Schemes and ShamsMan’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up. Systems of elaborate folly have been erected with the most impossible of promises. That prosperity can be attained without labor. That benefits can be paid without taxes. That cheap credit can make everyone rich. Central to these promises are the central government and central planning authorities. They take your money and, in return, they make you a dependent. They promise you a secure retirement, and free drugs, while running a scheme that’s well beyond anything Charles Ponzi ever dreamed of. |

|

| According to the government’s statistics, the economy has never been better. By the official numbers, we’re living in a magical world of full employment, 2.3 percent price inflation, and the second-longest growth period in the post-World War II era. Agreeable reports like these are broadcast each month without question.

Still, we have some reservations. How come, with the nirvana of full employment, 62 percent of all U.S. jobs don’t pay enough to support a middle class life? An economy with full employment should be an employee’s market; one where employees can name their price. Surely, workers would select a middle class life if they could. But they can’t… because full employment is a sham. |

Left: Charles Ponzi back in his heyday. Right: the almost free lunch, a.k.a. the no free lunch theorem ATM [PT] |

An $8 Trillion PurgeThis week brought forth new evidence that we are living in a world of epic disorder. A world that is so full of shams it is often unclear what is real and what is deception. Yet, what is lucidly clear is that the scope and scale of the ultimate quietus is so immense, one can hardly fathom its completion. In the meantime, madness and folly prevail with acute enthusiasm. The stock market, a crude barometer of fear and greed, is currently registering great uncertainty. The mood vacillates from one extreme to the next with wild abandon. |

S&P 500 Index, daily(see more posts on S&P 500 Index, ) |

| Last month, the S&P 500 dropped 215 points, or roughly 7.3 percent. This marked its worst month since February 2009. But that was nothing…

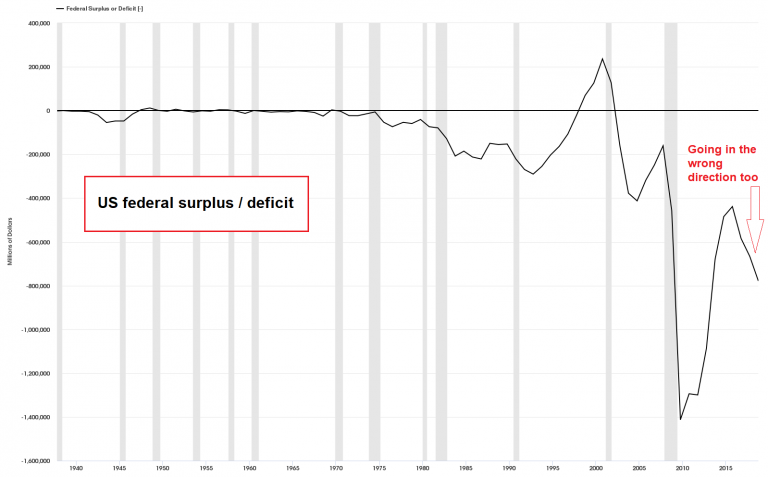

Goldman’s VIP Basket plummeted 11.5 percent in October. And FANG stocks – the digital economy’s best of the best – crashed 21 percent. All in all, global equity markets purged $8 trillion in shareholder wealth. The U.S. economy, if you go by the government’s numbers, appears to be healthy and growing. The latest Commerce Department report showed third quarter gross domestic product increased at a 3.5 percent annualized rate. On the surface, everything looks fabulous. But just a scratch below the surface, a different picture is revealed. The fiscal year 2018 deficit came in at $779 billion, an increase of 17 percent from 2017. The fiscal year 2019 deficit is projected to top $1 trillion. With deficit spending at these levels, GDP growth is more representative of the rate the government is going broke than real increases in economic productivity. In other words, like the stock market, the economy’s growth days are numbered… |

