Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing.

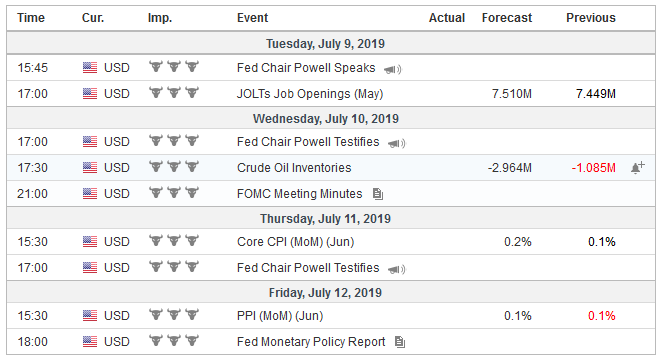

United StatesThe jobs report trumps the PMI/ISM data and suggests that although the economy slowed in Q2, the sky is not falling. There is no great urgency for the Fed to act, and surely not by the half a percentage point move that many economists have advocated. The market quickly took the odds of such a move from a little more than a 1-in-4 chance to about a 1-in-50 chance. The backing up of US yields spurred a sharp sell-off in Europe that offset most of Draghi-Lagarde inspired rally and will spur a sharp sell-off in Asia to start the new week. Coupled with a still robust labor market, the US is expected to report in the coming week that disinflationary forces remain in check. While headline CPI may ease, it is mostly because of food and energy prices. The core rate is expected to remain steady at 2.0%. Prior or January 2012, the Federal Reserve did not have a formal inflation target. The mandate from Congress is for price stability. Greenspan had famously defined price stability as that level of inflation that does not impact businesses. Given the lack of a scientific basis or what passes for it in the dismal science and the imprecision of our measurements, is there really a need to make a fetish of two percent inflation? The Federal Reserve should declare victory. It has achieved price stability with full employment in a record-long expansion cycle. Powell is unlikely to do that at his Congressional testimony on July 10 and 11. Yet, if he were going to lean against the rate cut that is nearly fully discounted by the market for later this month, this would be the venue. It might be too late to persuade the market that it will not cut rates now, but Powell can lean against the idea that it will cut rates 75 bp this year, by emphasizing the still robust expansion (hard data: jobs and auto sales), strong financial conditions (that many think is frothy), and perhaps couching a cut in terms of “insurance.” Besides, the market has already done a lot of the lifting, while the Fed has been patient. The 10-year note yield has fallen nearly 65 bp this year, and the two-year yield has fallen a little more than yields, and the increased amount of them also have pushed rates well belo60. The Fed has already signaled the end of its tightening cycle to much effect. The deeper negative w levels most economists expected by the end of this year. |

Economic Events: United States, Week July 08 |

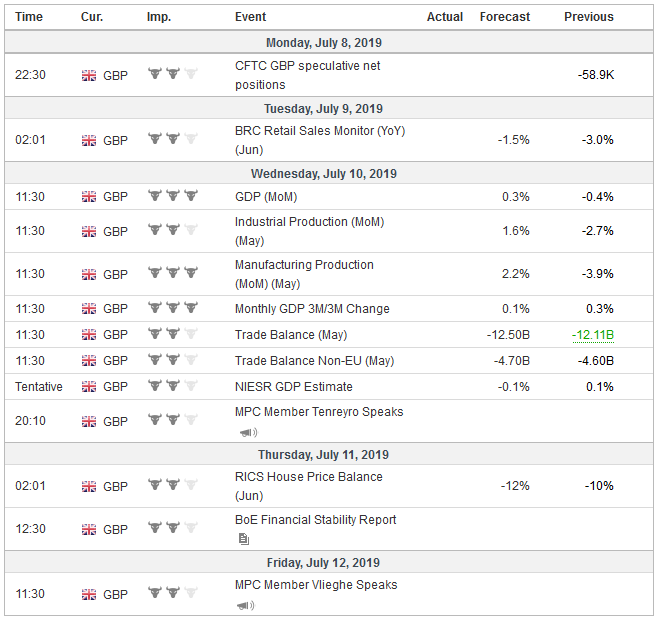

United KingdomAt the same time, there are indeed storm clouds on the horizon, or what Powell called “crosscurrents.” The UK seems to be drifting toward a no-deal Brexit as both candidates to replace May are campaigning on ideas like renegotiating the Withdrawal Agreement, eschewing the backstop that the EC has already rejected, and rest assured, the new configuration of the EC will be no more sympathetic to the UK’s posture. The UK economy appears to have bounced back in May from a poor April. The monthly GDP is expected to have risen by 0.3% after a 0.4% contraction in April. It was likely fueled by a strong recovery in industrial production (1.5% in May after a dismal 2.7% decline in April), and a slight expansion of services (0.1% from flat). The trade deficit is expected to have widened, and perhaps there is some pre-Brexit inventory stocking taking place. Yet, BOE Governor Carney’s recent rhetoric has turned more gloomy, and this likely presages a change in the central bank’s rhetoric and forward guidance at the next meeting on August 1. |

Economic Events: United Kingdom, Week July 08 |

The unexpected sharp drop in German factory orders snapped a two-month advance and dashed the signal of the composite PMI reaching a seven-month high in June. It warns of downside risk to industrial output figure that starts the new week. A 0.3% gain had been expected after the outsized April drop of 1.9%. French and Italian data are due out in the middle of the week. Small increases are expected. Spain reported a better than expected 0.3% gain (-0.5% median forecast in the Bloomberg survey).

