| ◆ China has added more than 100 tons of gold bullion bars to its gold reserves since it resumed buying in December; China’s gold holdings rose to 62.64m ounces in September, an increase of 190,000 ounces in one month

◆ The People’s Bank of China (PBOC) increased it’s gold reserves for a 10th straight month in September, reinforcing its standing as one of the major official accumulators as many creditor nation central banks stock up on the precious metal ◆ China and central banks around the world need a hedge against their massive, near non yielding dollar holdings and central banks are trying to reduce their exposure to the dollar ◆ Investors globally need a hedge due to their massive dollar and negative interest rate bond and fiat currency exposure |

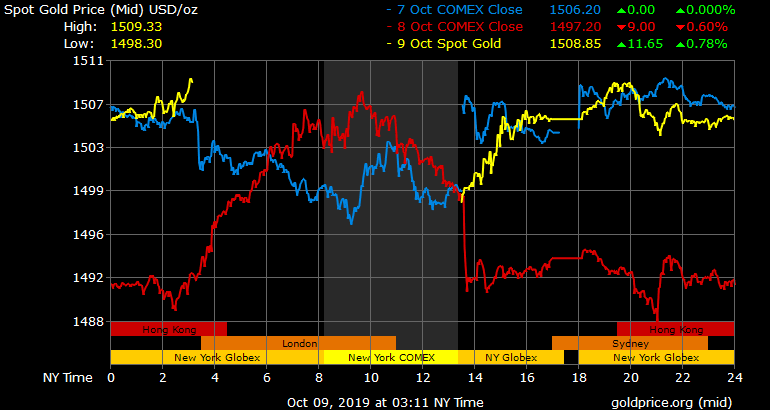

Spot Gold Price USD |

Focus On Gold’s Safe Haven Value, Not Gold $16,000 and Silver $700 Prices ! |

Tags: Daily Market Update,newsletter