| Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries

– Increased efforts in green energy and advanced technology set to boosts silver’s demand |

Silver Price in USD, Jan 2013 - 2017(see more posts on silver price, ) |

| The beauty of silver is its dual role. It is both a monetary metal and an industrial metal. Because of this investors can look to a positive few years as the metal’s fundamentals will thrive due to strong demand in major growth areas.

Over 50% of silver’s annual demand comes from industry. This is set to continue to grow as high-growth industries such as self-driving cars, green energy and health care drive demand for the precious metal. The majority of industries are looking at improving products with technology and boosting energy efficiency. Many solutions call for silver, a tricky solution given the ongoing supply deficit. Along with silver’s growing importance in the world of manufacturing we should also remember its importance when it comes to its role as a monetary metal. Government and central bank policies will continue to increase budget deficits and drive inflation which is positive for both gold and silver. The tables look set to turn for a precious metal that is able to serve us both in our portfolios and our day-to-day lives. Go silver to go green

|

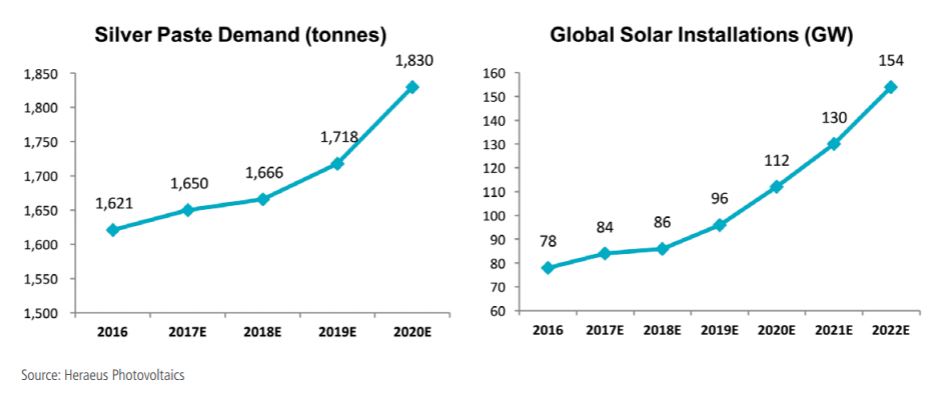

Silver Paste Demand and Global Solar Installations, 2016 - 2020 |

| Silver has enormous potential in the field of technology. It is the most electrically conductive known material other than gold. Unsurprisingly gold is far too expensive to use in the majority of areas where silver makes for a viable alternative. As we find more solutions to solve energy and technology issues we will inevitably require more and more silver. Right now there is no obvious substitute for it.

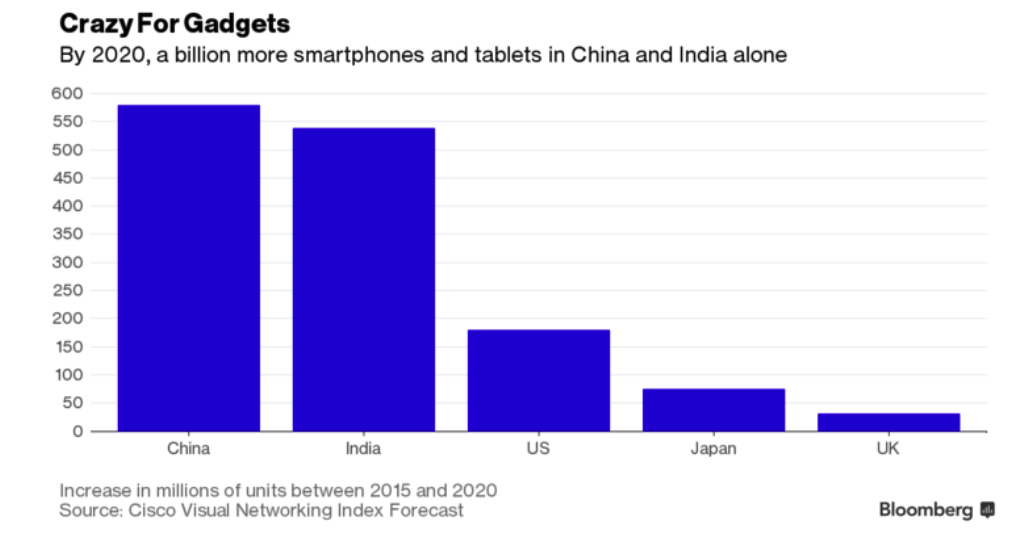

Consider the drive for technological solutions in increasing populous and economically developing areas. For example, even the poorest cities have high smart-phone concentrations. So much of a smart-phone’s workings are thanks to silver. This demand is not set to go anywhere but up. Silver is a very limited commodity, mined as a by-product more often than not. As the world goes crazy to stay online, demand for silver will also go crazy. |

Rise in Smartphones and Tablets, 2015 - 2020 |

| This isn’t just about staying connected but it is also about finding improvements. Consider silver’s anti-bacterial and reflective properties in everything from hospital paints to solar-windows.

