- Markets remain unsettled even as policymakers worldwide continue to take aggressive emergency measures; the dollar continues to power higher

- Fed rolled out another crisis-era program last night; US Senate passed the House virus relief bill by a 90-8 vote

- ECB held an emergency call last night and announced an additional bond purchase program to the tune of €750 bln that now includes commercial paper

- SNB kept rates steady at -0.75% as expected; BOJ continues to flood the market with liquidity

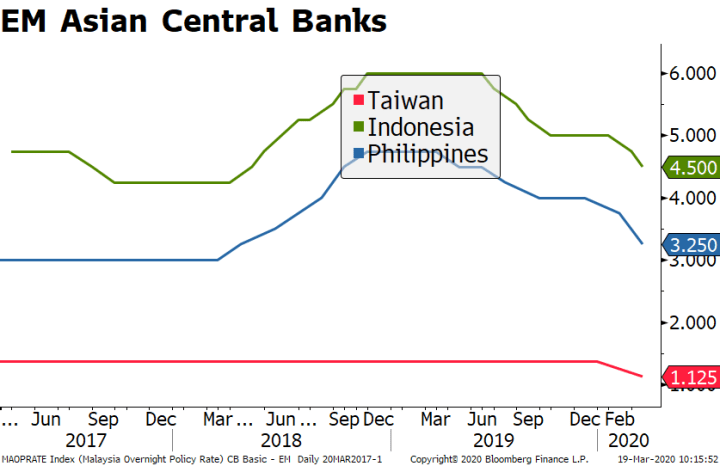

- RBA delivered another emergency 25 bp cut and started Yield Curve Control; there was another wave of rate cuts by EM Asian central banks

| The dollar is broadly firmer against the majors as markets remain unsettled despite more emergency measures worldwide. Loonie and sterling are outperforming, while the Scandies are underperforming. EM currencies are broadly weaker.

RUB and PHP are outperforming, while MXN and IDR are underperforming. MSCI Asia Pacific was down 2.8% on the day, with the Nikkei falling 1.0%. MSCI EM is down 3.0% so far today, with the Shanghai Composite falling 1.0%. Euro Stoxx 600 is down 0.2% near midday, while US futures are pointing to a lower open. 10-year UST yields are down 4 bp at 1.15%, while the 3-month to 10-year spread is down 5 bp to stand at +115 bp. Commodity prices are mostly lower, with Brent oil up 6.3%, copper down 4.5%, and gold down 0.6%. |

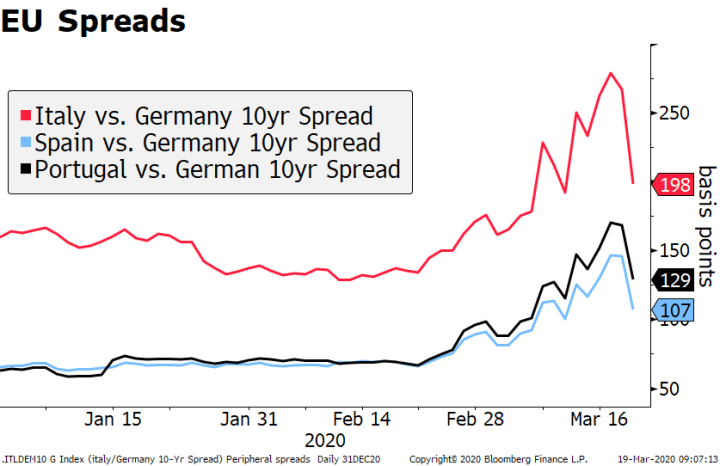

Credit Risk Rising, 2019-2020 |

| Markets remain unsettled even as policymakers worldwide continue to take aggressive emergency measures. Of note, the US 3-month yield has gone negative for the first time ever. The situation in funding markets is looking mixed. FRA-OIS spreads have widened somewhat, suggesting ongoing concerns about counterparty risk in the US banking system. Global funding markets remain tense, but we have only seen a significant widening of the yen cross-currency basis swap; the euro’s measure continues to improve. |

Cross Currency Basis Swaps, 2020 |

| The dollar continues to power higher. DXY broke above the April 2017 high near 101.34 and so the next target is the March 2017 high near 102.26 and then the January 2017 high near 103.82. Cable broke below the October 2016 low near $1.1840 and so we have to go back to February 1985 for the next target of $1.0520. For the euro, a break below the February low near $1.0780 would set up a test of the April 2017 low near $1.0570. USD/JPY continues to rise despite the risk-off backdrop and is on track to test the February 20 high near 112.25.

AMERICAS The Fed rolled out another crisis-era program last night. The Money Market Mutual Fund Liquidity Facility was re-launched to create a back-stop for money market funds. With demand for cash rising, the Fed said the new facility would assist those funds “in meeting demands for redemptions by households and other investors, enhancing overall market functioning and credit provision to the broader economy.” The facility will provide short-term loans to those mutual funds and is supported by the US Treasury, which will guarantee up to $10 bln of loans. Elsewhere, the NYSE announced plans to temporarily move to fully electronic trading. The US Senate passed the House virus relief bill by a 90-8 vote. It will provide paid sick leave, increased food assistance, and financial assistance for coronavirus testing. Lawmakers will immediately begin work on a second one that has been estimated to be as large as $1.3 trln and includes so-called helicopter money. Republican Senator Collins said they hope to vote on the bill this weekend. Elsewhere, senior White House economic advisor Kudlow said the government may take equity stakes in companies receiving coronavirus aid. The regional Fed manufacturing surveys for March continue rolling out. Philly Fed survey will be reported and it is expected at 8.0 vs. 36.7 in February. Empire survey came out Monday at -21.5 vs. 3.0 expected and 12.9 in February. Manufacturing had just begun to recover from the US-China trade war, but the outlook has gotten worse. US also reports Q4 current account data, along with February leading index. Weekly jobless claims for the BLS survey week containing the 12th of the month (220k expected) really won’t tell us much, as the surge in jobless claims due to virus-related shutdowns really intensified the following week. |

