Monthly Archive: March 2018

Government proposes new pension reform guidelines

The Swiss government on Friday fixed the outlines of a new state pension reform plan, including raising VAT to fund it, and raising the retirement age for women from 64 to 65. The proposed reform is to be financed by an increase in VAT of up to 1.7%. Home Affairs Minister Alain Berset, who oversees social security and pension issues, is to submit a detailed proposal for consultation by lawmakers before the summer break.

Read More »

Read More »

Emerging Markets: What Changed

Indonesia will freeze prices for electricity, gasoline, and diesel fuel until next year. US President Trump and North Korean President Kim Jong Un will hold a summit meeting this spring. National Bank of Poland has tilted even more dovish. Moody’s downgraded Turkey a notch to Ba2 with a stable outlook. Saudi Arabian Energy Minister hinted that the Aramco IPO could be delayed until 2019. Tanzania finally obtained a sovereign rating after years of...

Read More »

Read More »

US Equities – Mixed Signals Battling it Out

Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator.

Read More »

Read More »

FX Daily, March 09: Today is about Jobs, but Not Really

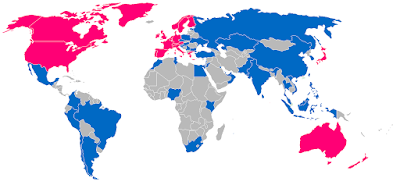

The US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea's Kim Jong Un.

Read More »

Read More »

Une TVA à 9.4 percent avec une perspective de retraite à 70 ans.

M Berset a présenté, ce 2 mars, les lignes directrices de sa réforme de l’AVS. Nous en retiendrons deux propositions phares. La première consiste à faire passer la TVA de 7,7% à 9,4%. M Berset impose une majoration de celle-ci de plus de 22%! L’information nous arrive au lendemain d’une annonce d’un excédent de 4,8 milliards de francs sur l’exercice 2017! Deux milliards avaient été provisionnés pour l’impôt anticipé.

Read More »

Read More »

Train business deal with Iran causes confusion

The Swiss firm, Stadler Rail, has rejected reports that it signed off on a major infrastructure contract with Iran’s Industrial Development & Renovation Organization for 960 wagons for an underground railway system. The companyexternal link said there is no deal or decision but merely a public tender, according to SRF public radio.

Read More »

Read More »

Gold Does Not Fear Interest Rate Hikes

Gold Does Not Fear Interest Rate Hikes. Gold no longer fears or pays attention to Fed announcements regarding interest rates. Renewed interest in gold due to inflation fears and concern Fed won’t do enough to control it. Higher interest rates on horizon will make debt levels unsustainable. New Fed Chair warns “the US is not on a sustainable fiscal path” and could lead to an “unsustainable” debt load. Higher interest rates are good for gold as seen...

Read More »

Read More »

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge. Sales in London property market at ‘historic lows’. 65% fall in pre-tax profits in 2017 to £6.5m reported by London estate agents Foxtons. Foxtons warns 2018 will ‘remain challenging’ for London property. Norway’s sovereign wealth fund is backing London’s property market. RICS: UK property stock hits record low as buyer demand falls. Own physical gold to hedge falls in physical...

Read More »

Read More »

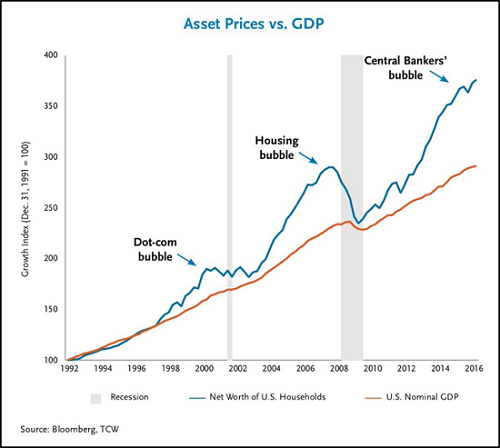

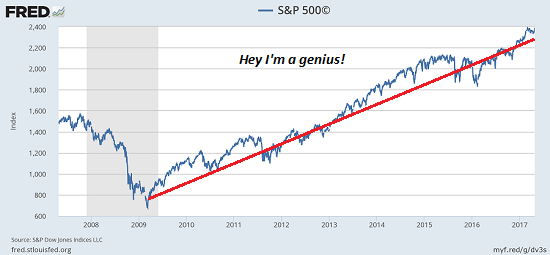

The Death of Buy and Hold: We’re All Traders Now

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses. The conventional wisdom of financial advisors--to save money and invest it in stocks and bonds "for the long haul"--a "buy and hold" strategy that has functioned as the default setting of financial planning for the past 60 years--may well be disastrously wrong for the next decade.

