Bank Bail-In Risk In Europe Seen In 5 Charts

– Nearly €1 trillion in non-performing loans poses risks to European banks’

– Greece has highest non-performing loans as a share of total credit

– Italy has the biggest pile of bad debt in absolute terms

– Bad debt in Italy is still “a major problem” which has to be addressed – ECB

– Level of bad loans in Italy remains above that seen before the financial crisis

– Deposits in banks in Greece, Cyprus, Italy, Ireland, Czech Republic and Portugal most at risk from bank bail-in

Editor: Mark O’Byrne

|

As reported by Bloomberg this week in an important article entitled ‘Five Charts That Explain How European Banks Are Dealing With Their Bad-Loan Problem’:

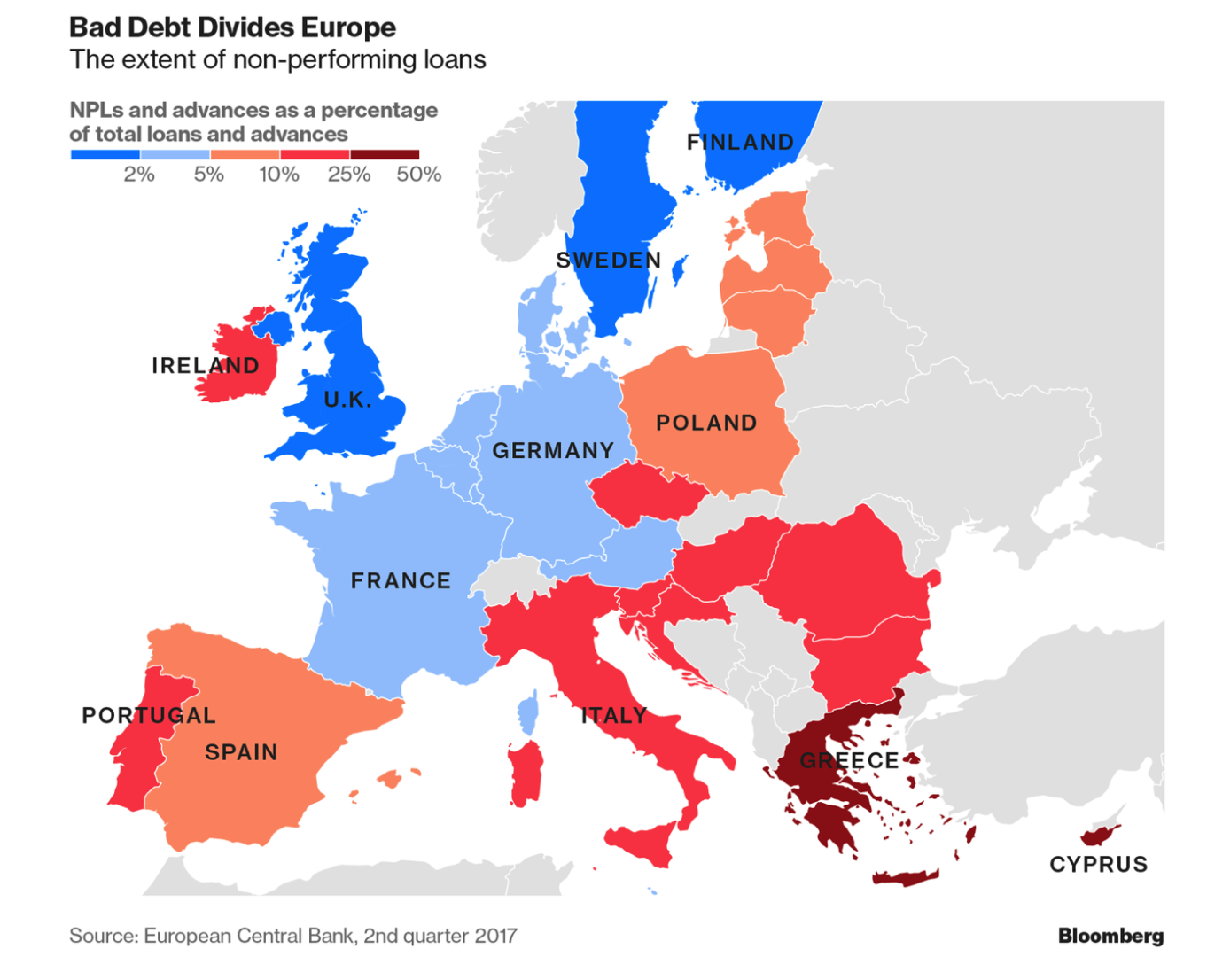

The problem is particularly acute in the countries that were hit hardest by the sovereign debt crisis. Greece, which has yet to exit its bailout program, tops the list of non-performing loans as a share of total credit, while Italy has the biggest pile of bad debt in absolute terms. |