EU Spreads, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

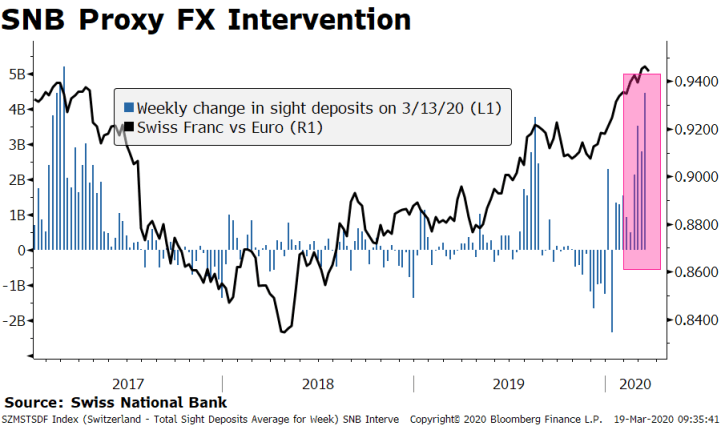

The ECB held an emergency call last night and announced an additional bond purchase program to the tune of €750 bln that now includes commercial paper. Lagarde said there were “no limits to our commitment to the euro.” The bank also eased collateral standards and will consider lifting the limits on QE holdings. Is this Lagarde’s whatever it takes moment? If Italian spreads and equity markets are any indication, the verdict is so far favorable. Keeping yields low will be a tremendous help in reducing costs of the massive fiscal effort to come, especially in Italy. Governing Council member Villeroy later stressed that “Debt markets are our priority, because in the short term they are the most important for financing the economy.” Swiss National Bank kept rates steady at -0.75% as expected. However, it said it will step up its FX intervention as the Swiss franc “is even more highly valued.” The banks spent some CHF13 bln in FX intervention last year to keep the franc from appreciating and has been active again. Commercial bank’s cash deposits at the SNB, a proxy measure for intervention, has been increasing sharply over the last few weeks. According to the statement, “negative interest and interventions are necessary to reduce the attractiveness of Swiss franc investments and thus counteract the upward pressure on the currency.” The Swiss franc has appreciated about 3% against the euro is 0.5% weaker against the dollar this year. Like the ECB and BOJ last week, the SNB is clearly reluctant to take rates more negative. It even reduced “the negative interest burden on the banking system” by adjusting its exemption factor to 30 from 25. However, SNB head Jordan said further rate cuts are possible if needed. The Swiss government said it would discuss and announce more crisis measures Friday. |

SNB Proxy FX Intervention, 2017-2020 |

| ASIA

The BOJ continues to flood the market with liquidity. It offered JPY2 trln in an unscheduled operation, and also offered to buy JPY300 bln of 5-10yr JGBs. USD/JPY traded at the highest level since February 28 following huge demand around the Tokyo fix, and is attempting to stabilize above 200-day moving average near 108.25. Tomorrow is a holiday in Japan, so it seems that the market wanted to be long dollars over the long weekend. Japan reported February national CPI. Headline came in lower than expected at 0.4% y/y, while ex-fresh food came in at the consensus 0.6% y/y. Both readings slowed from January. The RBA delivered another emergency 25 bp cut, taking the cash rate to the lower bound of 0.25%. The bank also introduced so-called Yield Curve Control, targeting the 3-year yield at 0.25%. It also pledged to keep these policies in place until it sees progress on jobs and inflation. Yet the 10-year yield rose 23 bp to 1.41%. Governor Lowe provided a little boost to AUD by commenting that FX trading has become disorderly and that the RBA would intervene if current patterns continue. Australia reported February jobs data, with total jobs up 26.7k vs. 6.3k expected. The breakdown was not so good, as there were only 6.7k full-time jobs and 20k part-time jobs created. Unemployment fell to 5.1% from 5.3% in January. There was another wave of rate cuts by EM Asian central banks overnight. The Philippines cut rates 50 bp to 3.25%, to go along with the government’s $528 mln stimulus package. Indonesia cut rates 25 bp to 4.5% following the government’s multiple stimulus package, the latest one worth $1.8 bln. Lastly, Taiwan cut its benchmark rate 25 bp to 1.125%, along with a cut of the same magnitude to the secured loan rate to 1.50%. This is Taiwan’s first move in four years. |

EM Asian Central Banks, 2017-2020 |

We also saw FX intervention from both the BOK and BI. USD/KRW hit the highest levels since 2009 and the next target is the July 2009 high near 1316.50. USD/IDR does not have a great deal of resistance between the day’s high (16230) and the 1998 high around 16950. USD/SGD is testing the 2017 high near 1.4547 and MAS may have to widen the $NEER band or make a more fundamental adjustment. The BOK was on the wires noting the excessive nature of the move vs fundamentals, but this is not a fundamental driven environment and so the impact was muted. A national fund will be created to stabilize domestic Korean securities, and there was a further program announced to support small businesses.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,newsletter