While growth in France rebounded, Italy stalled in Q3. Our full-year forecast for the euro area remains unchanged but is clearly at risk.

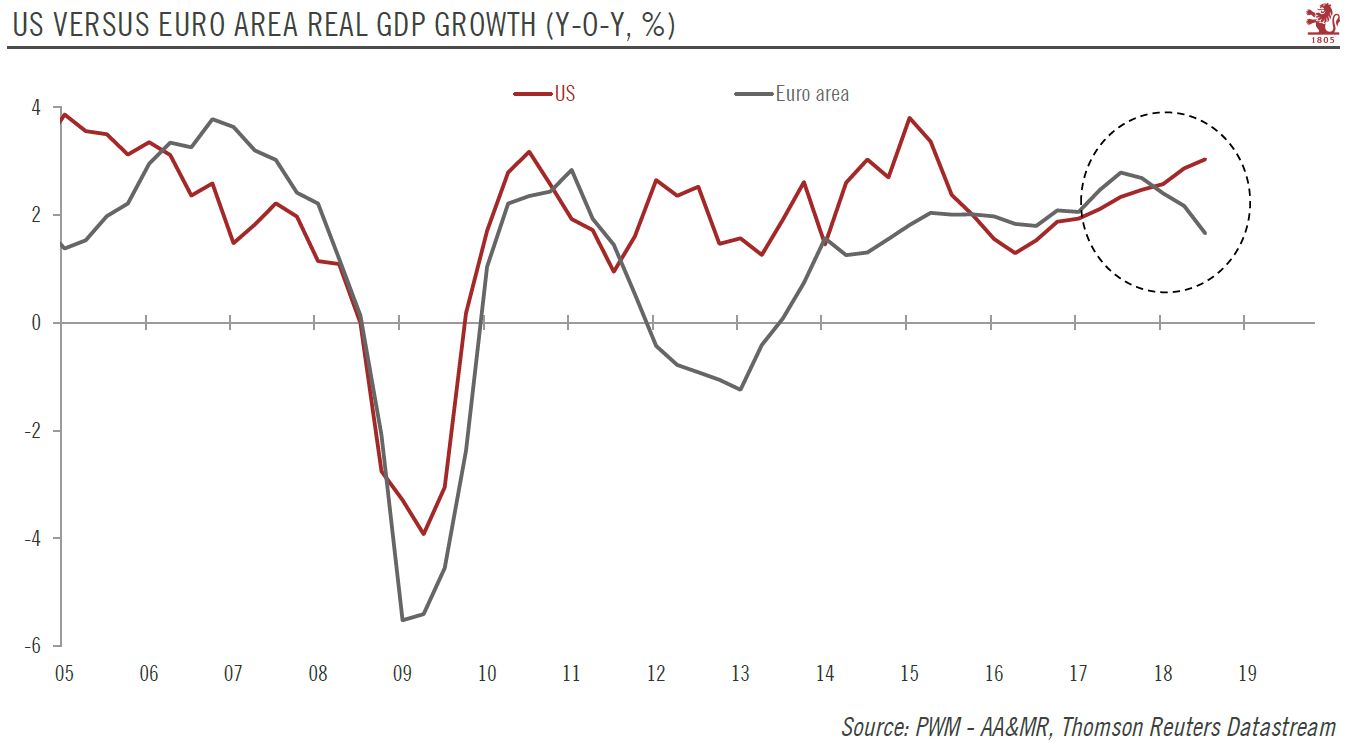

According to initial estimates, growth in the euro area slowed in Q3 to 0.2% q-o-q (quarter on quarter) from 0.4% in Q2. These latest GDP results were below consensus expectations and our own forecast. This was the weakest quarterly growth figure for the euro area since Q2 2014 and marks the widest divergence vis-à-vis the US since 2015.

Advanced estimates showed that French real GDP rebounded in Q3, so that French GDP growth is back where it should be at this stage of the economic cycle after a sluggish first half of the year affected by a series of temporary factors (strikes, weather, and timing of fiscal policy). The details were pretty good, with domestic demand remaining the main driver of growth. Of note was the positive momentum in manufacturing investment in spite of a drop in manufacturing business confidence.

| By contrast, the Italian economy stalled in Q3. The full details are not yet available (they will be published on November 30), but the Italian statistics office, Istat, has already signaled that the slowdown was driven by a decline in industrial activity, while services output increased. Overall, weak exports and export-driven manufacturing activity are the main culprits for Italy’s poor GDP showing in Q3.

While a weakItalian economy could put some pressure on the Italian government in its negotiations with the European Commission over its proposed budget plan, the latest growth figures are unlikely to impact them in any meaningful way in the short term. Looking ahead, this initial Q3 GDP data put our 2018 growth forecast (2.0%) for the euro area at risk of downgrade to 1.9%. Easing in global growth momentum, trade war, ongoing Brexit negotiations, Italian politics and the uncertainty around the budget are all source of concner, while the latest cyclical indicators (notably purchasing manager indexes) highlight further weakness ahead.. But at this stage we are keeping it unchanged. We will have a better idea of the state of the euro area economy when the second estimate of Q3 growth is released on November 14. |

US Versus Euro Area Real GDP Growth 2005-2019 |

Full story here Are you the author? Previous post See more for Next post

Tags: euro area growth,Italy budget plan,Macroview,newsletter