We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

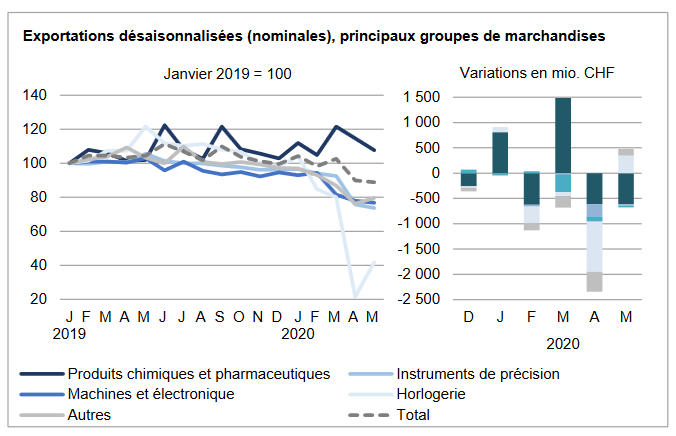

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

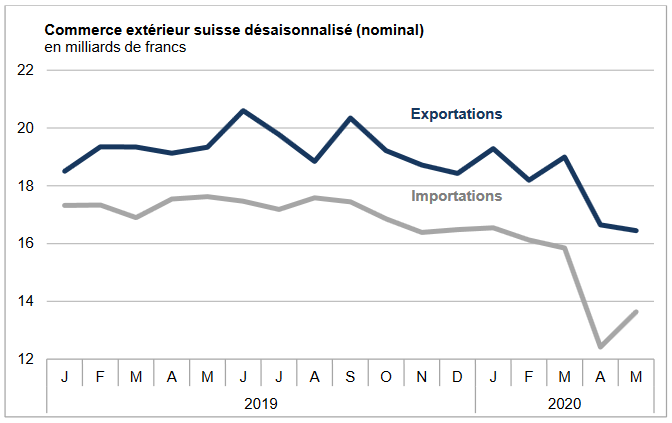

Exports and Imports YoY DevelopmentAfter its historic setback of the previous month, foreign trade recovered a few colors in May 2020. Imports posted a seasonally adjusted increase of 9.8% to 13.6 billion francs; however, they are still below their March 2020 level. Although exports fell again (-1.2%), they eased compared to April. The trade balance closed with a surplus of 2.8 billion francs. In short ▲ Increase in trade with Europe ▲ Watchmaking: exports have doubled, but remain at a low level ▼ Chemistry-pharma: decline in both directions of traffic |

Swiss exports and imports, seasonally adjusted (in bn CHF), May 2020(see more posts on Switzerland Exports, Switzerland Imports, ) |

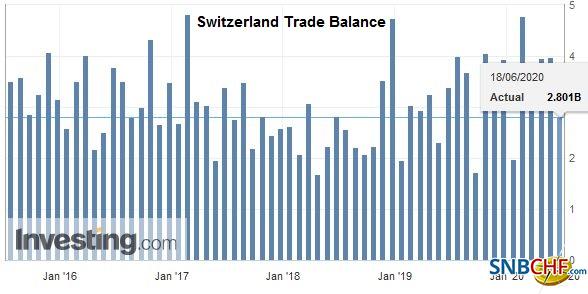

Global evolutionIn May 2020, exports registered a further decline (-1.2%; real: -0.2%), which however was less virulent than the previous month. Exports contracted from 201 million francs to 16.4 billion francs. For their part, imports rebounded clearly after their historic plunge of the previous month. They indeed increased by 9.8% (+1.2 billion francs; real: + 13.0%), however, settling at a level (13.6 billion francs) still significantly lower than that of March 2020 The trade balance closed with a surplus of 2.8 billion francs. |

Switzerland Trade Balance, May 2020(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

Third consecutive monthly decline in exports to Asia

|

Swiss Exports per Sector May 2020 vs. 2019(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) |

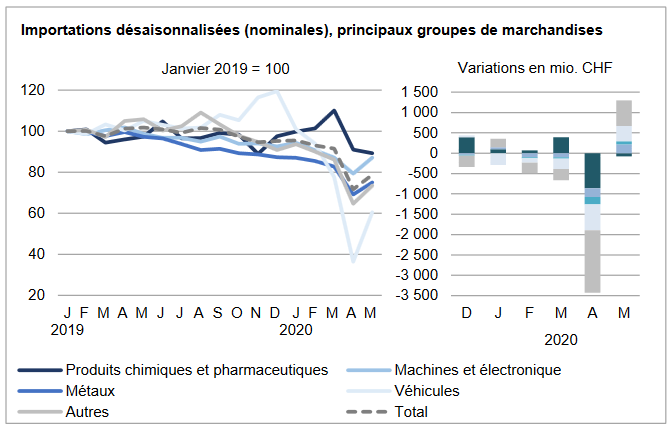

Imports: broadly sustained rebound

|

Swiss Imports per Sector May 2020 vs. 2019(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) |

Tags: newsletter,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance