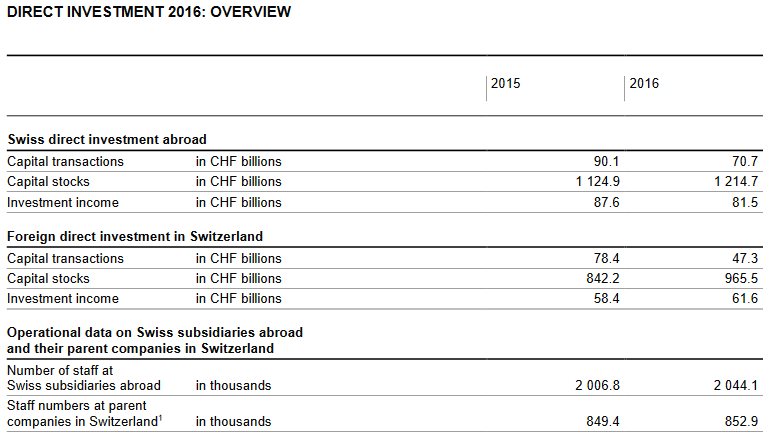

Swiss direct investment abroadIn 2016, companies domiciled in Switzerland invested CHF 71 billion abroad. Swiss direct investment abroad thus fell short of the CHF 90 billion recorded in 2015, due primarily to lower investment activity by finance and holding companies. All other industry categories combined actually exceeded the level of the previous year with investment abroad of CHF 62 billion (2015: CHF 46 billion). Of this total, CHF 29 billion was accounted for by manufacturing and CHF 33 billion by services. Of this investment abroad, CHF 58 billion went to countries in Europe, mainly to the Netherlands and the UK. To a large extent, this direct investment was attributable to group reorganisation, with foreign-controlled holding companies incorporating participations abroad. Companies in Switzerland invested CHF 36 billion in the US, partly in the form of acquisitions. By contrast, CHF 22 billion was withdrawn from offshore financial centres in Central and South America. Stocks of direct investment abroad rose by CHF 90 billion, or 8%, to CHF 1,215 billion. The increase was mainly due to capital transactions, while valuation changes played a subsidiary role. Finance and holding companies reported the highest capital stocks abroad, with a total of CHF 452 billion. At CHF 168 billion, chemicals and plastics were a distant second. Income from direct investment abroad amounted to CHF 81 billion, a decline by CHF 6 billion compared to the previous year. This was primarily the result of lower income in two categories of manufacturing: electronics, energy, optical and watchmaking, on the one hand, and chemicals and plastics, on the other. By contrast, investment income from subsidiaries in the services sector registered a slight growth year-on-year. |

Direct Investment 2016: Switzerland Swiss direct investment abroad, Foreign Investment in Switzerland, Swiss subsidiaries abroad Source: snb.ch - Click to enlarge |

Foreign direct investment in Switzerland

Foreign-domiciled companies invested CHF 47 billion in companies in Switzerland (2015:CHF 78 billion), mostly in the form of increased lending to subsidiaries in Switzerland and the reinvestment of earnings achieved by these companies. The main recipients of these investments were finance and holding companies (CHF 27 billion), followed by the other services category (CHF 9 billion). Direct investment in manufacturing companies amounted to CHF 4 billion.

Stocks of foreign direct investment in Switzerland climbed by CHF 123 billion, or 15%, to CHF 965 billion. The increase primarily affected the equity capital of finance and holding companies, and was mainly the result of higher valuation of their participations in Switzerland. A breakdown by immediate investor shows that 78% of capital stocks originated from investors in the EU and a further 13% from investors in the US. However, this breakdown only provides a limited idea of the countries of origin of investors in control of companies in Switzerland. This is due to the fact that foreign direct investment stocks in Switzerland are largely held via intermediate companies controlled by groups headquartered in a third country. The SNB therefore publishes an alternative breakdown of capital stocks by country of origin of the ultimate beneficial owner. This breakdown shows that investors from the US and the EU controlled 43% and 37% of the capital stocks respectively.

Investment income from foreign direct investment in Switzerland increased by CHF 3 billion to CHF 62 billion. This was mainly attributable to higher earnings by finance and holding companies.

Operational data on multinational companies

In their subsidiaries abroad, Swiss companies employed a total of 2,044,000 people, of whom 895,000 (44%) were in Europe and 535,000 (26%) in Asia. The number of people employed advanced by 37,000, or 2%, compared with the previous year. The increase in Europe was slightly above the average for the past ten years, whereas no growth was registered in Asia for the first time since 2001. Swiss parent companies with participations abroad were also significant employers in their home country, providing jobs for 853,000 persons in Switzerland, equivalent to 17% of overall employment in manufacturing and services.

Special topic: Pass-through capital in Switzerland’s direct investment statistics

Since the mid-1990s, Switzerland and other countries with high appeal as a location for finance and holding companies have registered a sharp increase in direct investment stocks. To a certain extent, this is caused by major, globally operating groups who transfer capital via a chain of group companies in various countries, in the process of which capital may be ‘passed through’ a country without having any significant impact on the local real economy. This year’s special topic reveals the importance of such ‘pass-through capital’ for Switzerland’s direct investment statistics.

Remarks

Comprehensive tables on direct investment and operational data for multinational companies are available on the SNB’s data portal (data.snb.ch) under ‘International economic affairs’. The data can be accessed there in the form of configurable tables. The data are currently available for 1998 to 2016. The data portal also contains notes and information on methods used.

Operational data on foreign subsidiaries in Switzerland (staff numbers and number of companies) are no longer contained in the report on direct investment. The Swiss Federal Statistical Office (SFSO) now provides these data in a separate publication. They will continue to be compiled jointly by the SFSO and the SNB. The SFSO will publish data for 2014 and 2015 on 21 December 2017. Previous time series for the period 2003 to 2015 remain available on the SNB’s data portal. They will, however, no longer be updated.

Direct Investment 2016 contains the usual revision of figures from previous years (2014–2015). These revisions are mainly based on information about business transactions or group structures relating to the respondent companies which only becomes available after the previous year’s report has gone to press. Most strongly affected by the revisions for 2015 were Swiss direct investment abroad by finance and holding companies and foreign direct investment in Switzerland in the other services category.

Download PDF

Full story here Are you the author? Previous post See more for Next postTags: newslettersent