| Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver” – JP Morgan continues to accumulate the biggest stockpile of physical silver in history – “JPM now holds more than 133m oz -more than was held by the Hunt Bros” – Butler – Silver hoard owned by JPM has increased from Zero ozs in 2011 to 120m ozs today – Money managers showing more optimism towards silver through record buying – “Near impossible to rule out an upside price surprise at any moment” |

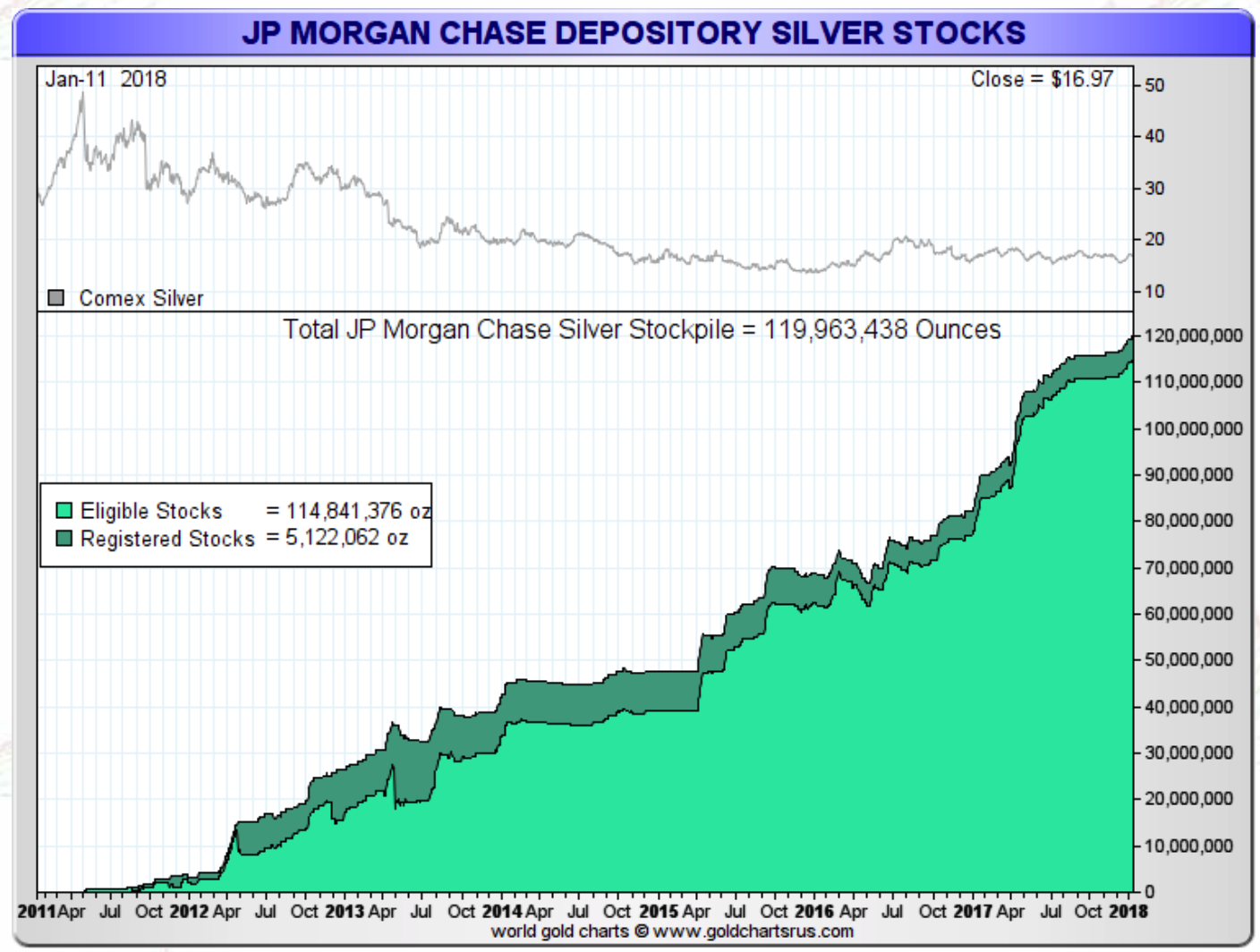

JP Morgan Silver Stocks, Apr 2011 - Jan 2018 |

| Money managers are feeling increasingly optimistic about silver, against a backdrop of cautiousness regarding gold according to the latest Commitment of Traders (COT) report.