US Federal DeficitEconomic growth is reportedly the strongest since the GFC of 2008/2009 – and yet, the federal deficit somehow manages to grow anyway. Some of this is due to the temporary short-fall from tax cuts that should be made up over time by improving growth rates, but there are also other factors, such as soaring debt service costs as short term interest rates rise and the recent increase in government spending. It is not quite clear why implementing more “fiscal stimulus” was actually held to be a good idea at this juncture, but there it is. [PT] |

Pushing Past the Breaking PointNo doubt, the upcoming tests facing the economy will be observable in aggregate numbers and statistics. How much GDP contracts, or how high unemployment rises, are loosely quantifiable. They can be calculated and charted, though we wouldn’t place much credence in them. The real tests facing the economy are less measurable. They cannot be counted up and expressed as percentages. Nor can they be charted over time. But that doesn’t mean these tests are any less observable than a calculated statistic. |

|

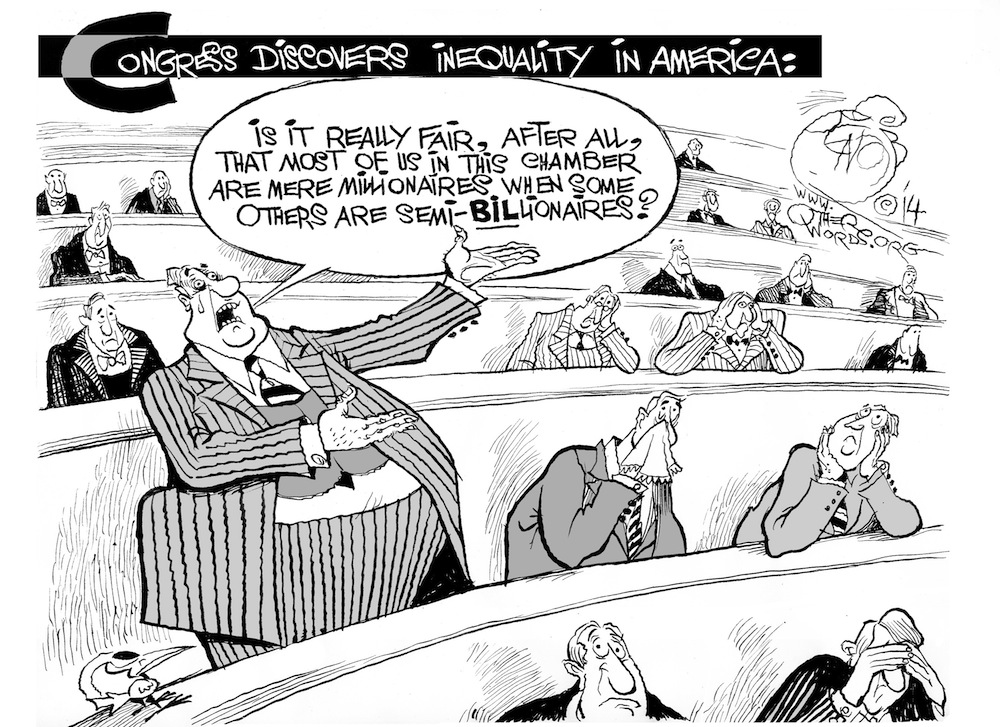

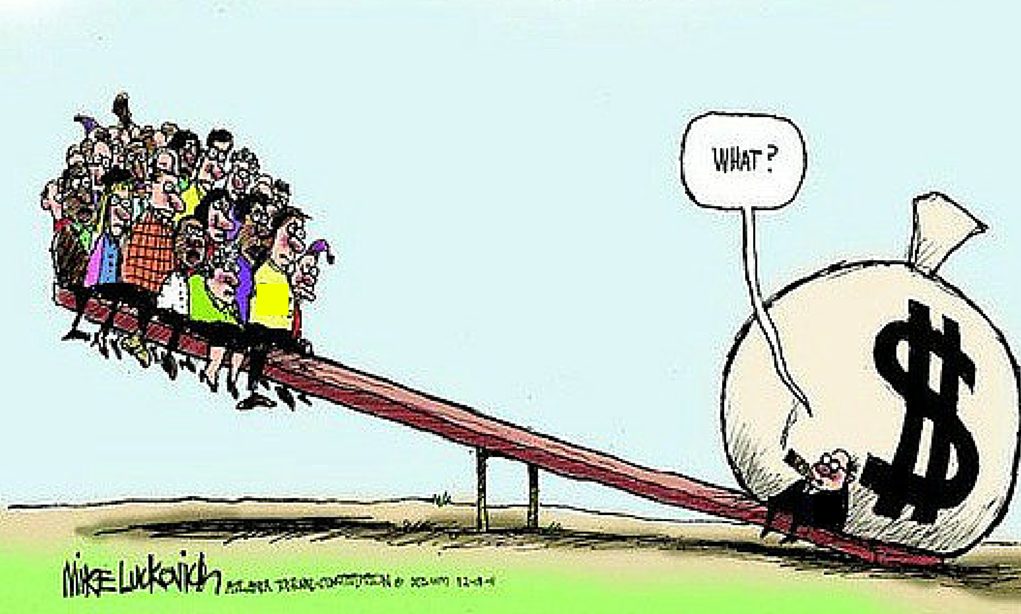

| To be clear, the tests facing the economy have little to do with markets and everything to do with central government. Over the last 30 years, as the Fed and the Treasury colluded to rig the financial system in earnest, wealth has become ever more concentrated in fewer and fewer insider hands. The effect over this latest period of expansion has been a disparity of such magnitude few can ignore it. |

