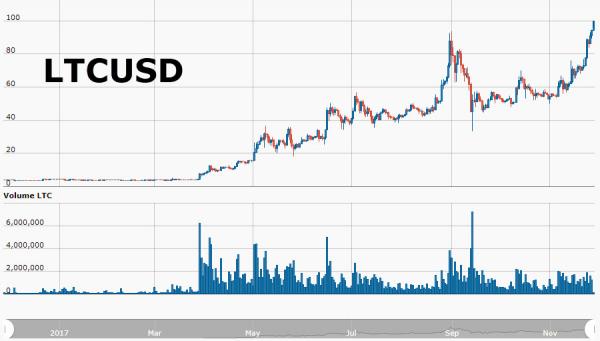

| Update: Cryptocurrencies are widely bid tonight with Bitcoin over $10,150, Ether holding $475, and LiteCoin topping $100 for the first time… |

LiteCoin Price in USD, Mar - Nov 2017 |

| Bitcoin has now soared over 20% since Black Friday’s close, topping $10,000 for the first time in history (rising from $9,000 in just 2 days)… now up over 950% year-to-date. | |

It’s been quite a year….

BITCOIN TOPS $10,000 FOR THE FIRST TIME IN BLOOMBERG PRICING Up 950% YTD… |

Bitcoin Price in USD, Jan - Nov 2017(see more posts on Bitcoin, ) |

| Up over $2000 since Thanksgiving… |

Bitcoin Price(see more posts on Bitcoin, ) |

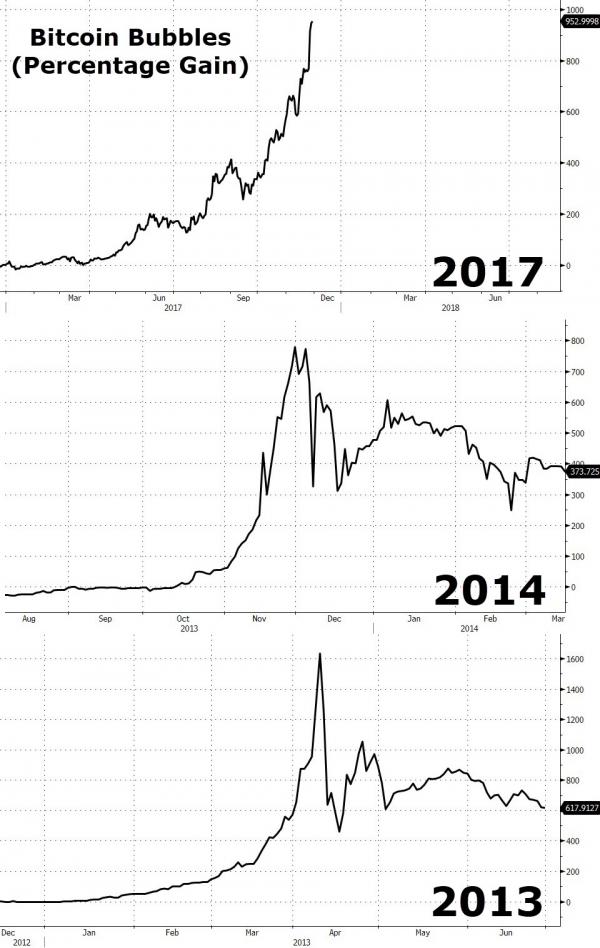

| But for some context, we have seen two other ‘Bitcoin Bubbles’ before… which saw retracements and then roared to new record highs… were each of them “tulip-manias” too? |

Bitcoin Bubbles, 2013 - 2017(see more posts on Bitcoin, ) |

|

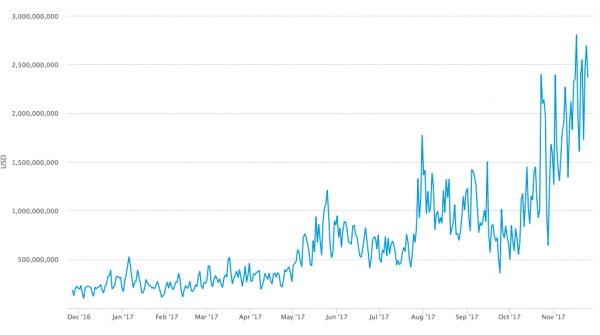

As CoinTelegraph reports, the year has been filled with major announcements that signal the widespread acceptance and growth of Bitcoin. Extensive coverage by mainstream analysts was followed by huge growth in Bitcoin hedge funds and institutional investors. Now the launch of regulated futures markets is imminent, and Bitcoin has become the investment du jour of the financial community. Whether they love it or hate it, big bankers can’t keep their mouths shut about Bitcoin. The attention Bitcoin has garnered from mainstream media has been astounding. Only a year ago, news would spread of a local newspaper mentioning Bitcoin, and the community would be thrilled. Now, major publications mention Bitcoin daily, and no one is surprised. Bitcoin has literally gone viral. Further, the growth in hedge funds that invest in cryptocurrencies has exploded as well. As early as August, the news that 70 new funds could be starting was a headline. Now, the existence of 120 new or modified crypto related funds barely warrants a head nod. Another major contributing factor for Bitcoin’s sizeable gains is the reality that Bitcoin futures will soon be traded on major regulated markets. Two of the world’s largest futures markets, the Chicago Mercantile Exchange (CME) and the Chicago Board of Options Exchange (CBOE), will soon launch Bitcoin futures. As adoption increases, the network is forced to keep pace. However, Bitcoin has continued to maintain a huge transaction volume as the price has increased. As shown below, the daily transaction volume is now over $2 bln. |

Bitcoin Price in USD, Dec 2016 - Nov 2017(see more posts on Bitcoin, ) |

|

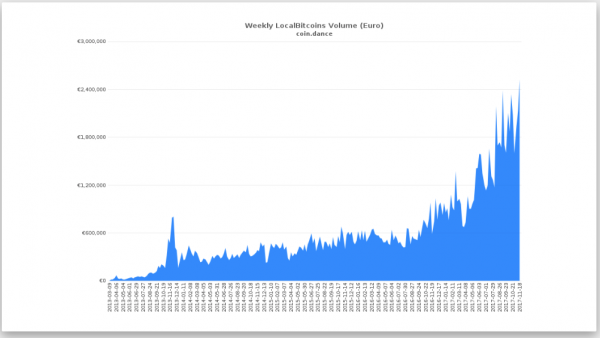

As transactions continue to proliferate, Bitcoin mining has become increasingly profitable as well. Miners today make $1.5 mln in fees alone, not including block rewards. As the market has increased, the mining returns have increased exponentially as well. All this growth in adoption is not localized either. The entire global community has begun to embrace Bitcoin, from Venezuela to Zimbabwe, and from South Korea to Switzerland. The international transactions numbers have been steadily rising since Bitcoin’s inception. |

Weekly Local Bitcoins Volume, Mar 2013 - Nov 2017(see more posts on Bitcoin, ) |

The numbers are staggering, but what is most encouraging is that the growth in markets has not been geographically localized. A simple perusal of charts from various countries around the world indicates that adoption is not localized, but global, and nearly uniform.

So what happens next?

Coinivore reports that Hong Kong cryptocurrency exchange Gatecoin’s marketing chief Thomas Glucksmann says that Bitcoin’s price is “highly undervalued” even at $10,000 per coin.

In a televised interview with Bloomberg Today, Glucksmann was asked about Bitcoin’s “fair value,” at a time when the price is nearing $10,000 – an incredible unheard of 10x gain since just this year.

When he was asked if it was “impossible” to determine Bitcoin’s fair value, Glucksmann replied:

“I would still argue that it is highly, highly undervalued. If you look at the long-term potential of the technology in the next 10, 20, 30 years, $10,000 is cheap in my opinion,” he said.

While Bitcoin is now starting to be seen in the mainstream as a store of value among retail investors, it remains a peer-to-peer decentralized electronic cryptocurrency, a fact Glucksmann pointed out. “Bitcoin is divisible up to 8 decimal places,” he said.

Finally we levae you with this…

Full story here Are you the author? Previous post See more for Next post“In the long long run, cryptocurrencies could matter. They just don’t matter today.”

-Fed Chair Nominee Jerome Powell

Tags: Alternative currencies,Bitcoin,Blockchains,Business,Cryptocurrencies,Currency,Economics of bitcoin,Hong Kong,Institutional Investors,Legality of bitcoin by country or territory,money,newslettersent,Newspaper,Reality,Switzerland,US Federal Reserve