Another Highly Useful ReportAs we noted on occasion of the release of the first Incrementum Crypto Research Report, the report would become a regular feature. Our friends at Incrementum have just recently released the second edition, which you can download further below (if you missed the first report, see Cryptonite 2; scroll to the end of the article for the download link). |

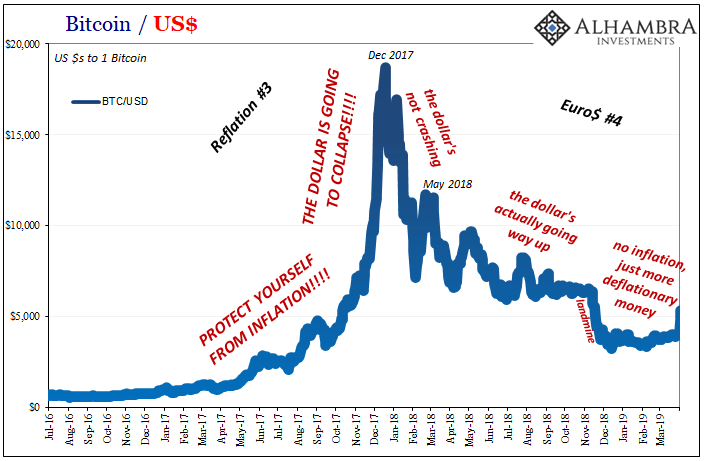

BTC Hourly, 16 - 23 March 2018(see more posts on Bitcoin, )Although BTC has been in a bear market since peaking in December, it still offers numerous short term trading opportunities due to its high volatility. We took the above snapshot of the hourly chart at around 8:00 am EST to illustrate this. After declining sharply amid an onslaught of negative news (including an announcement by Google that it would no longer accept cryptocurrency-related ads, which strikes us as an utterly absurd decision), bitcoin made a short term low in March 18 at $7,325; from there it rose to a short term peak at $9,188 on March 21. This is certainly what one would consider a “playable move” as a trader. Note the strong trading volume right at the low – this is a recurring characteristic of short term lows in BTC (sometimes the low of the heavy volume candle is retested at lower volume before the trend actually turns – the same phenomenon can often be observed at short term highs as well). |

The new crypto report was penned by Demelza Kelso Hays (a research analyst with Incrementum and the company’s crypto expert) and Mark J. Valek, one of Incrementum’s fund managers, whom many of our readers also know as the main co-author of Ronald Stoeferle’s “In Gold We Trust” report.

The new crypto report is once again very interesting and in our opinion highly useful. It should be of particular interest to investors who either want to learn more about cryptocurrencies and the potential merits and pitfalls associated with them, or who just want to stay abreast of what is happening in this fast-moving sector.

The new report starts out with a summary of recent events (the topics addressed are: bubble & crash, hacks & scams, reaction & regulation and adoption & trends), an in-depth discussion of whether bitcoin’s surge actually deserves to be called a bubble (which we found particularly interesting), and a section that deals extensively with the schism in the bitcoin community that led to the fork that created Bitcoin Cash (BCH) and other offshoots. As an aside to this, we have argued in the past that the premium of BTC over BCH should shrink over time; as long as BCH offers lower transaction costs and faster transfer speeds, we believe this trend should continue (or rather resume).

In light of trading volume in BCH, its market capitalization and the hash rate devoted to BCH mining, it is probably fair to say that it is currently the only post-fork currency that can be considered a potentially viable competitor of BTC – perhaps even a contender for the crown. Note, this remark is only in reference to currencies that have been created by BTC forks, we think other cryptocurrencies should be considered separately.

There is also a chapter on technical analysis by Florian Grummes of Midas Touch Consulting, who has contributed to recent editions of the “In Gold We Trust” report as well. We actually believe that the application of technical analysis is particularly useful in cryptocurrency markets. It is certainly very difficult (if not impossible) to put a value on bitcoin based on “fundamentals”, so in a way one actually has little choice in the matter if one wants to trade in these markets.

Regardless of the difficulty in evaluating it, the bitcoin market obviously enjoys broad participation (we previously noted that Elliott Wave analysis seems to work very well with BTC for this very reason). Since technical analysis is essentially an analysis of market psychology based on price and trading volume data (as well as sentiment and positioning data to the extent they are available), cryptocurrencies seem ideally suited to this analytical approach.

Next is a chapter discussing the concept of cryptocurrency forks in greater detail, then a section by Coinfinity CEO Max Tertinegg, who shares his views on the cryptocurrency market, and lastly an interview with Incrementum CEO Stefan M. Kremeth on the likely impact of blockchain technology and cryptocurrencies on the financial sector.

Download

We hope our readers will find the report as interesting and beneficial as we have – we actually think it is well worth reading regardless of whether one is active in the cryptocurrency markets.

Here is the download link: Incrementum Crypto Research Report II, March 2018 (PDF)

PS:

The report inter alia briefly mentions the alleged lack of a “use case” for cryptocurrencies apart from their potential use as media of exchange; in other words, the often heard assertion that if one applies the regression theorem to these currencies, one won’t arrive at a point when they had a use value distinct from their supposed monetary value. We would actually dispute this conclusion, but decided to do so in a separate post (note: the report does not come out in favor of this conclusion either, it merely mentions the argument as one that is made by critics of bitcoin). Stay tuned.

Full story here Are you the author? Previous post See more for Next post

Tags: Bitcoin,Crypto - Currencies,newslettersent