Monthly Archive: March 2018

Gold Cup At Cheltenham – Gold Is For Winners, Not For the Gamblers

Gold Cup at Cheltenham – ‘The Olympics’ of the European horse racing calendar. Gold Cup trophy contains 10 troy ounces of gold – worth £9,000. £620 million bets on horses, 230,000 pints of Guinness will be drunk, 9.2 tonnes of potato eaten. Since the 5th century BC, gold has been the ultimate prize to award champions and gold has been constantly and universally awarded as top prize.

Read More »

Read More »

Zurich is the world’s second most expensive city

Only Singapore is more expensive than Zurich, finds an economic survey that compared the prices of more than 150 grocery items in 133 cities around the world. In fact Zurich tied with Paris for second place, followed by Hong Kong, Oslo, and Geneva – which tied with Seoul for sixth place.

Read More »

Read More »

SWISS reports record profits for 2017

Swiss International Air Lines saw an increase in profitability of almost one-third in 2017, the company has reported. The performance is largely due to more efficient and capacious planes. While total income increased by a more modest 3.2% to CHF4.95 billion ($5.24 billion), pre-tax profits jumped by 31% to CHF561 million.

Read More »

Read More »

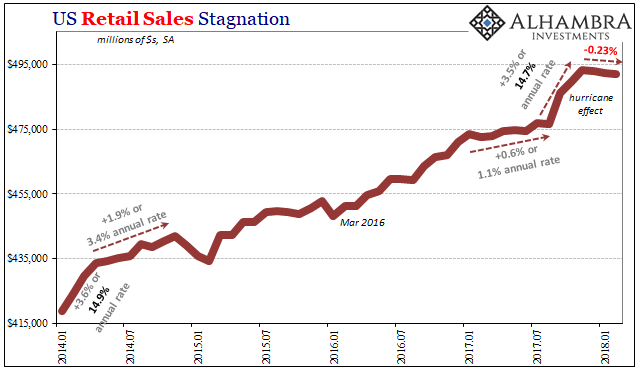

Three Months Now of After-Harvey Retail Sales; or, The Boom Narrative Goes Boom

If indeed this inflation hysteria has passed, its peak was surely late January. Even the stock market liquidations that showed up at that time were classified under that narrative. The economy was so good, it was bad; the Fed would be forced by rapid economic acceleration to speed themselves up before that acceleration got out of hand in uncontrolled consumer price gains. On February 1, the Atlanta Fed’s GDPNow tracking model was moved up to...

Read More »

Read More »

Geneva wants to limit Airbnb rentals to 60 days a year

The canton wants the platform to place limits on its use to put the brakes on commercial operators. The 60 day limit was set by Geneva’s State Council. Antonio Hodgers, State councillor in charge of housing told Tribune de Genève that renting on the platform had become a real business for some and that this needs to be controlled.

Read More »

Read More »

BOOM: Wyoming Ends ALL TAXATION of Gold & Silver

Cheyenne, Wyoming (March 14, 2018) – Sound money activists rejoiced as the Wyoming Legal Tender Act became law today. The bill restores constitutional, sound money in Wyoming. Backed by the Sound Money Defense League, Campaign for Liberty, Money Metals Exchange, and in-state grassroots activists, HB 103 removes all forms of state taxation on gold and silver coins and bullion and reaffirms their status as money in Wyoming, in keeping with Article 1,...

Read More »

Read More »

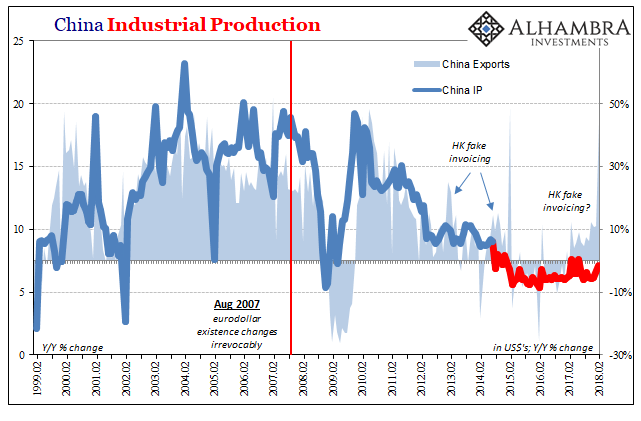

China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

Les banques centrales financées par les banques commerciales

Vincent Held continue à présenter des extraits dans cette 3ème et dernière vidéo. Les 3 vidéos se trouvent sur le site de Planètes 360. Cette vidéo fait suite à celle sur le marché REPO.

Read More »

Read More »

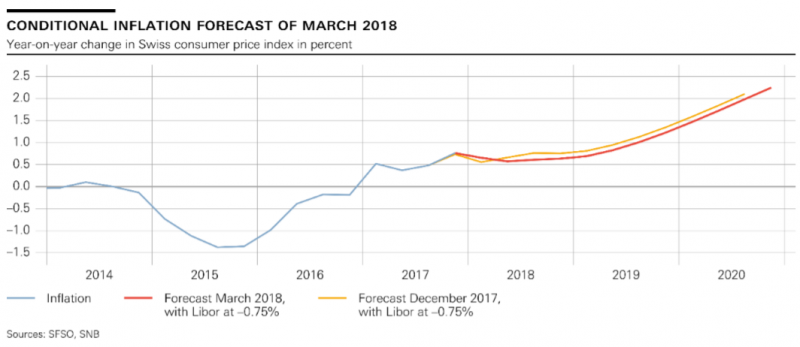

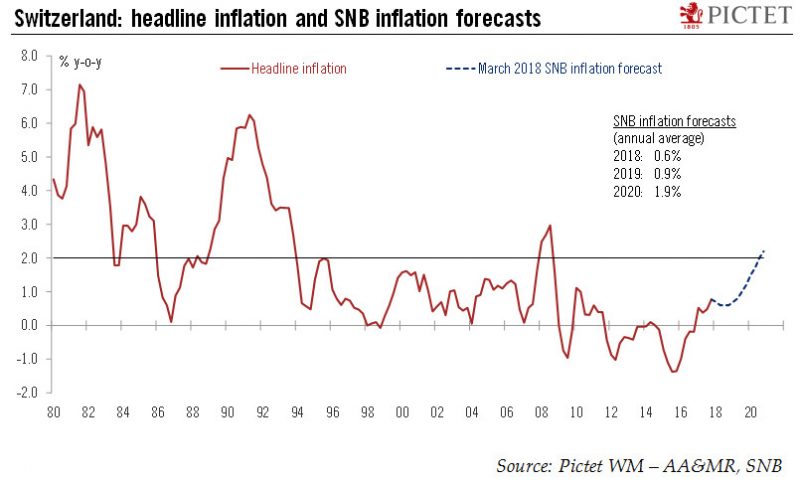

SNB Monetary policy assessment of 15 March 2018

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Too early for Switzerland’s central bank to change policy…

At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

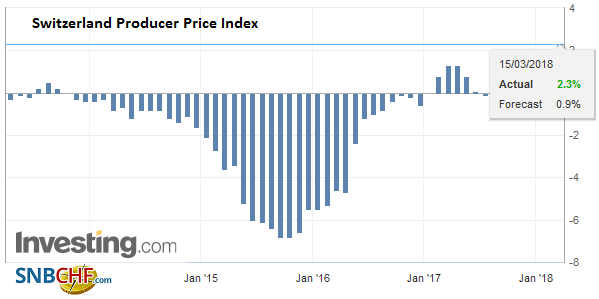

Swiss Producer and Import Price Index in February 2018: +2.3 percent YoY, +0.3 MoM

The Producer and Import Price Index rose in February 2018 by 0.3% compared with the previous month, reaching 102.6 points (December 2015=100). The rise is due in particular to higher prices for chemical and pharmaceutical products. Compared with February 2017, the price level of the whole range of domestic and imported products rose by 2.3%. These are some of the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Call for pensions paid abroad to be taxed at source

A proposal to tax at source the old-age pensions of Swiss retirees living abroad has been made in parliament. The aim is to prevent differential treatment of pensioners based on where they live. On Wednesday, Christian Democrat senator Peter Hegglin tabled an interpellationexternal link in parliament to address unequal treatment between pensioners who reside in Switzerland those who opt to spend their twilight years abroad.

Read More »

Read More »

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony. Hungarian National Bank (MNB) to repatriate 100,000 ounces gold from Bank of England. Follows trend of Netherlands, Germany, Austria and Belgium each looking to bring gold back to home soil. Hungary one of the smallest gold owners amongst central banks, with just 5 tonnes. Central bank gold purchases continue to be major drivers of gold market.