Much of these ‘green’ technologies, such as solar-panels had costs that were so high that adoption was minimal. But, prices are dropping (by as much as 9% in some cases) which is driving up demand. This inevitably means more silver. We are also becoming more safety conscious, increasingly keen to place our faith in technology over human-ability. Rear cameras, night vision, rear-object detection and lane departure warnings are each examples of new car-technology that relies on silver. All of this increased demand is fantastic for the silver market and for the overall push towards more efficient technology, but it might not happen so easily. For the past four years there has been a supply deficit in the silver market. This is thanks to the reduction in opening of new mines and discovery of silver deposits. The price is far too low given these difficulties as well as increasing political risk around silver mining. There will be a breaking point. Gold-silver ratio signals a turn-around Currently precious metal fans might be feeling down about silver. At present the gold-silver ratio is around 79. The 100-year average is 40. The industrial precious metal is arguably due a much needed catch-up given its serious underpricing. |

Gold:Sivler Ratio, 1999 - 2017(see more posts on gold silver ratio, ) |

| In 2017 gold has outperformed silver most likely because of strong safe-haven demand. But, this may well reverse next year as ongoing improvement in the global economy boosts silver’s industrial demand.

Karen Jones, technical analyst at Commerzbank, recently explained how she expects the gold-silver ratio to improve significantly. Jones’ analysis explained that the ratio has broken above a 2016-2017 downtrend and her first upside target is at 79.44.

Artificial prices? There are major frustrations surrounding the price of silver. Many struggle with the fact that not only is the global economy seemingly improving but there is also demand for financial hedges, such as gold and silver. Yet the price of silver remains subdued when compared to the likes of gold and other major economic indicators: |

S&P 500 Level, New York Silver Price and 2 Year Treasury Rate, 2013 - 2017(see more posts on S&P 500, silver prices, ) |

| This is most likely down to manipulation.

Since 2003, we have believed and written about how the silver and gold markets are manipulated and “fixed” by banks. Just under a year ago our beliefs were confirmed when we revealed that leading bullion banks were working to fix the silver market:

Despite a major investigation into the bullion banks, we still see signs of manipulation today. Silver has the largest concentration of short positions compared to any other metal or commodity. It is the short positions held by JPMorgan and Scotiabank that are often cited as the root cause for the low silver price. At the end of the month JPMorgan and Scotiabank controlled approximately 53% of the 210 days’ worth of global silver production to cover short positions. The bullion banks are super keen to keep the price of silver well below the 200-day moving average. Why? No more reason other than greed and profit. But this should not dissuade investors. As we explained last year:

Buy silver to support industry and your portfolio The silver price in recent years could be something investors don’t want to dwell on too much. There is a general feeling that things have been slow and disappointing. Gold is considered to be a safe play in times such as these, hence silver isn’t keeping pace with it. This is also not helped by the fact that the market perceives silver to be exposed to economic weakness. But this won’t be forever. Inflation will begin to show itself in a less covert manner. As it does so more of the public will realize silver’s second role as a store of value and inflation hedge. In the meantime the world needs silver in a number of different areas, for health, for energy and for technological advances. Should you believe the politicians both here and across the pond that the economy is improving, this is a further reason to hold silver as part of your portfolio. This makes it an excellent two-way hedge. We have no idea where the silver price may go tomorrow, next year or in a decade. What we do now right now is that it is currently relatively cheap when considered against a backdrop of heightened geopolitical concerns, rising inflation and ever-prominent and increasing debt risks. History tells us that silver has a key role to play as a safe haven in your portfolio and not just industry. Academic research backs up this idea. In 2012 Belousova and Dorfleitner concluded that: ‘Adding silver or platinum to a portfolio [of stocks, sovereign bond and the money market instruments] during bull markets reduces volatility and enhances return.’ When looking at all four precious metals’ role as a safe haven between 1989 and 2013, against the S&P 500 and US 10 year bonds, Lucey and Li (2015) found that: ‘silver was a safe haven at times during which gold failed to be’, but also during far more quarters than both platinum and palladium.’ |

World Equity Index Market Capitalization, Sep 2003 - Nov 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,gold silver ratio,newslettersent,S&P 500,S&P 500,silver price,silver prices