SUMMARY

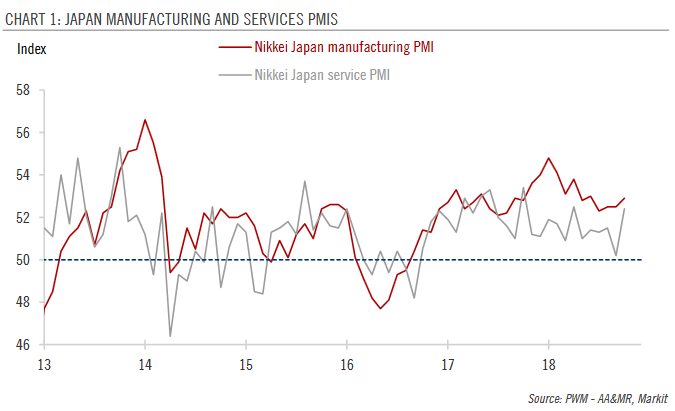

- Japan’s services PMI surged by 2.2 points to 52.4 in October after a notable drop in September. The manufacturing PMI rose modestly to 52.9 in October from 52.4 in September.

- The strength in services PMI may suggest momentum in Japan’s domestic economy remains solid. Consumption recovery and expansion of corporate capex are driving growth.

- However, headwinds are building on the external fronts. Elevated trade tensions could continue to weigh on Japanese growth going forward.

|

The Japanese services purchasing managers index (PMI) rose sharply in October. Combined with the modest increase in the manufacturing PMI, the latest set of survey results generally point to solid growth in the Japanese economy (Chart 1). However, data on real economic activity are mixed, with developments in the external sector especially worrying.

Export growth dipped into negative territory in September, suggesting elevated trade tensions between the US and China might be weighing on corporate investment globally. |

Japan Manufacturing and Services PMIS(see more posts on Japan Manufacturing PMI, ) |

|

In more detail, services PMI in Japan surged by 2.2 points to 52.4 in October after a notable drop in September. The soft reading in September may have been due to natural disasters in various parts of the country that disrupted activity. The manufacturing PMI was less volatile, rising modestly to 52.9 in October from 52.4 in September.

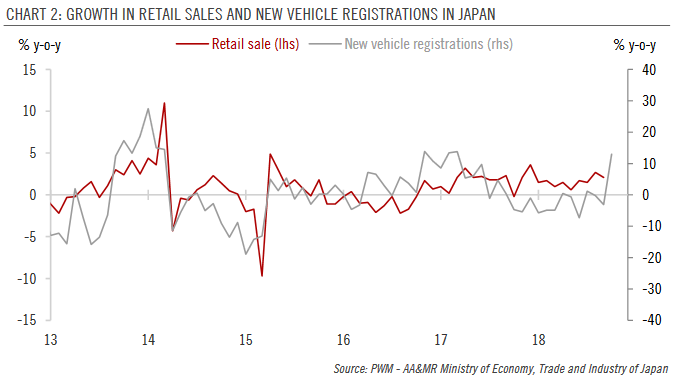

The strength in services PMI suggests domestic momentum in Japan remains solid. On the one hand, a recovery in household consumption is well underway. Expansion in retail sales has started to pick up again in recent months after softness in the first half of the year. New vehicle registrations rose by 13% year-over-year (y-o-y) in October after having mostly declined since late 2017 (Chart 2). As income growth has finally started to gain momentum in 2018, we expect the recovery of the Japanese consumer sector to continue in the coming quarters. |

Growth in Retail Sales and New Vehicle Registrations in Japan |

|

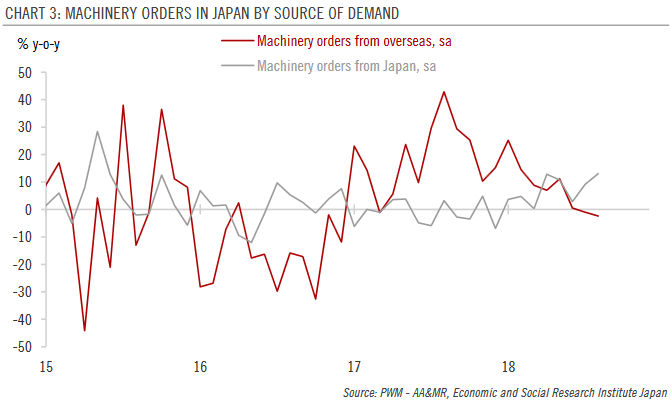

On the other hand, domestic corporate capex continues to rise, as Japan comes up against capacity constraints. In Q2, non-residential private investment in Japan rose by 13% quarter-over-quarter (q-o-q) annualised, the highest growth rate in over three years. The strength in capital investment may have extended into Q3, as indicated by domestic machinery orders, which rose by 13.1% y-o-y in August, compared to average growth of 8.8% in Q2 and 2.9% in Q1 (Chart 3).

However, the situation in Japan’s export sector is worrying. As Chart 3 shows, overseas demand for Japanese machinery has declined on a y-o-y basis since July, with the latest reading available for August at-2.4% y-o-y. The weakness in Japanese exports is not limited to machinery; it extends to other capital goods as well. |

Machinery orders in Japan by source of demand |

|

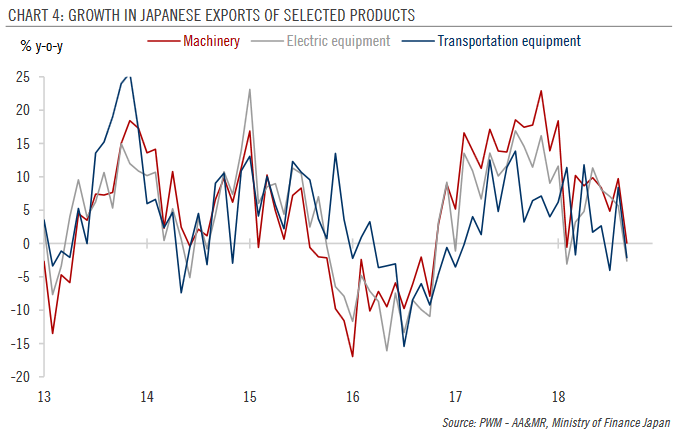

The top three product categories among Japanese exports (machinery, electric equipment and transportation equipment) have all seen growth weakening significantly in recent months (Chart 4).

In our view, Japan’s weakening exports likely reflect the deteriorating corporate sentiment caused by rising uncertainties about the global economic outlook. While Japan currently is not at the centre of trade disputes with the US, it is still vulnerable to any potential trade disruptions due to its role as a major supplier of capital goods and an important link in the global supply chain. To summaries, the latest data point to solid momentum in Japan’s domestic economy, but headwinds are building on the external front. Elevated trade tensions could continue to weigh on Japanese growth going forward. |

Growth in Japanese Exports of Selected Products |

Tags: Japan Gross Domestic Product,Japan Manufacturing PMI,Macroview,newsletter