| German growth may remain subdued in H1 2019, before picking up somewhat in H2 2019 as some near-term risks dissipate.

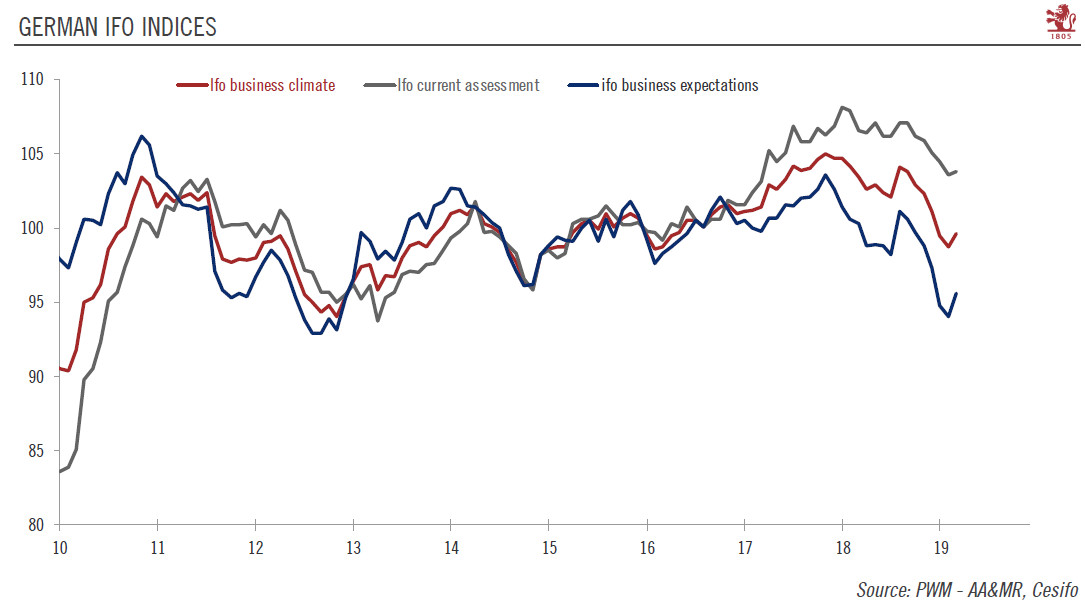

Germany’s leading indicator, the Ifo index, rose in March, driven by an increase in both sub-components: current assessment and expectations. The Ifo index differs in make-up from Markit’s purchasing manager indexes, but at the sector level, the story is the same: the more domestically driven services sector is showing signs of resilience, while the most export-oriented manufacturing sector is struggling. The divergence between the manufacturing and services sectors is strikingas well as worrying. Germany’s manufacturing sector has been on a downward trend since August last year, dragging the entire economy down. There is no single explanation for this. Rather, the German economy is suffering from a combination of transitory factors (impacting mainly the automotive and the chemical industries) and external uncertainties (trade, Brexit…), and is currently the perfect illustration of how a fundamentally solid economy can be brought down by short-term risks and uncertainties. |

German IFO Indices 2010-2019 |

The external backdrop remains challenging, and uncertainties will not disappear immediately. Near term, a no-deal Brexit and a potential escalation of trade tensions between the US and Europe are the main downside risks to our scenario for Germany Nonetheless, German domestic demand remains solid and is underpinned by healthy fundamentals. Sustained jobs and wages growth, falling inflation (due to lower oil prices) and fiscal stimulus are all factors that should continue to help private consumption this year. In addition, the government has further fiscal space to stimulate the economy.

Overall, however, we expect the German economy to continue underperforming more domestically driven euro area ones such as France’s and Spain’s. We believe that German growth will remain subdued in H1 2019, before picking up somewhat in H2 2019 as some near-term risks dissipate. But the balance of risks to our growth outlook remains angled to the downside.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newsletter