|

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December).

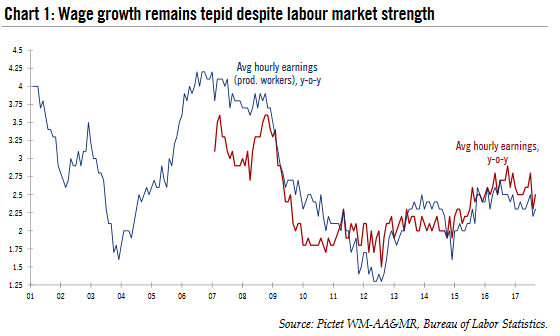

Non-farm employment rose 228,000 in November, from a downwardly revised 244,000 in October, leaving the three-month average at a healthy 170,000/month. The unemployment rate remained at 4.1%. Meanwhile, average hourly earnings were up 0.2% m-o-m, pushing up the y-o-y reading to 2.5% (but still below the one-year average of 2.6%). Our view remains that wage growth should remain under control in coming months, due mostly to structural reasons like technological change, robotisation and globalisation, which are having a greater effect than the increasing tightness of the labour market conditions. Wage growth in retail was only 1.1% y-o-y, for instance.

The picture is rosy at the macro level, with data neither too hot nor too cold (hence our ‘Goldilocks’ characterisation). There was some seeming respite to ongoing crisis in the retail sector, as retail jobs grew a solid 19,000 in November. This also could be a good omen for private consumption in the holiday shopping season.

|

Wage Growth, 2001 - 2017 |

Momentum– Another steady payroll print, at +228,000 in November, above the current one-

year average (173,000/month).

– The 3- month (170,000), 6-month (178,000) and 12-month (173,000) averages remain in a tight range, suggesting ongoing low macro volatility.

– This is consistent with above 3% GDP growth in Q4 2017

Business cycle– All cyclical indicators continue to flash green, suggesting healthy underlying momentum.

– Manufacturing employment was particularly robust, with a 31,000 increase after +23,000 in October (up 1.5% y-o-y)

– The exception to strong manufacturing was lacklustre jobs growth in motor vehicles production (+1,700 only, after two negative prints). Employment in the sub-sector is down 0.1% y-o-y.

– Construction employment was firm too, at +24,000 in November after +10,000 in October (up 2.7% y-o-y)

– Mining continues to perform strongly (employment up 10.5% y-o-y), reflecting the recent pick up in oil drilling on the back of recent uptick in oil prices.

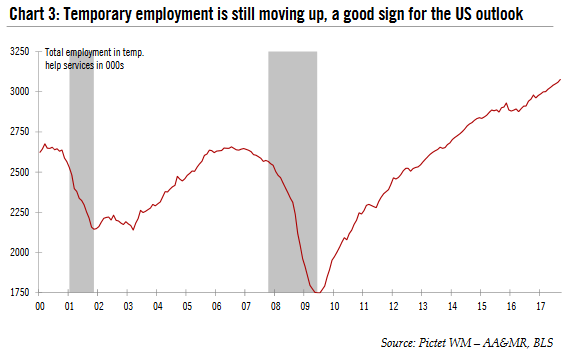

– Temporary-help employment remained very healthy, up 18,000 in November

(from +18,000 in October ). This is a crucial sign of the strong momentum of the jobs market in general . Temporary-help employment was up a solid 3.9% y-o-y in October.

–

These robust labour-market signals echo recent solid business surveys, strong job openings data, and very low levels of initial jobless claims. Payroll growth looks likely to remain firm for the next three to six months, at least.

|

The Unemployment Rate, 1984 - 2017 |

Structural trends– The ‘retail crisis’ had a pause as retail employment rose sharply (+18,700, from -2,200 in October). This is an encouraging sign for the holiday shopping season.

– Internet retailing posted a 3,400 increase in employment (employment up 11.4% y-o-y)

– The labour force participation rate remained at 62.7%, suggesting that the re-appearance of previously discouraged workers seems to be stalling.

– More worryingly, the participation rate for men aged 25-54 remained unchanged at 88.5% in November , below the one-year average of 88.6%.

Fed policy– This report probably keeps expectations for the trajectory of monetary policy unchanged. Slow wage growth is likely to keep monetary tightening very gradual (the Fed looks set to go ahead with a hike on 13 December), and the Fed’s terminal rate is likely to remain low.

– We think slow wage growth, coupled with recent mixed core inflation prints, will make many Fed officials hesitant to raise their dots (expectations for Fed hikes) even though news have been positive on the tax side lately.

– Incoming Fed Chair Powell has shown a similar sensitivity as Yellen to wage data as a sign of labour market ‘over-heating’. For now, Powell should guide markets to a still slow gradual rate hiking path.

|

Temporary Employment, 2000 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Macroview,newslettersent