|

I should know better than to make declarative all-or-none statements like this. I said there isn’t any data which comports with the idea of a global turnaround, this shakeup in sentiment which since early September has gone right from one extreme to the other. Recession fears predominated in summer only to be (rather easily) replaced by near euphoria (again). Narrative yes, sentiment maybe, data nope. The vast majority of the economic accounts, anyway. There are a few which might suggest things are turning around. Another one (not quite two) was added to the positive side of the divide late last night. The Baltic Dry Index (BDI) has had a rough run of late. Shipping rates on the most important commodity routes, which the index measures, have been down sharply particularly late in December and to begin January. BDI last week experienced its worst day since 2008.

That was the good news, apparently. Mercantile traders had booked passages and capacities to get their products into whichever country before whatever levies took effect. The small rush in activity had pushed shipping rates up modestly. Now they’re down again in the aftermath. |

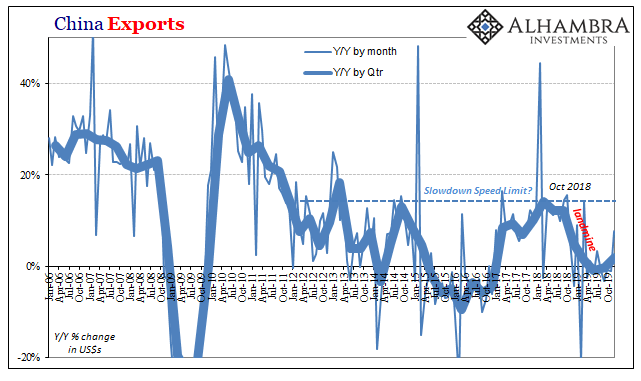

China Exports, 2006-2019(see more posts on China Exports, ) |

But is this good news signaling a bottom in rates, therefore the “trade wars” and thus the global economic downturn?

It is also possible that any recent upturn in sentiment or those few data series were related to this phenomenon. It had happened before, this sugar-high front-running effect, in 2018. The Baltic Dry Index is not the data Richard Clarida is looking for to back up his claim global headwinds and deflationary pressures must be abating. Instead, China’s General Administration of Customs reported in the wee hours of the American nighttime that Chinese exports had grown by 7.6% year-over-year in December 2019. It was the first increase since July and the largest going back to March. Not only that, the rise last month was enough to turn Q4 positive (+1.9%) as a whole (year-over-year) after two straight quarters of small negatives. It could be that this is the start of the global turnaround (which wouldn’t be anything more than Reflation #4 setting the world up for yet another false dawn that won’t dawn on everyone for a few more wasted years down the road). After all, if worldwide economic demand is picking up the Chinese would be among the first to gain from it and have it show up in their trade figures. Then again, see: BDI. If any of the data is leaning in the direction of Reflation #4 that would have to be what was coming into China during December. Imports were up an impressive 16.3% last month. It was the largest gain (by far) in 14 months, and it turned the comparison for the whole quarter positive for the first full-quarter increase since the last one of 2018. |

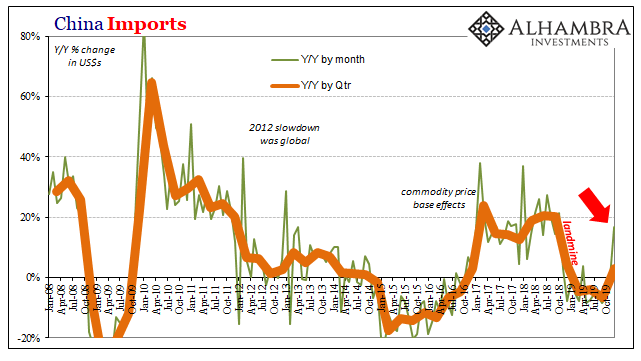

China Imports, 2008-2019(see more posts on China Imports, ) |

| Coming in at near 20% would be consistent with what could be the first step on the road to a global turnaround.

