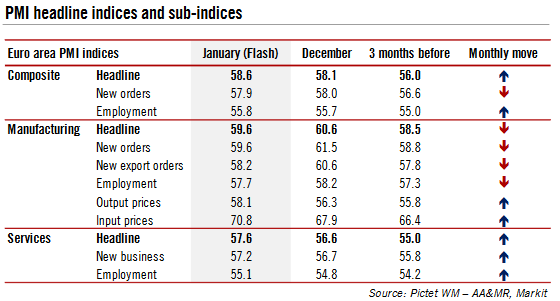

| The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.

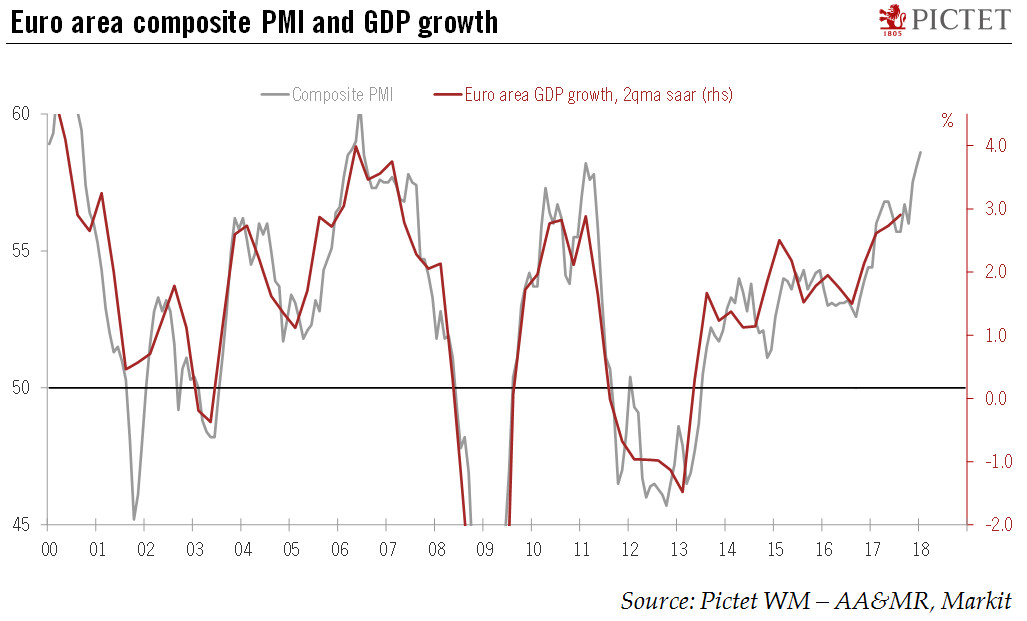

The only piece of less positive news was a modest drop in forward-leading indicators in the manufacturing sector, consistent with our forecast of a gradual slowdown in the pace of growth in the second half of 2018. Still, January PMIs confirm that growth is improving in terms of quantity as well as quality, with rising job creation and investment. We forecast euro area GDP growth of 2.3% both in 2017 and 2018, with near-term upside risks. |

Eurozone PMI Headline Indices |

| Meanwhile, price pressures intensified further in January, according to the flash survey, and “capacity continued to show signs of being stretched” despite rising employment. Input costs and selling prices rose to their highest levels since April 2011, both in the manufacturing and services sectors. Delivery times remained close to record highs. These bullish developments in soft data, along with GDP growth that is stable and well above potential, could impel the ECB to become more hawkish in its communication over the course of the year (see “Guide me if you can! ”, 19 January). Importantly, there has been little evidence so far that a stronger currency is having any meaningful impact on euro area growth or inflation. |

Eurozone Composite PMI and GDP Growth, 2000 - 2018 |

In Germany, the flash composite PMI index fell marginally to 58.8 in January from 58.9 in December, above consensus expectations (58.5). The details suggest that manufacturing (-2.1 points to 61.2) cooled, while momentum in services picked up (+1.2 points to 58.8) reaching a nearly seven years high. That being said, the expansion in manufacturing remains one of the strongest on record. Momentum in employment is still brisk, with job creation rising at its fastest pace since early 2011. Delivery times lengthened further in January due to capacity constraints, mainly in the manufacturing sector. Inflation pressures mounted further, according to the flash survey, driving up both input and output prices. Overall, PMI data suggest that momentum in Germany is being maintained. The highlight of January’s PMI report was the strong impetus in the services sector. Firms remain strongly optimistic about 2018 despite lingering political uncertainty.

In France, the flash composite PMI increased marginally to 59.7 in January from 59.6 in December, above consensus expectations (59.2). This marginal rise was primarily led by the services sector (+0.2 to 59.3), offsetting a 0.7 point drop in the manufacturing index to 58.1. The breakdown by sub-indices showed that output was supported by a further rise in new orders. The rate of new order growth in January was the most marked since April 2011, mainly driven by the services sector. Firms boosted employment —but not enough to avoid a rise in orders. Input price pressures intensified in January due to higher wage and raw material costs, prompting firms to raise selling prices to protect margins. Overall, PMIs continue d to signal solid momentum in the private sector at the start of the year. French composite PMI suggests that the strong finish to 2017 has continued into 2018.

Outside the two largest euro area countries , Markit noted that “business activity rose at the fastest pace since July 2006, with manufacturing recording the strongest monthly increase in output since April 2000. Service sector growth accelerated but remained below some of the peaks seen last year. Prices charged rose at the steepest rate for nearly a decade”.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newslettersent