| The Markit group that provides many of the PMI surveys noted with today’s reports that the eurozone outlook has “darkened dramatically.” This makes for a poor backdrop for the ECB, which meets next week. However, with price pressures recovering from the Easter-related distortions, the ECB is still on track to finish its asset purchases at the end of the year. This seems largely taken for granted.

The real issue is when will it deliver its first hike. Although some observers had forecast a hike for the end of Q1 19, we had thought mid-year was a better bet. We have been picking up more talk that the first rate hike may come after Draghi’s term ends in October 2019. Growth and inflation are the least of Europe’s problems, which is no joking matter. The growth peak is behind it. The business cycle is mature. The price pressures generated during the expansion did not rise to levels that would have justified an ECB rate hike. When the ECB gets done with its asset purchases, which we expect to be the year-end, the deposit rate will be sitting at minus 40 bp. Europe’s political problems are multiplying and becoming more pressing. The most difficult decisions about Brexit are unresolved and some tentative agreement by October or so, to give the various stakeholders time to debate and approve, seems like a stretch. Greece’s third assistance program formally ends later this month, though the last payment is in August. Greece does not want another credit facility as a backstop. Greece access to the capital markets may have improved, but it is still tenuous. Meanwhile, the creditors who promised debt relief at the end of Greece’s program are balking, which could further impinge on the willingness of investors to buy Greek paper. |

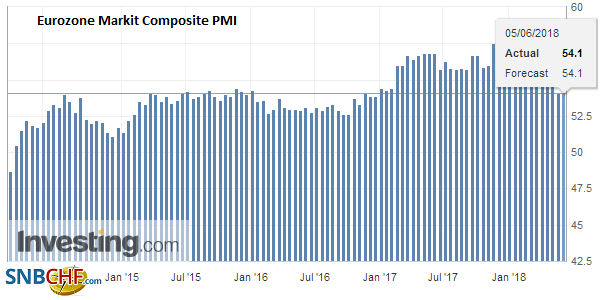

Eurozone Markit Composite PMI, May 2018(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

Central and Eastern Europe also pose a challenge. The Visegrad countries (Hungary, Poland, Czech, and Slovakia) challenge the liberalism of western members and resist efforts on re-settling refugees. It appears that Slovenia (who is an EMU member as is Slovakia) may join the bloc after this past weekend’s election. The former prime minister, Jansa political party, garnered 25% of the votes and will be given the first chance to try to form a government. It is not a done deal most of the political parties shun a coalition with Jansa.

We have long maintained that monetary union grew out of the ERM crisis that stemmed from the extreme policy mixed after the Berlin Wall fell, which in proportionate terms, was as significant of a policy mix shock as the Reagan-Volcker shock of the early 1980s. Emphasizing the political nature of monetary union (economic solution to a fundamental political problem posed by the reunification of Germany) helped us navigate through the speculation of Grexit. We have consistently argued another country would join before a country would leave.

This still seems to be a good bet. Ironically, the next candidate is meeting resistance by the ECB and EC but appears to be drawing more support from the heads of state. Merkel and Macron seem more sympathetic to Bulgaria’s candidacy. Bulgaria said it will apply for membership in the ERM later this month, which is understood as a precursor to joining the EMU. The ECB and EC want Bulgaria to first join the Single Supervisory Mechanism that would regulate the country’s largest banks. Bulgaria had indicated that it would join the SSM when it was in the ERM.

The new government in Italy will be a challenge, even if Quitaly is not in the cards. Italy’s week-long recovery from last Tuesday dramatic sell-off is being snapped today. In his first speech to the Italian parliament, Prime Minister Conte promised fiscal expansion. We suspect there is some flexibility given that Italy’s budget deficit is projected to be less than 2% of GDP.

There are of course many differences between Spain and Italy, but what has gone mostly unsaid, is that Italy’s economic hit was second only to Greece and Spain has consistently had a larger budget deficit than Italy. Italy’s budget deficit in 2012 was 2.9% of GDP. Spain’s was 10.5%. Italy’s deficit has not been above 3% since 2011. This year is projected to be the first that Spain’s deficit is less than 3% of GDP since 2007. Italy’ debt burden, a function of poor practices in the past and weak growth, limits it room to maneuver but there is some room.

These would be formidable challenges in themselves, but on top of it, is Russia and the US who pose different sets of problems. Russia is projecting its powers and continues to try to destabilize what it regards as the near abroad. At the same time, it is pursuing what seem to be persistent low-level attempts to sabotage and destabilize the US and Western Europe.

Under Trump, the US relationship with its military and economic allies including Europe have suffered. Many observers make it sound like this has never happened before, even though the post-WWII history, running through the Suez Crisis, Vietnam, putting Pershing missiles in Germany, James Baker’s threat to let the dollar fall if Germany did not stimulate its economy, which some say sparked the 1987 equity crash, W.Bush’s steel tariffs, etc. etc. Still, the relationship is at a very low point, and it comes as Brexit and the Great Financial Crisis are forcing officials to re-thinking Europe and its meaning.

It seems that the US is defecting from the very multilateral trade system that the US was instrumental in erecting. That multilateral system was based on tariff schedules taken in their entirety. Now the US is deconstructing and complain about this or that tariff. Europe’s average tariff is a little (~1.5%) higher than the average US tariff.

The importance of the US economy and the unique role of the dollar allows the US to project its power far and wide. It is not just an exercise in extraterritoriality (applying one’s laws abroad). European companies that want to trade with Iran can, but then they may not be able to do business in the US. China also uses its economic power for political ends, like willing to grant aid to countries who do not recognize Taiwan as a country. While great powers are able to do this, Europe has limited ways it can resist.

There is increased talk that US trade practices and the weaponization of access to dollar funding could spark a change in the dollar’s status as a reserve currency. Some scholars suggest that it is possible to have a multiple currency reserve system and sometimes find in history that this occurred. Even though the euro is cited as a likely candidate, the facts on the ground tell a different story. The euro’s share of global reserves is smaller than the sum of its parts (e.g., DEM, FRF, BEL, ECU). Yields are lower. Liquidity is lower. The European sovereign bond market is more like the US muni market than the US Treasury market with many different issuers, of relative small offerings, and with different rules and idiosyncrasies.

The IMF’s COFER data for Q1 will be released at the end of the month. The euro peaked in February, but in Q1 18 it posted a small 1.6% gain. If central banks want to maintain a certain allocation of reserves, the 5.4% decline in the euro so far in Q2 would suggest some additional purchases may be necessary. However, given the modest uptick of existential risk and low yields available, suggest that the conservative species known as central bankers may be in no rush to adjust allocations.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,Europe,Eurozone Markit Composite PMI,newslettersent