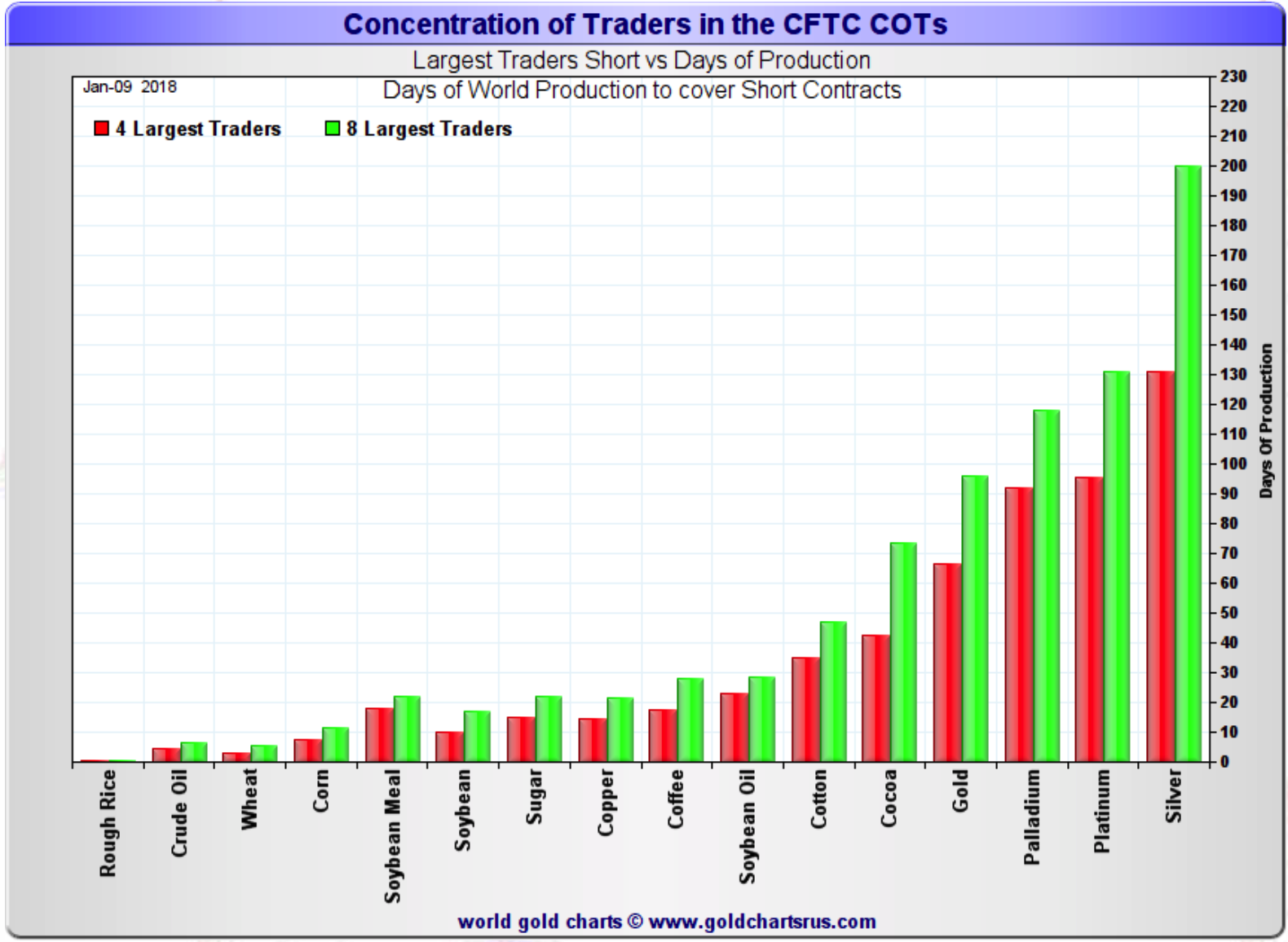

There has been some record buying in the last fortnight. The report shows some impressive moves given just under a month ago the silver market was net short. Last week speculative gross long positions in Comex silver futures rose by 11,920 contracts to 66,224. Whilst short positions fell by 10,379 contracts to 28,122. Silver’s net long positions now stand at 38,102 contracts. For the current week’s reporting, the four largest traders are short 130 days of world silver production-and the ‘5 through 8’ large traders are short an additional 70 or so days of world silver production-for a total of 200 days. This is around seven months of global silver production. Much of this is attributed to JP Morgan, who according to respected silver analyst Ted Butler, is responsible for the ‘third great investment accumulation of physical silver’. The silver market has been closely monitoring JP Morgan’s activities for some time. Since April 2011 the powerful bank has been accumulating silver at a quite a rate. It has taken its position from zero to nearly 120m ounces this month, less than six years later. Butler explains:

|

Concentration of Traders |

|

Why would JP Morgan be stockpiling silver? As we pointed out a few years ago, it may be the case that they are anticipating geopolitical and financial turmoil? This would not come as a surprise to JP Morgan shareholders who have previously received such warnings from CEO Jamie Dimon who has stated ‘there will be another crisis’. Dimon has even admitted that the trigger for the next crisis may not be the same trigger as the last one – but there will be another crisis:

JP Morgan’s silver accumulation in the face of upcoming turmoil may lead some to ask why not go for gold? It’s likely that the depressed price is the deciding factor here. The bank is often compared to the Hunt brothers when it comes to cornering of the silver market, but in truth the bank has been much savvier and is set to make far more. After all, the Hunt’s accumulated primarily paper silver, JP Morgan are going after the hard stuff. Had the Hunt brothers, bought more physical silver bullion and less paper silver in the form of futures, they would likely have made even more money than they could imagine. |

