Monthly Archive: December 2018

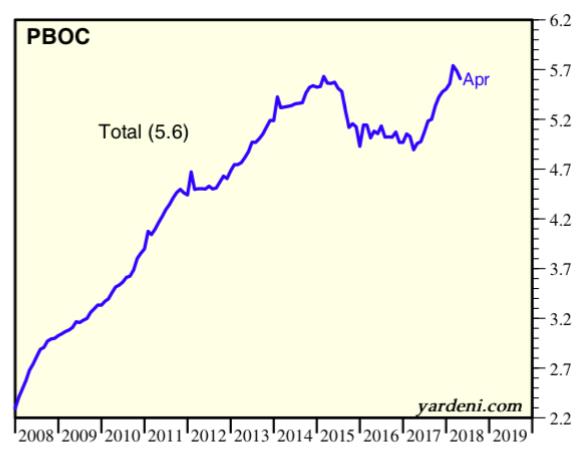

China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of one US investment “bank”) the...

Read More »

Read More »

FX Daily, December 12: Markets Calm on May Day

The US S&P 500 failed to sustain the early upside momentum, but global equities are moving higher today, and there is some optimism on the trade front. Emerging market equities and currencies are also doing well today.

Read More »

Read More »

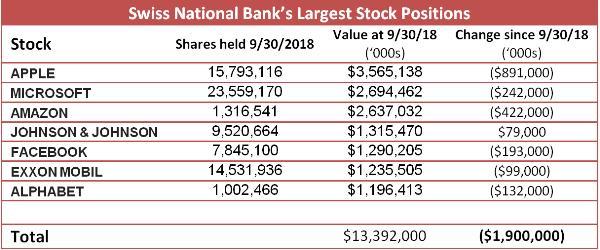

The World’s Biggest Hedge Fund Is Getting Whacked, And Why “Moneyness” Matters

A few years ago the Swiss National Bank (SNB) - which traditionally held “monetary assets” like government bonds, cash and gold to back up the Swiss franc - decided to branch out into common stocks. This was a departure, but for a while a brilliant one.

Read More »

Read More »

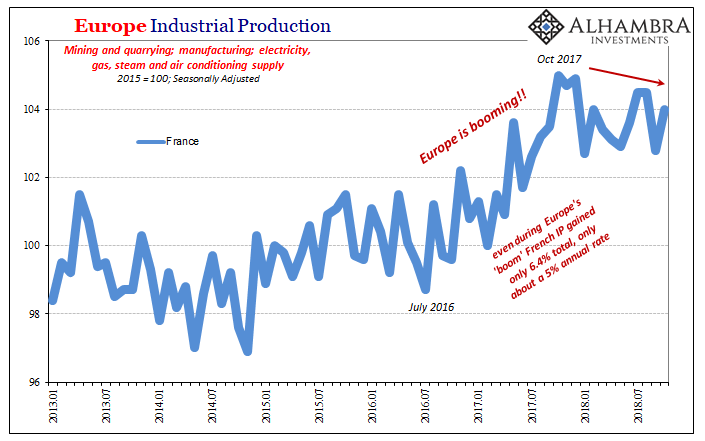

‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts.

Read More »

Read More »

Older workers have ‘untapped potential’ to fill labour shortages

Switzerland’s workforce is in good shape but perhaps not for long, according to a new study by the consulting firm Deloitte. Tapping existing pools of talent including older workers and women are key to helping companies meet future demands for skilled labour.

Read More »

Read More »

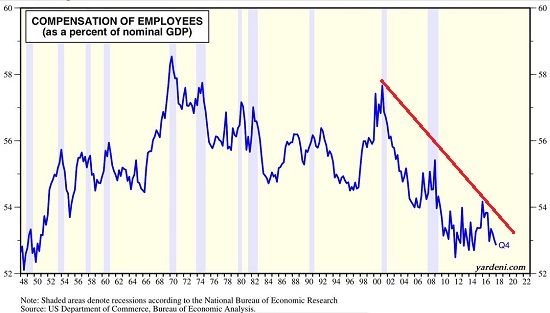

Are We in a Recession Already?

The value of declaring the entire nation in or out of recession is limited. Recessions are typically only visible to statisticians long after the fact, but they are often visible in real time on the ground: business volume drops, people stop buying houses and vehicles, restaurants that were jammed are suddenly sepulchral and so on. There are well-known canaries in the coal mine in terms of indicators.

Read More »

Read More »

FX Daily, December 11: Fragile Calm Threatens to Break Out

Indications that US and Chinese trade talks are proceeding, coupled with a dramatic reversal in the S&P 500 yesterday is helping stabilize the capital markets today. Asian equities were mixed, but the Greater China (China, Hong Kong, and Taiwan markets) alongside India and Australia posted modest gains.

Read More »

Read More »

Cool Video: Bloomberg Economic Discussion

I joined Chris Wolfe from First Republic Wealth Management on the set of Bloomberg's Daybreak to discuss market developments and the outlook for the US economy. We generally agreed that while the economy is slowing it is doing so from unsustainably strong levels.