If there is any problem with China’s December imports, there’s the small(er) chance of the same sort of front-running behavior as with BDI and China exports. There’s also the small matter of seeing if anyone’s exports (into China) can be found to equal or even hint at what the General Administration of Customs there says. And that goes toward what is a bigger problem: the lack of conviction in commodities (even copper). According to the World Bank’s Pink Sheet commodity indices, non-energy base metals turned positive (year-over-year) in November and accelerated in December. |

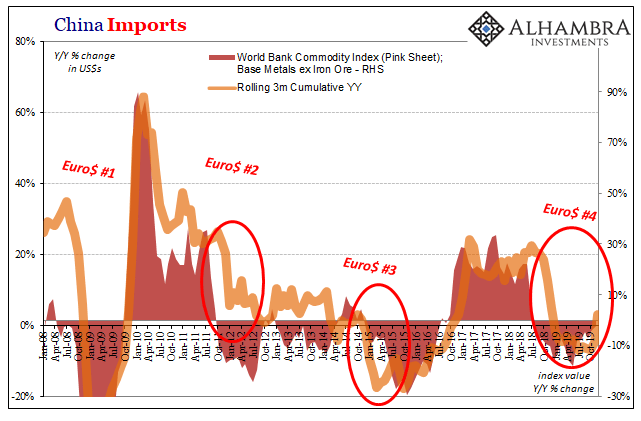

China Imports, 2008-2019(see more posts on China Imports, ) |

| Inflection? Not likely. Nearly all of it was due to global food prices (up a painful 10% annual rate in December).

Pork, as the Chinese want desperately to get their hands on, and vegetables, specifically onions, as the Indians struggle through the late monsoon. Raw materials prices were only slightly positive, while more economically sensitive non-ferrous base metal prices continued their deflation, in December prolonging this latest stretch to 17 months. It is possible commodity prices are finding their bottom, too, but there’s nothing in the price data that would be consistent with 16.3% annual Chinese import growth. At least not that same rate sustained over any significant length of time, which is what abating global headwinds and deflationary pressures is supposed to mean. At any rate, there is one monthly data point, an important one, China imports, which might suggest the global economy is turning around. It will have to be repeated (several times) and then still it needs corroboration. The others, China exports and BDI, are actually on the other side of the ledger as they further describe only trade war distortions hiding what might be continued future weakening. |

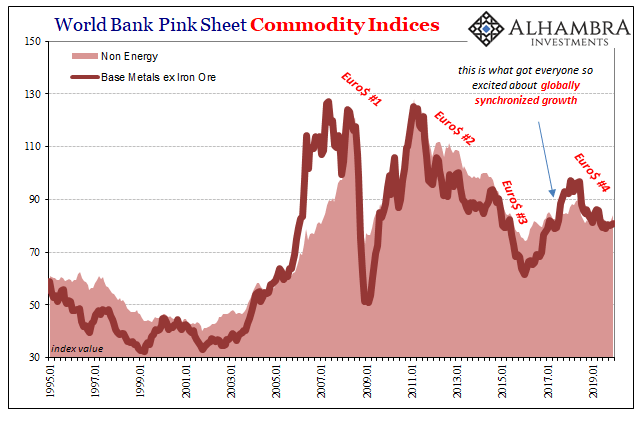

World Bank Pink Sheet Commodity Indices, 1995-2019 |

More Euro$ #4, or the start of Reflation #4? Not that this isn’t an important question, but the one thing we are near certain about is that it won’t be Recovery #1. As to the short run, not all but most of the data remains on the side of the downturn. China imports are right now like the US unemployment rate. That could change, a lot could change, over the next few months (in either direction).

Full story here Are you the author? Previous post See more for Next postTags: China,China Exports,China Imports,currencies,economy,exports,Federal Reserve/Monetary Policy,global trade,imports,Markets,newsletter,richard clarida