What’s with the long faces? Unfortunately only very few people are aware of what the root cause of growing wealth inequality actually is (not even all members of the agency largely responsible for it realize it is the fault of the policies their institution imposes – decades of statist propaganda combined with a shoddy economics education saw to that). Unfortunately this means that the “solutions” that will eventually be offered are likely to create an even worse situation. [PT] |

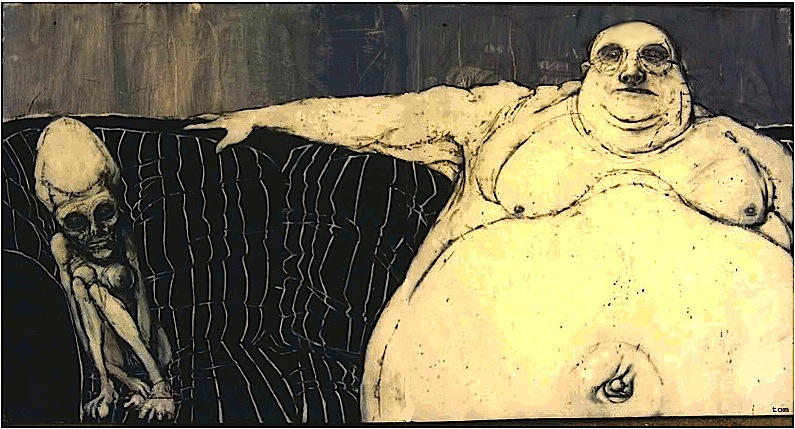

| This trend will be further intensified by the forthcoming depression. What’s more, bitterness and contempt for wealthy insiders is already much higher than it was during prior business cycles. Without question, this bitterness and contempt will increase to a fever pitch when this business cycle turns down.

Discontent throughout the broad population will take a financial crash and an economic collapse, and transform it into a complete societal breakdown. Then the central government will fail the test of its making. But, alas, the discord will provide the perfect cover for a much larger central authority. They will offer promises to fix things while delivering a much wider range of wealth inequality. They won’t stop. They will push it to the breaking point… and then they will push it some more. |

Charts by: StockCharts, St. Louis Fed

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next postTags: newsletter,On Economy,On Politics,S&P 500 Index