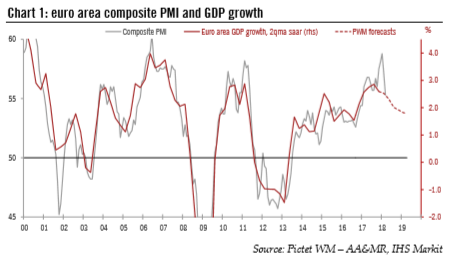

Today’s first batch of euro area March business surveys looks worrying at first sight. The drop in the euro area composite PMI index, from 57.1 to 55.3 in March (consensus: 56.8), was the second one in a row and the largest monthly decline in six years. New orders fell to a 14-month low. The correction in business sentiment was predominantly driven by the manufacturing sector, which could reflect broader concerns of a trade war.

However, most business surveys remained at high levels in absolute terms, consistent with our forecast of a gradual deceleration in euro area sequential growth rates this year. Moreover, PMI sub-components were still encouraging overall, consistent with a mid-cycle pause more than anything else. Both the German IFO and the French INSEE surveys moderated in March, with the former still relatively close to all-time highs. Elsewhere in the euro area, output growth slowed to a 5-month low according to the PMIs.

| In all, we view the sharp correction in euro area business surveys in Q1 as the consequence of an overshoot in late 2017 (relative to the actual pace of growth), which was likely amplified by the inventory cycle. Markit noted that supply-side constraints weighed on output growth in March (as well as “an unusually high prevalence of staff sickness” in Germany). It will be very important to see whether PMIs manage to stabilise at current levels, but so far our forecasts look on track (see Chart 1). We see no reason to change our assessment of the business cycle assuming trade frictions do not turn into a proper trade war. At the domestic level, we continue to forecast labour market conditions and investment spending to improve further. |

Euro Area Composite PMI and GDP Growth, 2000 - 2018(see more posts on Eurozone Composite PMI, ) |

| On average in the first quarter of this year, euro area PMIs were consistent with real GDP growth of around 0.7-0.8% q-o-q, according to Markit, a touch higher than our forecast (0.65%). While the balance of risks could indeed shift to the downside if the correction in business confidence were to be sustained, anecdotal evidence of supply chain delays and other temporary factors suggest that the underlying pace of activity expansion remains healthy. |

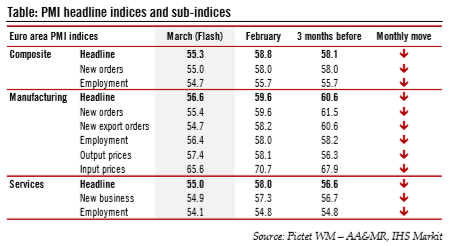

PMI Headline, Feb - Mar 2018 |

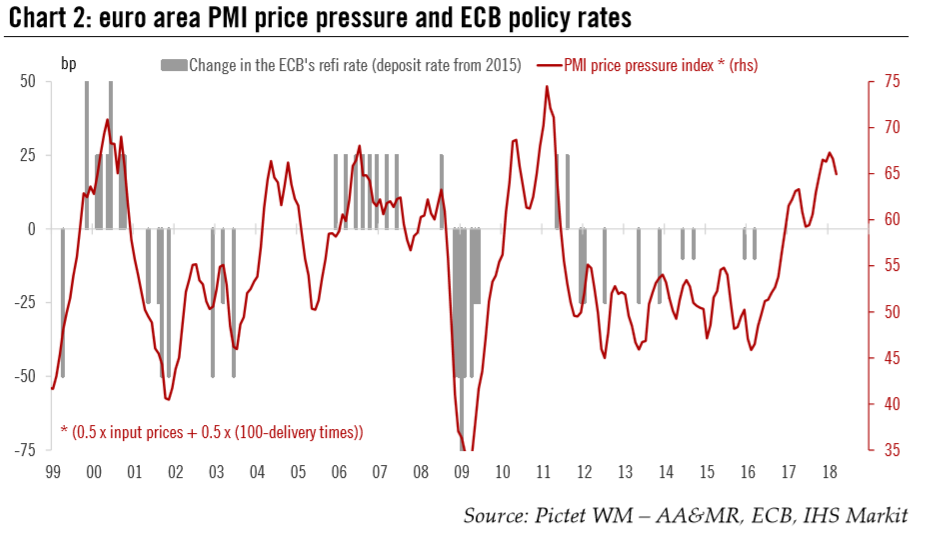

| Meanwhile, price and wage pressure continued to increase in March, if only at a slightly more moderate pace than in recent months. Our PMI price pressure gauge fell marginally further in March, to a six-month low (still in ‘ECB tightening’ territory). PMI components remained consistent with rising capacity constraints and tighter delivery times, which fell to all-time lows in Germany. Still, survey-based inflation expectations have proved to be very imperfect indicators of actual inflation in the recent past. |

Euro Area PMI Price Pressure and ECB Policy Rates, 1999 - 2018 |

In the end, today’s flash PMI reports may well fuel additional dovish comments from ECB members, but we do not think that they will materially influence their broader assessment of price stability over the medium term. More than ever, the focus will be on the downside risks to global growth and the adjustment to euro area core inflation. We continue to expect the ECB to announce a gradual tapering of QE in June or July, and to start hiking policy rates in Q3 2019 (see “Rotation”; 8 March 2018).

Full story here Are you the author? Previous post See more for Next postTags: Eurozone Composite PMI,Macroview,newslettersent