Monthly Archive: March 2018

Four Charts: Debt, Defaults and Bankruptcies To See Higher Gold

$8.8B Sprott Inc. sees higher gold on massive consumer debt, defaults & bankruptcies. Rising and record U.S. debt load may cause financial stress, weaken dollar and see gold go higher. Massive government and consumer debt eroding benefits of wage growth (see chart).

Read More »

Read More »

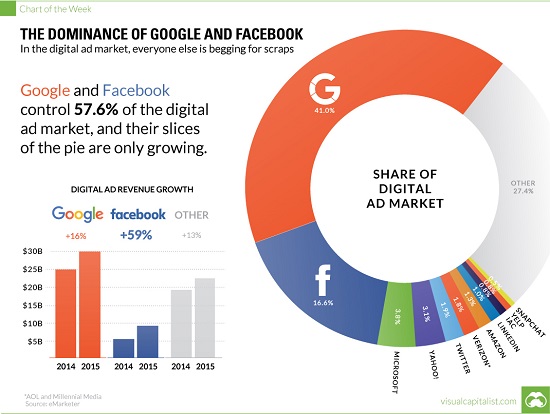

Is Profit-Maximizing Data-Mining Undermining Democracy?

As many of you know, oftwominds.com was falsely labeled propaganda by the propaganda operation known as ProporNot back in 2016. The Washington Post saw fit to promote ProporNot's propaganda operation because it aligned with the newspaper's view that any site that wasn't pro-status quo was propaganda; the possibility of reasoned dissent has vanished into a void of warring accusations of propaganda and "fake news" --which is of course propaganda in...

Read More »

Read More »

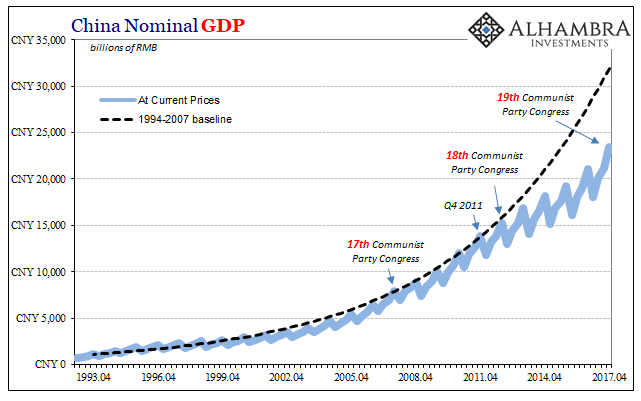

The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

BNS; les liquidités des banques suisses au service du QE de la communauté monétaire internationale

La BNS s’est arrimée à l’euro en 2011 sous le prétexte de soutenir les exportateurs suisses.Ce serait donc la raison de sa transformation en hedge fund. De notre côté, nous avons toujours soutenu depuis 2011 qu’elle n’avait fait que suivre ses collègues dans la pratique du quantitative easing, dans le but de soutenir les grandes banques et autres hedge funds, en les déchargeant de leurs créances publiques à haut risque.

Read More »

Read More »

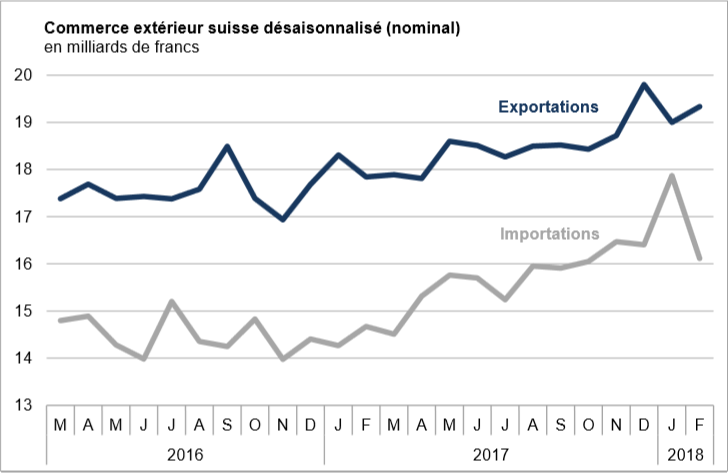

Swiss Trade Balance February 2018: Foreign Trade at a High Level

In February 2018, exports increased by 1.8%, confirming their positive trend. After their January record, imports fell back (-9.8%). However, they continued to grow at a high level, at 16.1 billion francs. At the entrance, the flagship markets Europe and North America led the result.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM.