Read More »

Read More »

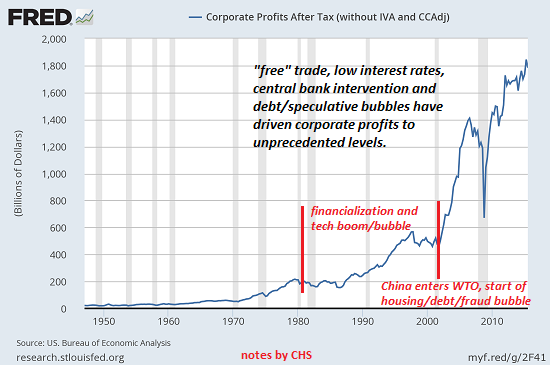

There is No “Free Trade”–There Is Only the Darwinian Game of Trade

Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows. Stripped of lofty-sounding abstractions such as comparative advantage, trade boils down to four Darwinian goals: 1. Find foreign markets to absorb excess production, i.e. where excess production can be dumped. 2. Extract foreign resources at low prices. 3. Deny geopolitical rivals access to these resources.

Read More »

Read More »

Great Graphic: Potential Topping Pattern for Euro

The euro appears to be potentially carving out a topping pattern. Recall that after correcting lower last September and October, the euro rallied for three months through January before weakening 1.75% in February. That was its biggest decline since February 2017. The euro's high print was actually on February 16 near $1.2555, when it posted a key reversal, which is when it makes a new high for the move and then closes below the previous day's low.

Read More »

Read More »

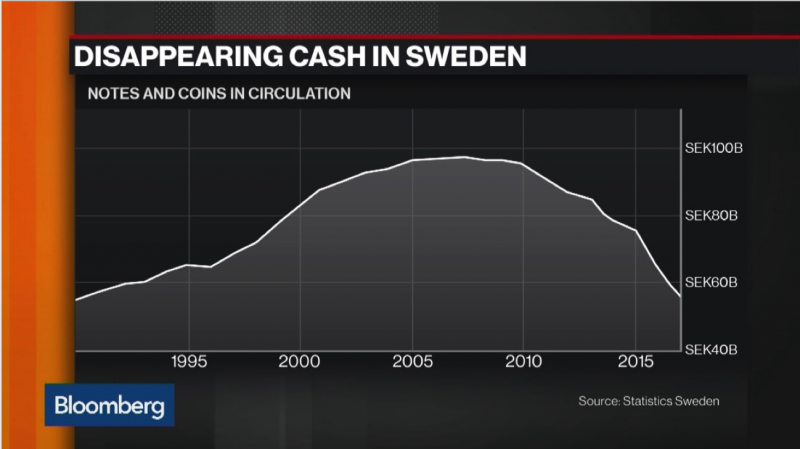

Gold Protects As Cashless Society Threatens Vulnerable

Gold Protects As Cashless Society Threatens Vulnerable. Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’. Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash. Cash usage in Sweden falling both as share of GDP and in nominal terms. Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona. Cashless is not a disincentive for illegal drug...

Read More »

Read More »

Switzerland – a definition of middle class

A recent survey calculates 60.1% of Switzerland’s population was middle class in 2015, a figure that has remained broadly stable since 1998, reaching its highest in 2009 (61.3%) and lowest in 2013 (56.8%). But what is middle class in Switzerland? According to Switzerland’s Federal Statistical Office, it is anyone living in a household with a gross income between 70% and 150% of the gross median income.

Read More »

Read More »

Raiffeisen chair resigns over scandal-tainted former CEO

Johannes Rüegg-Stürm, the chairman of the board of directors of Switzerland’s third-largest bank has resigned from his position with immediate effect. The bank hopes turn a new page following the arrest and criminal proceedings against former CEO Pierin Vincenz. A statementexternal link released by the bank on Thursday, said the move was intended to “preserve the long-term credibility of the bank”.

Read More »

Read More »

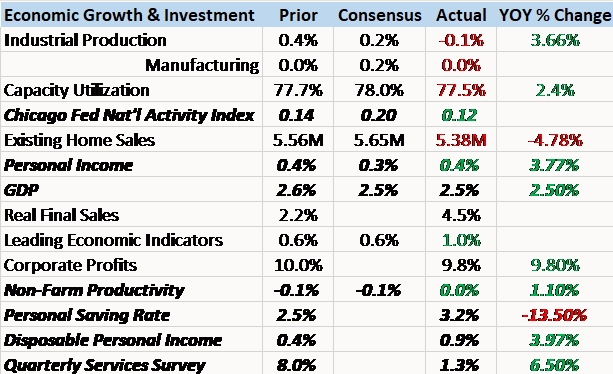

Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing.

Read More »

Read More »