NPLs and Advances of Total Loans and Advances, Q2 2017 |

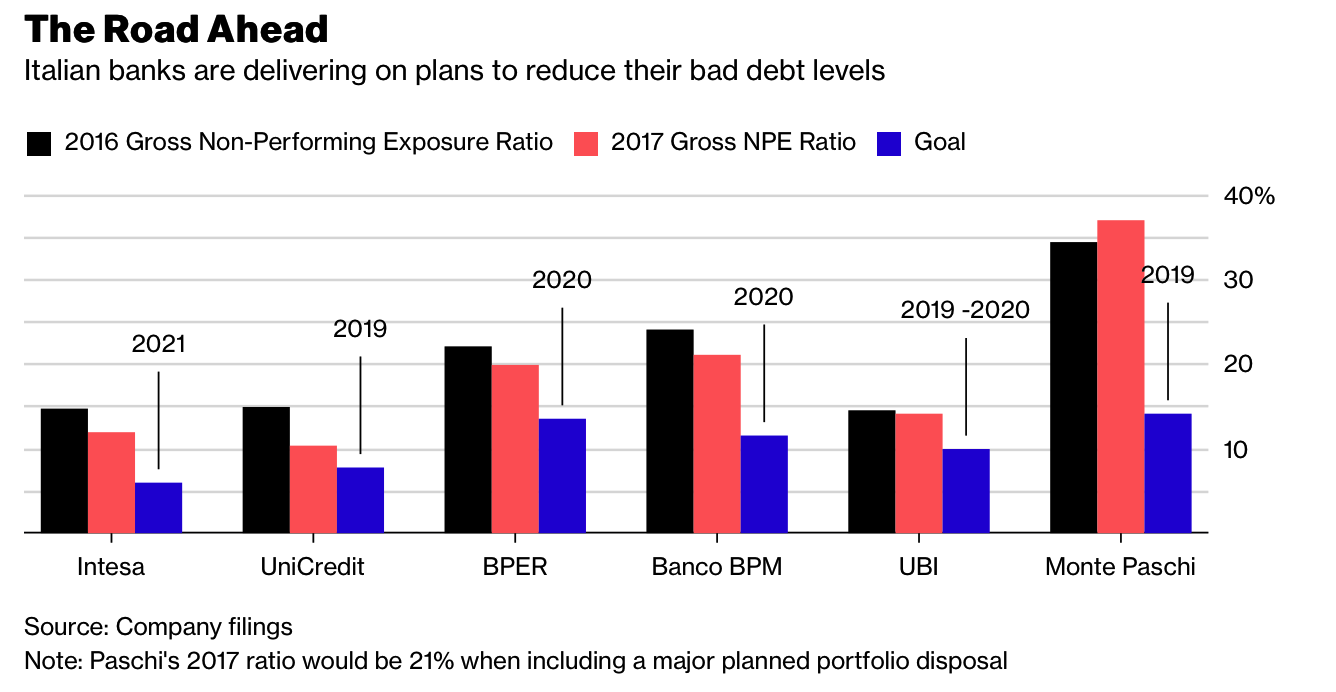

| Italian banks have fixed goals for shrinking their bad credit levels by selling portfolios or winding down loans. Intesa Sanpaolo SpA, the country’s biggest bank by market value, got a head start on its rivals two years ago and plans to accelerate the reduction of non-performing loans, Chief Executive Officer Carlo Messina said last month. He says other Italian banks “are doing the right job” and should make further progress this year. |