Read More »

Read More »

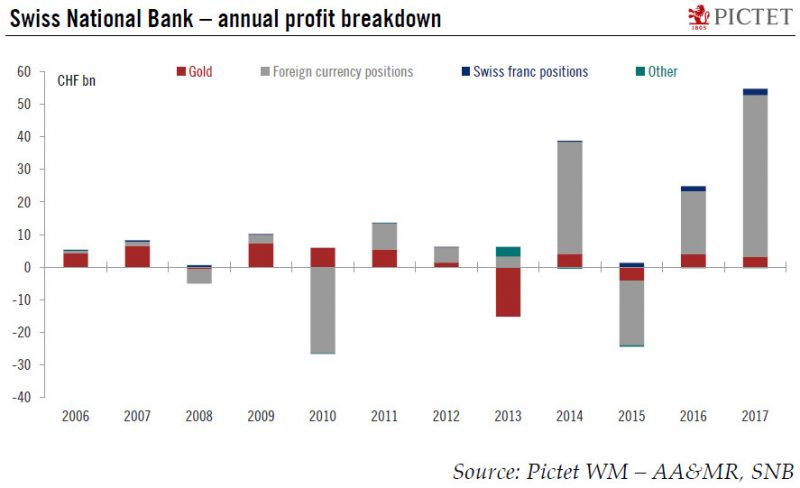

SNB confirms record profit for 2017

The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn (see Chart below).

Read More »

Read More »

Switzerland Unemployment in February 2018: Down to 3.2 percent from 3.3 percent, seasonally adjusted unchanged at 2.9 percent

Registered unemployment in February 2018 - According to SECO surveys, at the end of February 2018, 143,930 unemployed people were registered with the regional employment agencies (RAV), 5,231 fewer than in the previous month. The unemployment rate fell from 3.3% in January 2018 to 3.2% in the month under review. Compared with the same month of the previous year, unemployment fell by 15,879 persons (-9.9%).

Read More »

Read More »

FX Daily, March 08: Euro Slips Ahead of the ECB Meeting

Expectations that the European Central Bank would change its forward guidance in a substantive way had been one of the factors behind the euro's appreciation. However, more recently, the anticipation has slackened. The last meeting took place around the same time that many perceived US Treasury Secretary Mnuchin as having abandoned the strong dollar policy.

Read More »

Read More »

Former Raiffeisen boss Vincenz faces criminal probe

Zurich prosecutors have opened criminal proceedings against the former chief executive of Swiss banking group Raiffeisen, Pierin Vincenz, looking into suspicions of misdealing. The bank has also joined the probe as a private complainant. “Raiffeisen is therefore making a maximum contribution to the complete clarification of all processes,” the bank said in a statement on Wednesday.

Read More »

Read More »

Silver bullion will likely outperform gold bullion going forward

Normally the action in the gold and silver futures markets tends to be pretty similar, since the same general forces affect both precious metals. When inflation or some other source of anxiety is ascendant, both metals rise, and vice versa. But lately – perhaps in a sign of how confused the world is becoming – gold and silver traders have diverged.

Read More »

Read More »

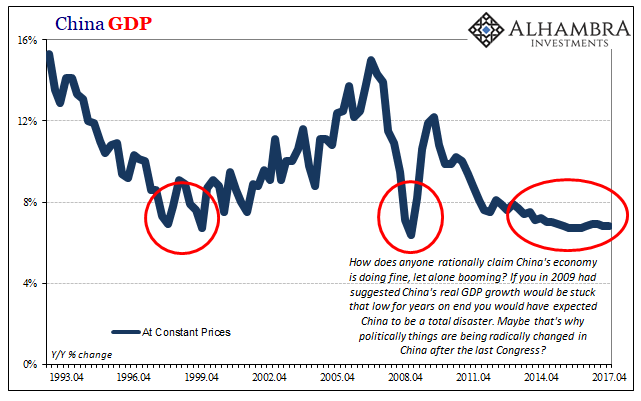

China Going Boom

For a very long time, they tried it “our” way. It isn’t working out so well for them any longer, so in one sense you can’t blame them for seeking answers elsewhere. It was a good run while it lasted. The big problem is that what “it” was wasn’t ever our way. Not really. The Chinese for decades followed not a free market paradigm but an orthodox Economics one. This is no trivial difference, as the latter is far more easily accomplished in a place...

Read More »

Read More »

FX Daily, March 07: Renewed Threat of Trade War Makes Investors Angry

In response to the resignation of one of the few "globalist" advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields.

Read More »

Read More »

UN’s Geneva staff planning a strike over pay cuts

Employees of the United Nations in Geneva are planning a half-day strike on Tuesday to protest against wage cuts. The work stoppage would take place during a busy week, with dozens of ministers and officials expected at various events. "We have tried other forms of protest in vain before," said Ian Richards, head of the Staff Coordinating Council at United Nations Office at Geneva, on Sunday. "They left us no choice."

Read More »

Read More »

2017 saw upswing in Swiss engineering jobs

The Swiss mechanical, electrical and metal industries are recovering, as indicated by increases in turnover and employment. The industry lobby group Swissmemexternal link reported on Thursday that 4,500 additional jobs were generated in 2017 compared to the previous year, taking the industry total to 322,100. In contrast, 12,600 jobs were cut in 2015 and 2016 combined.

Read More »

Read More »

Never Mind Volatility: Systemic Risk Is Rising

So who's holding the hot potato of systemic risk now? Everyone. One of the greatest con jobs of the past 9 years is the status quo's equivalence of risk and volatility: risk = volatility: so if volatility is low, then risk is low. Wrong: volatility once reflected specific short-term aspects of risk, but measures of volatility such as the VIX have been hijacked to generate the illusion that risk is low.

Read More »

Read More »