Between Draghi’s recent comments and the nomination of Lagarde as his replacement has sparked a dramatic rally in fixed income. Many see Lagarde as an extension of Draghi’s commitment and general strategy rather then Draghi’s predecessor and fellow-countryman Trichet. However, even before we get there, the ECB record of last month’s meeting will be released on July 11. They will be scrutinized for the extent of the easing bias.

The market accepts that the ECB will cut rates. The question is when and by how much. The current pricing in the derivatives market suggests around a 1-in-3 chance the ECB will cut the deposit rate by 10 bp (to minus 45 bp) later this month, and by the end of the year, the deposit rate will be minus 60 bp or lower. An unanswerable question a decade after the Great Financial Crisis and is how low can interest rates go?

Many real money managers appear to be building cash holdings on ideas that the negative rates (out 30-years in Switzerland) are not sustainable. Rising stocks amid falling earnings cannot persist. Yet many observers have been arguing this for years. Interest rates were supposed to rise when the central banks stopped buying them, but they didn’t. Asset managers and many businesses do not seem prepared for the persistence of lower and negative rates, though in our understanding, it is the most likely scenario.

Trade tensions represent a significant unknown and cross-current. The resumption of talks while freezing the tariffs at the new elevated level is a holding pattern, and the outlook does not look particularly favorable. Both sides are demanding actionables that the other rejects. China wants to talk about Huawei and resolve that and requires assurances any agreement will include the lifting of all punitive tariffs. Trump signaled the willingness to allow US companies to sell some products and services to Huawei, though it is not precisely clear what this entails, or whether the stigma remains. The US appears to demand a fundamental shift in China’s economy away from the statist command model.

China, of course, is not the only source of trade tension for the US. Between retaliation for subsidies for Airbus that the WTO ruled illegal, the EU’s attempt to create a special-purpose vehicle designed to facilitate trade (in medicine and food, initially), the persistent haranguing about NATO contributions (even though the EU spends four times more than Russia on defense), and the threat of auto tariffs promise many potential flashpoints. The US levied a 400% tariff on steel from Vietnam amid signs that Korean and Taiwanese producers may have been re-exporting from Vietnam to circumvent tariffs.

Separately, Trump was explicit, accusing Vietnam of being among the more egregious currency manipulators. More broadly, Trump’s penchant for verbally intervening in the foreign exchange market, and now implicitly threatening intervention may risk weaponizing the currency market. Like firing of Special Investor Mueller, or demoting Powell if not firing him, Trump has been unable to follow-through with such threats, which we suspect speaks to the institutional resilience in the US.

Despite claims in the US that China’s economy is genuinely hurting under the impact of 25% tariffs on roughly half of their exports to America, officials have been reluctant to provide significant stimulus. It has encouraged financial institutions to lend and lend they have. Aggregate financing for June is expected to show the second consecutive increase. Through the first five months of the year, it is running a little more than 25% higher than the same year-ago period. Money supply, measured by M2, has risen at an average pace of 8.4% through May this year, which is slightly faster than in the first five months of 2018.

China will report June reserve figures and trade. Reserves probably increased slightly in June, likely reflecting valuation shifts. Contrary to Trump’s claims that China is manipulating its currency, or some economists claim that a weaker yuan is desirable to offset the tariff increase, the PBOC appears to have consistently set the yuan stronger than private-sector models suggest.

Both imports and exports are expected to have fallen. For the past seven months, Chinese exports have alternated in a sawtooth pattern between year-over-year gains and drops in dollar terms. May’s 1.1% gain is expected to have been followed by a 0.6% decline in June.

China’s imports are expected to have fallen around 4.5% in the year through June after an 8.5% fall in May. Imports have averaged a 3.7% decline in the Jan-May period this year. In the same period last year, imports grew by an average of 21.5% and 20.4% in 2017. Prices and gaming tariffs are likely playing a role, and we advise against reading too much into short-term trends. Note that in yuan terms, China’s exports rose an average of 5.8% in the first part of this year, while imports averaged a 1.7% gain.

The Bank of Canada is the only major central bank that meets in the week ahead (July 10). The Bank of Canada is firmly on hold. The headline jobs growth disappointed, but this was because of the loss of part-time positions. Full-time positions grew by 24k. This was the weakest gain in Q2, but consider that last year’s average was about a third less. Also, wage growth accelerated for permanent workers by 3.6% year-over-year. It put this in context, hourly wages rose 1.5% year-over-year last December and climbed to 2.3% by the end of Q1.

Full story here Are you the author? Previous post See more for Next postTags: Bank of Canada,China,ECB,Federal Reserve,Interest rates,newsletter,US