Read More »

Read More »

Rolex ‘most reputable global brand’ for third straight year

Swiss watch brand Rolex has topped a ranking of the world’s most reputable brands for a third year in a row. Rolex beat Danish toy firm Lego for the top spot, while Swiss food manufacturer Nestlé jumped 21 places to rank 33rd. The Reputation Institute compiled the list in its annual Global RepTrack 100external link, after asking more than 230,000 people in 15 countries to rank some of the world’s biggest companies based on criteria such as ethical...

Read More »

Read More »

Swiss voters could get to decide on Switzerland’s Winter Olympics bid

In October 2017, when Switzerland’s Federal Council announced the government would stand behind Sion’s bid for the 2026 Winter Olympics, it sparked a backlash. A survey run by Tamedia in February 2018 suggests 59% of the Swiss public are against the bid, according to RTS. The estimated cost to Swiss taxpayers is close to CHF 1 billion. Other costs, to be borne by the host canton Valais and other cantons, are expected on top of this federal...

Read More »

Read More »

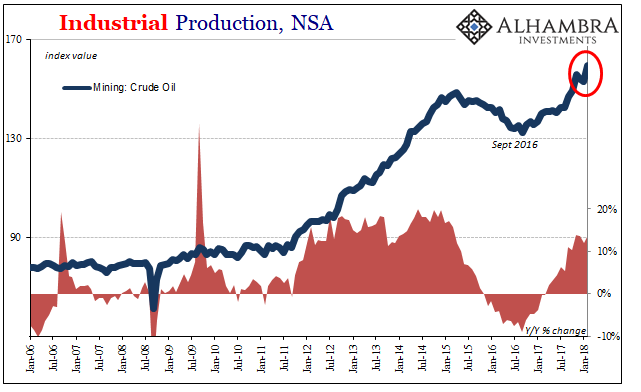

US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots.

Read More »

Read More »

New CHF200 banknote to be introduced in August

The Swiss National Bank (SNB) has announced that the latest addition to the new banknote series – the CHF200 note ($209) - will go into circulation on August 22. The brown note’s key motif will be physical matter. It will “showcase Switzerland’s scientific expertise”, the SNB said a press release on Monday.

Read More »

Read More »

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018.

Read More »

Read More »

FX Weekly Preview: The Fed and More

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be purchased under the...

Read More »

Read More »

Weekly Technical Analysis: 19/03/2018 – USD/JPY, EUR/USD, GBP/USD, NZD/USD, USD/CHF

The USDCHF pair leaned well on 0.9488 level to resume its positive trading, on its way towards our first waited target at 0.9581, as the price moves inside bullish channel that appears on the above chart, supported by the EMA50 that protects trading inside this channel, noting that breaching the targeted level will extend the pair’s gains to reach 0.9675.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. Bank of Israel’s MPC had a split vote last month for the first time in three years. South Africa President Ramaphosa said the ANC wants Julius Malema of the opposition EFF to rejoin the party. Former South Africa President Zuma will face trial on 16 criminal charges.

Read More »

Read More »

Buy Silver And Sell Gold Now

Buy silver and sell gold now – Frisby. Gold should cost 15 times as much as silver. Silver might have disappointed in short term – But it’s time to buy. Editor’s note: Silver has outperformed stocks, bonds and gold over long term (see table).

Read More »

Read More »

SWISS boss says that Geneva airport routes are not guaranteed

The CEO of Swiss International Air Lines has said that it is not impossible that the carrier’s Geneva operations be taken over by Eurowings, Lufthansa’s low-cost arm, in 2019. In an interview published in the Agefi newspaper on Monday, Thomas Klühr said he remained “confident” that such a scenario would not come about, but that it depended on the Swiss airline making a profit on its Geneva operations through the course of 2018.