Silver/USD, Jul 2008 - Oct 2017 |

More silver bullion than we know?Butler believes that ‘JPMorgan holds at least 675 million ounces of actual silver. Simply put, JPMorgan has acquired six times as much metal as bought by the Hunts or Berkshire Hathaway. If this really is the case then it would account for ‘nearly 45% of the 1.5 billion ounces of silver bullion in the form of industry standard 1,000 ounces bars in the world’. The ability to accumulate so much physical silver whilst at the same time sell short huge quantities of paper derivatives or futures contracts could be the poster child for market manipulation. After all, the selling results in lower prices which then paves they way for more physical buying by the bank. Butler again:

To what end are JP Morgan pursuing this path of silver hoarding?

Silver prices looks particularly undervalued right now. Last year it gained just 1.6%, compared to 11.5% for gold and 48% for palladium. Yet we (and big banks such as JP Morgan) remain bullish. We have previously written about our forecast that silver prices will surpass its nominal high of $50 per ounce and its inflation adjusted high of $150 per ounce in the coming years. The fundamental reasons for our very bullish outlook on silver is very reasonable. There are increasing global macroeconomic, systemic, geopolitical and monetary risks. Silver’s historic role as money and a store of value has already been identified time and time again in the past and history is repeating itself. It is also worth considering the declining and very small supply of silver, not to mention increasing investment demand from one of the world’s most powerful banks and other contrarian investors. We should see JP Morgan’s accumulation as not just a sign to buy physical silver but also that the next financial crisis is coming and its time to diversify into physical gold and silver bullion coins and bars.

|

Bank of China Growth Weaker Dollar, 2013 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent