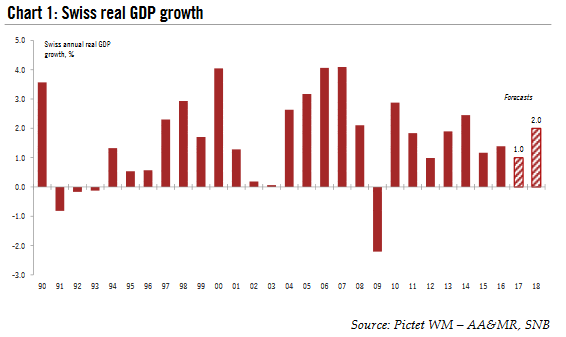

| Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0%, its lowest level since 2012. However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth.

Switzerland’s economic prospects look promising for next year. Its export industry will continue to benefit from robust global economic momentum, all the more so if the Swiss franc maintains its current level or depreciates further. Importantly, export growth is set to broaden: in addition to the chemical and pharmaceutical industries, the machinery, electronics and metal as well as the watch-making industries should contribute to a greater share of export growth. Domestic demand is expected to gain momentum as well, mainly due to a pick-up in investment in equipment and research and development (R&D). Therefore, we forecast Swiss annual GDP growth of 1.0% in 2017 (up from our previous forecast of 0.8 %) and 2.0% in 2018 (up from 1.7%). |

Swiss Real GDP Growth, 1990 - 2018(see more posts on Switzerland Gross Domestic Product, ) |

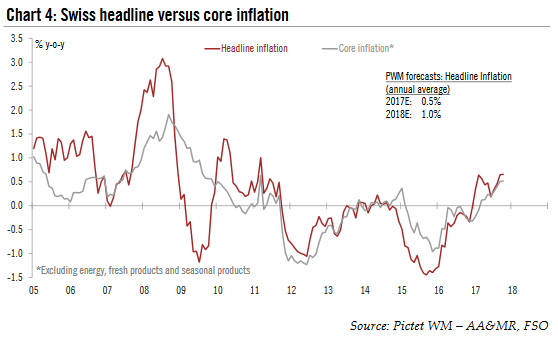

Headline inflation is likely to firm up somewhat, but to remain modest. Prices of imported goods are expected to rise due to the depreciation of the franc against the euro. However, several developments will dampen inflation, notably the reduction of Swiss VAT rates and the fall in the base rate which put rents under pressure.As a result, we expect average headline inflation of 1.0% in 2018, up from an estimated 0.5% in 2017, with risks tilted to the downside.

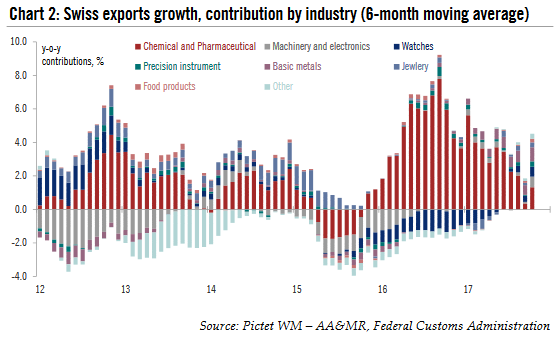

Stronger, faster and broader growthOwing to weak GDP momentum in late 2016 and the first half of the year, the Swiss economy is likely to see growth of just 1.0% in 2017. Part of the weakness in GDP figures was due to specific factors. However, leading indicators, notably consumer confidence, manufacturing PMI and the KoF economic indicator are running at multi-year highs, suggesting that underlying momentum is strengthening. The pick-up in exports is spreading across sectors (see Chart 2). In addition to pharmaceuticals and chemicals, the machinery, electronics, metal and watch industries are starting to grab a greater share of export growth. In 2018, Swiss exporters will continue to benefit from the healthy state of the global economy (in particular in the euro area, Switzerland’s main trading partner), all the more so if the Swiss franc maintains its current level or depreciates further. Domestic demand is expected to gain momentum as well. The growth in private consumption has been moderate so far and is expected to accelerate only slightly on the back of an improving labour market. Since the Frankenshock at the beginning of 2015, companies have reduced their investment spending on equipment and R&D. However, in view of the brighter global economic environment and the expected improvement in profits, corporate investment spending should soon gather pace. Specific factors such as sports events (the Winter Olympics in South Korea and the football World Cup in Russia) will also have a favourable impact on Swiss GDP growth in 2018, but make quarterly growth more volatile. As a result, we forecast Swiss annual GDP growth of 1.0% in 2017(up from our previous forecast of 0.8%) and 2.0% in 2018 (up from 1.7%) |

Swiss Exports Growth, 2012 - 2017 |

Job market recoveryThe removal of the SNB’s currency floor, which led to a sharp appreciation of the franc in 2015, hurt corporate margins and profits. Companies adjusted their prices, but also their costs. This was achieved by shortening hours, by limiting remuneration or by cutting work forces. The seasonally adjusted unemployment rate in Switzerland reached a peak of 3.5% in mid- 2016, but has gradually fallen since. Job creation remains subdued and concentrated in the tertiary sector, mainly healthcare and social services. Nevertheless, the situation is improving slowly in the manufacturing sector (see Chart 3). Growth in wages has been weak in recent years, partly due to reduced margins in many sectors. But Switzerland’s improved economic prospects suggest that the recovery in employment and income growth are likely to pick up. |

Swiss Employment Growth, 2001 - 2017 |

Headline inflation firming somewhatOver the past few years, Swiss corporates have sought to offset the strength of the franc by adjusting their prices and their costs. Inflation returned to positive territory in 2017. The base effects of energy price fluctuations are likely to drive Swiss headline inflation lower in the near term, but price inflation should firm up as 2018 progresses. Several developments will also dampen inflation. First, as a result of the rejection of the “2020 pension reform s” in a referendum in autumn 2017, Swiss VAT rates will be reduced to 7.7% (normal rate) and 3.7% (special rate for accomodation) as of 1 January 2018. The reduced rate of 2.5% will remain unchanged. The reduction of VAT rates, which will affect a range of consumer goods, could put some downward pressure on inflation. Second, rents are under pressure due to the fall in the base rate which will also impact inflation. In contrast, prices of imported goods are expected to rise due to the weaker franc. As a result, we expect average headline inflation of 1.0% in 2018 after an estimated 0.5% in 2017, with risks tilted to the downside. |

Swiss Headline Versus Core Inflation, 2005 - 2018 |

A window of opportunity to hike once in 2018

Given the outlook for inflation is still low, the Swiss national bank (SNB) is likely to remain cautious and true to its current ‘two-pillar’ strategy (negative interest rates and commitment to intervene in the FX market if needed). The franc’s decline this summer gave some relief to the SNB, which changed its assessment of the currency from “significantly overvalued” to “highly valued” in September. Variations in total sight deposits at the SNB (a proxy used to gauge the central bank’s interventions) suggest that it has not intervened in the FX market since July. Thanks to currency depreciation and the good performance of financial markets, the central bank posted record profits in Q3 2017.

The key question for 2018 is whether or not the SNB will start to hike rates ahead of the ECB. The SNB is caught between conflicting forces —a weaker CHF and improved economic prospects on the one hand, but a delayed start to ECB rate hikes on the other. However, the prospect that the ECB withdraws some of its monetary stimulus in 2018 affords the SNB an opportunity to normalise its own policy. We think that the SNB is more likely to “escape” from the current negative interest rate “trap” first before contemplating sale of its large foreign currency holdings. Therefore, we expect a window of opportunity for a first SNB rate hike to open in Q4 2018.

Risks are broadly balanced

Risks have become broadly balanced for the Swiss economy. On the positive side, global growth could prove to be more robust than expected in 2018, which in turn could boost the demand for Swiss goods further. More negatively, geopolitical and political risks are still present. The direction of Brexit negotiations and protectionist measures introduced by various countries could harm Switzerland’s exports. As a safe-haven currency, the Swiss franc could appreciate again, partially reversing the positive impact of an improving global economy on exports.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newslettersent,Swiss economy,Swiss GDP,Switzerland Gross Domestic Product