Read More »

Read More »

Captation des capitaux retraite LPP, le bras de fer…

C’est une réforme majeure du 2ème pilier qui a été repoussée sous la Coupole fédérale. Dans le cadre de la modification du régime des prestations complémentaires, le Conseil national a refusé de limiter le retrait de l’avoir vieillesse sous forme de capital.

Read More »

Read More »

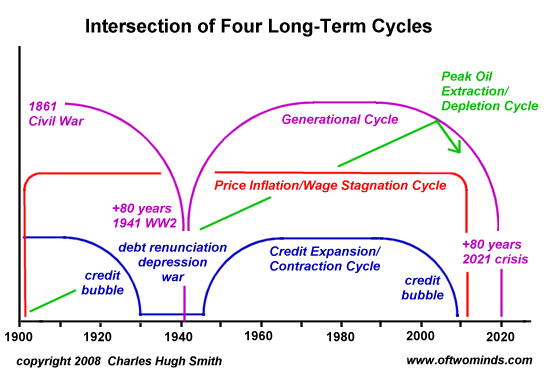

Checking In on the Four Intersecting Cycles

Correspondent James D. recently asked for an update on the four intersecting cycles I've been writing about for the past 10 years. Here's the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social).2. Price inflation/wage stagnation (economic). 3. Credit/debt expansion/contraction (financial). 4. Relative affordability of energy (resources).

Read More »

Read More »

How Much Longer Can We Get Away With It?

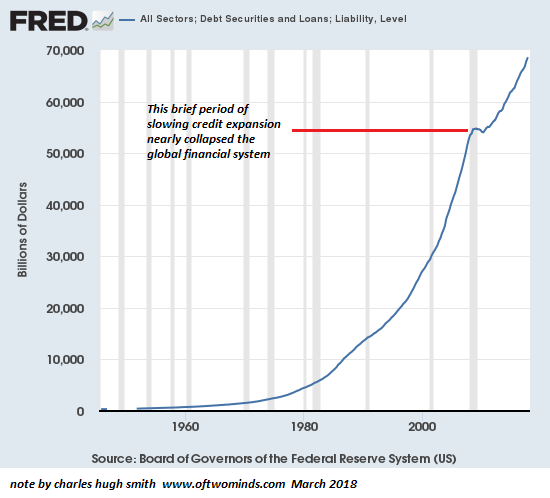

Alas, fakery isn't actually a solution to fiscal/financial crisis.. This chart of "debt securities and loans"--i.e. total debt in the U.S. economy--is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or "emitting" in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the...

Read More »

Read More »

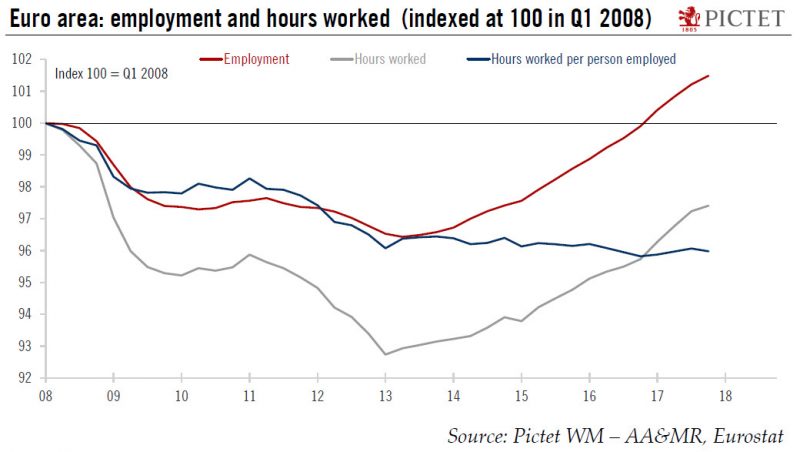

Europe chart of the week – Employment

Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level. The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total amount of labour input used by firms decreased massively.

Read More »

Read More »