy. Powell presented a very sobering view of the US outlook yesterday, emphasizing the long road to recovery ahead. The fact that the Fed is prepared to keep rates at current levels near zero through 2022 is telling us that there is no V-shaped recovery in the cards. This dose of much-needed reality has certainly caught the market’s attention today. Weekly jobless claims will be reported. Continuing claims data are giving a better picture of the labor market than the initial claims. For the May survey week containing the 12th of the month, continuing claims fell -4.1 mln and in hindsight was a warning that markets were being too pessimistic about the May jobs data. This week, continuing claims are expected to fall -1.49 mln after rising 649k the previous week, while weekly initial jobless claims are expected to rise 1.55 mln vs. 1.877 mln the previous week. May PPI will also be reported. Headline is expected to remain steady at -1.2% y/y, while core is expected to rise 0.4% y/y vs. 0.6% in April. Yesterday, both core and headline CPI came in lower than expected at 0.1% y/y and 1.2% y/y, respectively. There are no direct policy implications, but ongoing disinflation should give the Fed confidence to maintain its ultra-dovish stance. Peru central bank is expected to keep rates steady at 0.25%. Inflation was 1.8% y/y in May, which is in the bottom half of the 1-3% target range. For now, we believe the central bank is on hold, waiting to see how past monetary easing and fiscal stimulus take hold before moving further. The recovery in copper and gold prices should also help underpin the economy once the lockdowns pass. April trade data will be reported too. Brazil May IPCA inflation rate came in at -0.38% m/m and 1.88% y/y. These readings were close to expectations and consolidate expectations for another large rate cut next week. With little inflation threat or economic recovery in sight, we side with market consensus in calling for a 75 bp cut next Wednesday, bringing the SELIC rate to a record low 2.25%. The recent appreciation of the currency makes us even more confident on this call, though it was a necessary condition for it. |

Brazil Central Bank and Data, 2015-2020 |

EUROPE/MIDDLE EAST/AFRICA

The Brexit outlook remains grim. Reports suggest EU officials unanimously rejected demands to change chief negotiator Barnier’s mandate in order to allow him to offer more concessions to the UK. The memo also acknowledged “limited progress” in negotiations so far and called for increased preparedness for a potential hard Brexit at year-end. EU officials later acknowledged that the timing of a call between UK Prime Minister Johnson and EU leaders remains uncertain.

Our faithful readers know that we believe markets are still underpricing the risks of a hard Brexit. While an extension beyond the December 31 deadline is still our base case, the odds of a hard Brexit are getting uncomfortably high, perhaps somewhere in the neighborhood of 30-35%. While we acknowledge that the dollar is likely to remain under pressure near-term, Brexit risks should keep sterling as an underperformer.

Italian April IP fell -19.1% m/m vs. -24.0% m/m expected. The y/y rate came in at a whopping -40.7% (-42.5% WDA). Note that in April, German IP fell -17.9% m/m while French IP fell -20.1%. The eurozone-wide measure will be reported Friday and is expected to fall -19.0% m/m vs. -11.3% in March. Given the dire outlook presented by the ECB last week, we may not see much improvement in May.

ASIA

Reports suggest the Bank of Japan is likely to remain on hold next week. This comes as no surprise, as there are two rounds of fiscal stimulus in the pipeline and policymakers would probably like to gauge the impact before injecting fresh monetary stimulus. For now, Yield Curve Control is in place and working while the benefits of taking rates more negative remain questionable. Furthermore, the economy has begun emerging from lockdowns and so it makes perfect sense to take a wait and see approach. The BOJ may tweak its loan programs in the coming weeks. Since details were just released at the May 22 meeting, it seems too soon to make any changes at next week’s meeting.

Officials can’t be happy with recent yen strength. However, we do not think the exchange rate is at levels yet that cause real concern. USD/JPY is on track to test the 106 low from early May. However, the key level to watch is 105.20. This represents the 62% retracement objective of the March rally and so a break below would set up a test of the March 9 low near 101.20.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,newsletter