Stock MarketsEM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity just starting to emerge. We remain negative on EM FX.

|

Stock Markets Emerging Markets, June 27 |

MexicoMexico reports June PMI Monday. Banco de Mexico releases its minutes Thursday. At that meeting, it hiked rates 25 bp ahead of the election. If markets react badly to the weekend election results (results unknown as of this writing), Banco de Mexico may be forced to hike intra-meeting as the next scheduled meeting isn’t until August 2. KoreaKorea reports June CPI Tuesday, which is expected to rise 1.7% y/y vs. 1.5% in May. If so, it would be the highest since October and nearing the 2% target. Still, BOK has shown no urgency to hike rates again after its first (and last) move in November. Next policy meeting is July 12, no change is likely then. May current account data will be reported Thursday. Over the weekend, Korea reported June trade data. HungaryHungary reports May retail sales Tuesday, which are expected to rise 5.3% y/y vs. 6.1% in April. Central bank minutes will be released Wednesday. This should be of interest, as the bank seems to have tilted less dovish in response to HUF weakness. Hungary then reports May IP Friday, which is expected to remain steady at 2.9% y/y WDA. TurkeyTurkey reports June CPI Tuesday, which is expected to rise 13.88% y/y vs. 12.15% in May. If so, it would be the highest since November 2003 and further above the 3-7% target range. Next central bank policy meeting is July 24. While the bank should hike, it remains to be seen whether President Erdogan will allow it to happen. ChileChile reports June trade and May retail sales Tuesday. Sales are expected to rise 4.0% y/y vs. 7.4% in April. It then reports June CPI Friday, which is expected to rise 2.5% y/y vs. 2.0% in May. If so, it would be the highest rate since May 2017 and nearing the 3% target. The bank has signaled a rate hike towards year-end, and inflation data support this notion. Czech RepublicCzech Republic reports May retail sales Wednesday, which are expected to rise 3.5% y/y vs. 4.7% in April. The central bank just hiked rates 25 bp in light of a firm economy and rising price pressures. Next policy meeting is August 2. Right now, no change is expected so soon after the last hike, but much will depend on the koruna. According to central bank models, each 1% depreciation is equivalent to a 25 bp cut. BrazilBrazil reports May IP Wednesday, which is expected at -12.0% y/y vs. +8.9% in April. It then reports June IPCA inflation Friday, which is expected to rise 4.40% y/y vs. 2.86% in May. If so, this would be the highest since March 2017 and would put inflation just about at the 4.5% target for this year. COPOM meets August 1 and is expected to start the tightening cycle. PhilippinesPhilippines reports June CPI Thursday, which is expected to rise 4.8% y/y vs. 4.6% in May. If so, it would be a new high for the cycle and further above the 2-4% target range. The central bank has hiked 25 bp for two straight meetings. Next policy meeting is August 9, and we expect a third 25 bp hike then. TaiwanTaiwan reports June CPI Thursday, which is expected to rise 1.52% y/y vs. 1.64% in May. While the central bank does not have an explicit inflation target, low price pressures should allow it to remain on hold this year. Next quarterly policy meeting will be in September. While a lot can happen between now and then, our base case is steady rates then. ColombiaColombia reports June CPI Thursday, which is expected to rise 3.20% y/y vs. 3.16% in May. If so, it would still be above the 3% target but within the 2-4% target range. The central bank kept rates steady on Friday. Though the economy is sluggish, we think peso weakness has ended the easing cycle. |

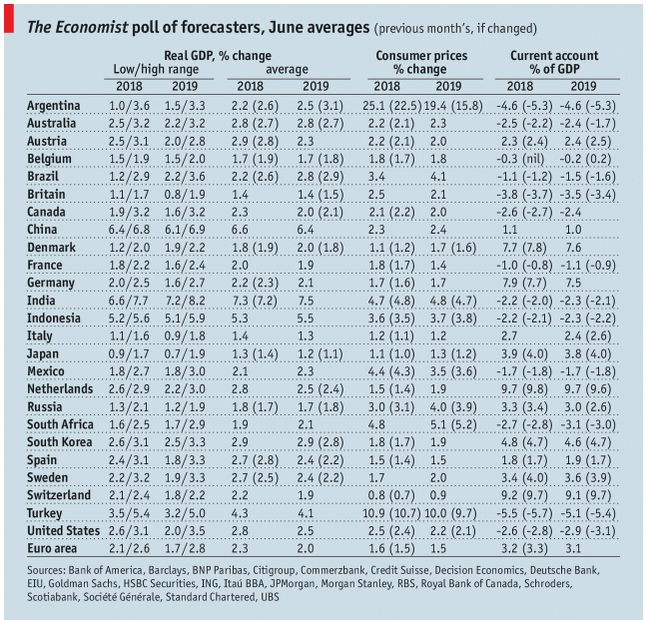

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2018 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Brazil,Chile,Colombia,Czech Republic,Emerging Markets,Hungary,Korea,Mexico,newslettersent,Philippines,Taiwan,Turkey,win-thin