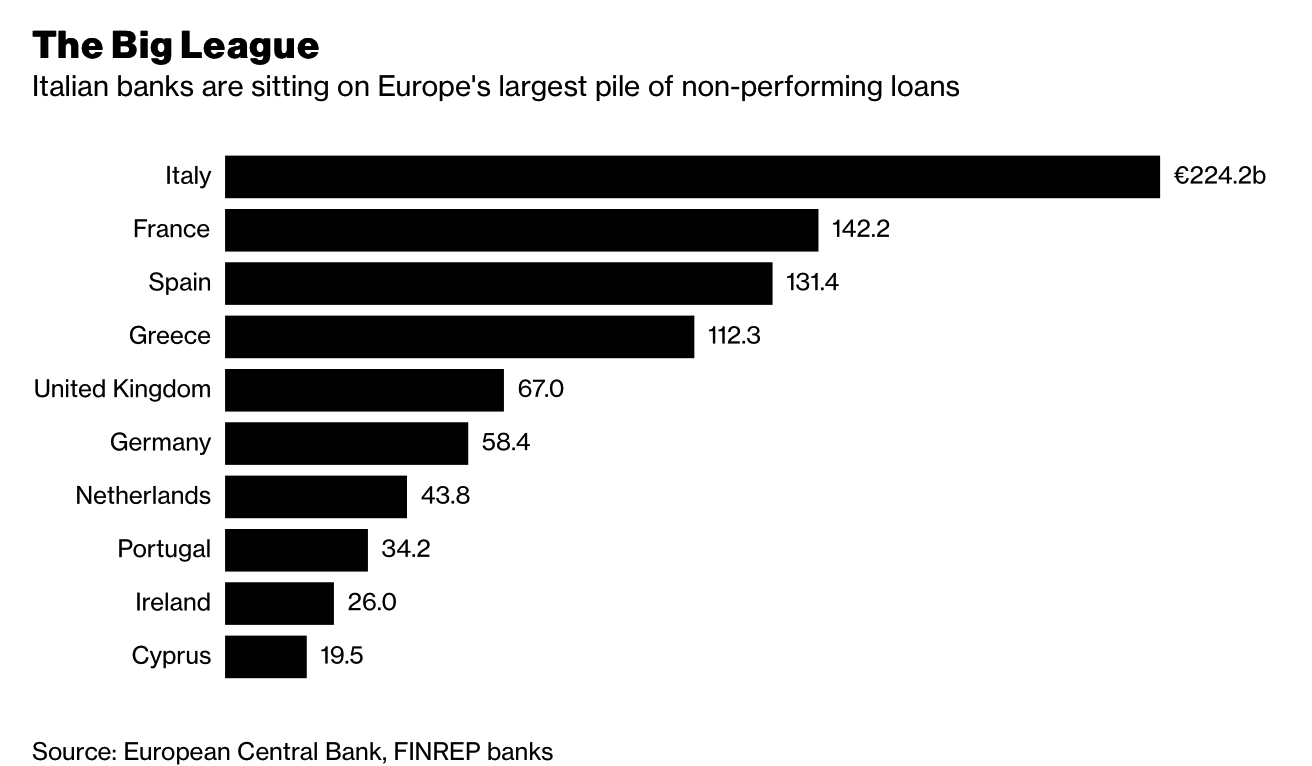

Italian Banks on Europe's Largest Pile |

| Italy amassed its pile of non-performing loans during years of little or no economic growth. The problem is compounded by the country’s legal system, where it takes lenders longer to liquidate collateral than in many other countries. Italy overhauled its bankruptcy rules in October to make them quicker and more efficient.