Read More »

Read More »

Swiss Government wants Public Consultation on EU Framework deal

The Swiss government says it wants to carry out a public consultation before taking a final position on an “institutional framework” agreement negotiated with the European Union aimed at cementing future ties between Switzerland and its biggest trading partner.

Read More »

Read More »

Economics Is Easy When You Don’t Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Don’t even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results.

Read More »

Read More »

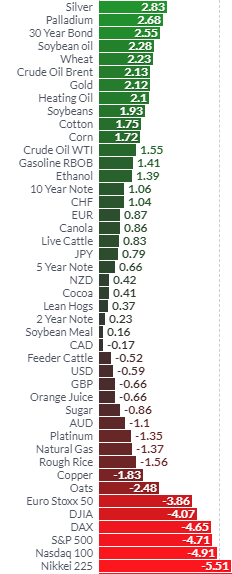

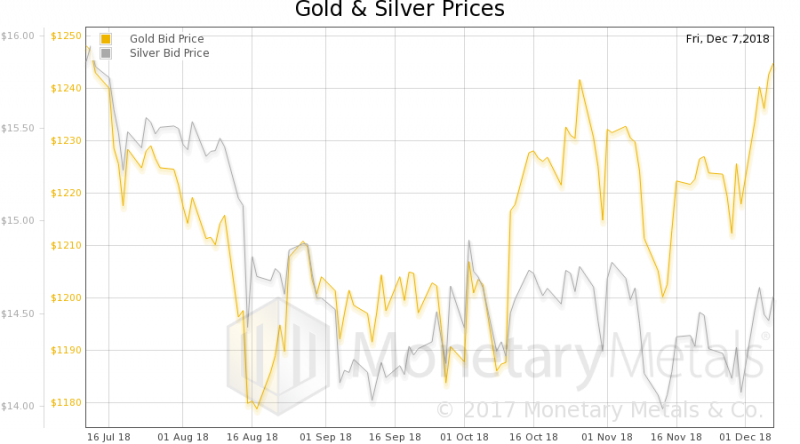

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Gold acted as a safe haven last week and is again acting as a safe haven in December. It has performed well despite the rout in stocks in Ireland and globally. U.S. stocks including the S&P500 and Nasdaq were down nearly 5% last week, while gold was 2% higher and silver over 3% higher.

Read More »

Read More »

FX Daily, December 10: Lack of Closure Weighs on Sentiment

Investors angst over trade tensions and Brexit continue remains elevated, and poor Chinese and Japanese economic news played on global growth fears. Equities continue to slog lower. Bond yields are little changed, and the dollar is lower against most of the major currencies.

Read More »

Read More »

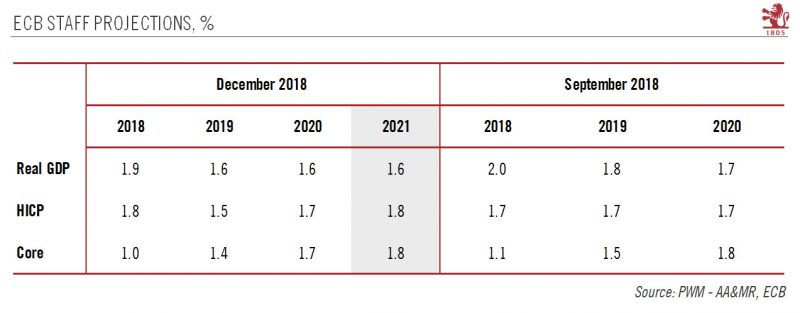

ECB Preview: an end to net asset purchases

With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation. At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end.

Read More »

Read More »

FX Weekly Preview: The Week Ahead: Don’t Skip Steps on Escalation Ladders

The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year seems misplaced.

Read More »

Read More »

Drones can be safely guided by mobile phone networks

Switzerland’s existing mobile telephony infrastructure is enough to guarantee the safety of drone flights in the country’s airspace, according to a study published Wednesday. Commissioned by Swiss air navigation service provider Skyguide and carried out by the Aviation Research Center Switzerland (ARCS), the study focused on the possibility of using mobile networks to control drones.

Read More »

Read More »

Swiss investment management sector growing

As the Swiss financial centre adjusts to the loss of banking secrecy and possible fallout from Brexit, a report highlights increased investment management as the sector's cornerstone. The report, released on Thursday by the Swiss Bankers Association (SBA) and the Boston Consulting Group (BCG), outlines the emergence of investment management – the “management of investments for institutional and private clients” – as a key component of the Swiss...

Read More »

Read More »

Swiss Post Office Expands Hospital Drone Delivery System

The Swiss Post is expanding its drone delivery system, transporting laboratory samples between two hospitals in Zurich. Similar pilots have been conducted in Bern and Lugano. On Tuesday, the Swiss Post announced it is launching a one-year pilot project to use drones to send laboratory samples between the University Hospital of Zurich and the Irchel site of the University of Zurich, which are 2.5 kilometres apart.

Read More »

Read More »