|

2016 Gross Non-Performing Exposure Ratio, 2017 Gross NPE Ratio and Goal |

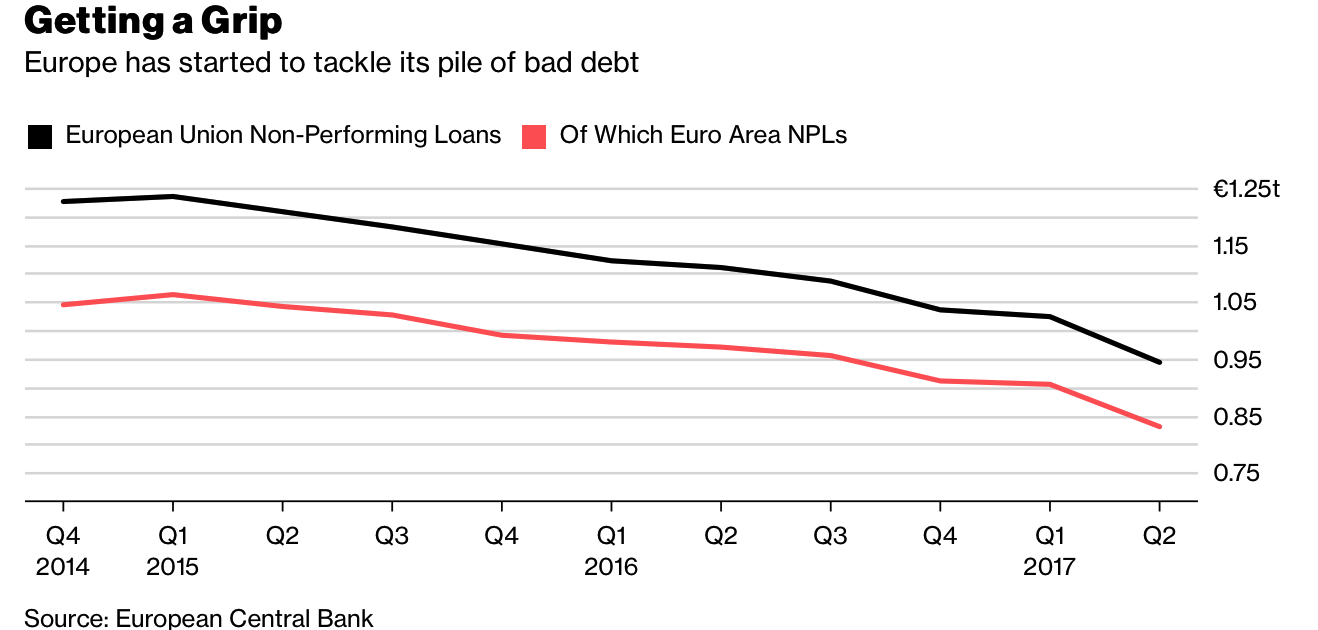

European debtEuropean banks overall have cut their non-performing loans by more than 280 billion euros since the end of 2014. The European Central Bank, which supervises most of the bloc’s big lenders, says bad debt is still “a major problem” which has to be addressed lenders while the economy performs well. |

European Union Non-Performing Loans and Euro Area NPLs, Q4 2014 - Q2 2017 |

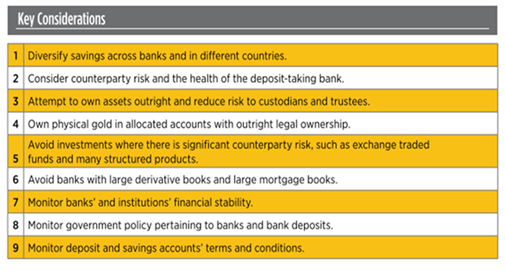

What the five charts don’t show you is how much at risk are the deposits of savers and the capital of small to medium size enterprises (SMEs) who are the backbone of our respective economies. Bank bail-in and bail-in tools are now the preferred option for the ECB when it comes to dealing with failing banks. As you can see from the five charts, failing banks in Europe remain a very real risk. In the EU it has been two years since the ECB decided it was better to force the financial burden of banks’ failures away from ordinary tax payers and instead onto bondholders and creditors i.e. those with deposits in a bank. Since then there has been very little information from the banks or mainstream media to warn individuals and businesses about the risk their deposits are exposed to and depositors have been lulled into a false sense of security regarding bank bail-ins. |

Companies, Consumers and Other Credits, Q1 2007, 2017 |

| The problem is particularly acute in the countries that were hit hardest by the sovereign debt crisis. Greece, which has yet to exit its bailout program, tops the list of non-performing loans as a share of total credit, while Italy has the biggest pile of bad debt in absolute terms.Depositors, including savers, should consider diversifying some of their capital and not having all their eggs in the bank deposit basket. An allocation to physical gold and silver is prudent in this regard.

Gold and silver are financial insurance against bank bail-in, political mismanagement, and insolvent banks and governments. Allocated and segregated coins and bars confers outright legal ownership that is difficult to be appropriated, confiscated or subject to “haircuts”. If bullion is owned in the safest ways possible, your precious metal intermediary or counter party cannot claim it is legally theirs and jeopardise your ownership of the asset. Nor can they hamper or remove that all important liquidity and the ability to use your precious metal assets as and when you need to. It has been more than 10 years since the start of the financial crisis and yet banking risks, particularly in Europe, remain very high. The root cause of the problem – too much debt – was not dealt with and as each year goes by it becomes more important than ever to protect yourself from bail-in risks. |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent