| The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week, after clearing the conference committee hurdle (a compromise between the House and Senate versions). A few hesitating Republican Senators have eventually said they will vote in favour of the bill, which is key as the Republican majority in the Senate is slim at 52-48. It will shrink to 51-49 in January after the recent loss of the Republican Senate seat in Alabama.

The latest version cuts the statutory corporate tax rate to 21%, from 35% currently, from January 2018 (it was 2019 in the Senate version). Furthermore, the bill eliminates the corporate alternative minimum tax (a mechanism of minimum taxation to avoid abusing deductions), whereas the earlier Senate bill had kept it. Corporate taxation moves to a territorial rather than worldwide tax regime, and the transition is helped by a one-off tax of 15.5% on cash held offshore (and 8% on accumulated foreign investment). There are additional changes to interest on debt, international intra-group taxation, and capital depreciation (see table next page). The changes on the individual tax side are more modest than on the corporate side. The top individual tax rate is reduced to 37% from 39.6%. There are several changes to other taxes and deductions (see table next page). We continue to think that risks to our 2018 growth forecast of 2.0% are to the upside, especially as the corporate tax rate reduction has been brought forward to January 2018. These tax cuts come at a time of strong, synchronised global growth, and a sharp pickup in US oil production boosting US manufacturing. This also implies a slight upside risk to our Fed rate hike scenario (more on page 6). |

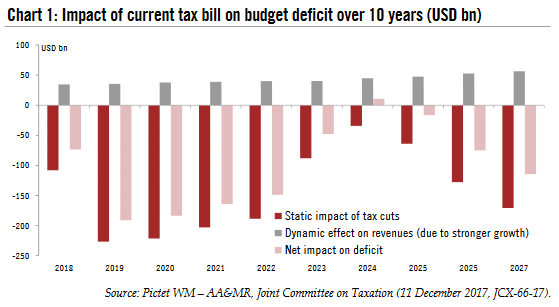

Future Impact of Current Tax Bill on Budget Deficit, 2017 -2027 |

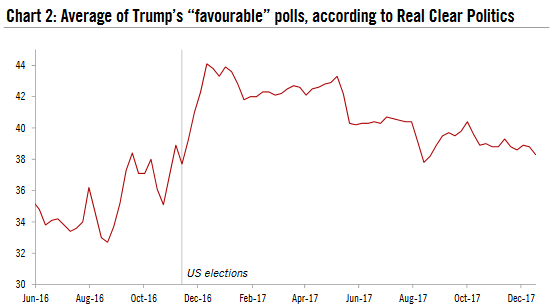

WHAT IS IN THE TAX BILL – SNAPSHOT ON THE CORPORATE SIDEStatutory tax rate – Reduction of the statutory corporate tax rate to 21% from January 2018, from 35% currently. Multinat-ionals – Change from a worldwide to a territorial tax system (to be precise: “participation exemption regime with current taxation of certain foreign income”) – First-year ‘bonus’ depreciation deduction raised to 100% (from 50%), until 2022, then gradually phased out. Limits on debt deduction – Deductibility of net business interest expense limited to 30% of adjusted taxable income (with the definition of ‘adjusted taxable income’ becoming more restrictive from 2022). Loss carry – overs – Carryover of net operating loss limited to 80% of taxable income, carryback eliminated, for losses arising after 2017 Pass-through entities – Owners of certain partnerships, S-corporations and sole proprietorships will be able to claim a 20% deduction against qualifying business income (expiring on 1 January 2026) INDIVIDUAL TAXATION – MOST PROVISIONS ‘ SUNSET’ AFTER 2025Tax brackets – Standard tax deduction increased to USD 24,000 (joint filers), from USD 12,700 currently State and local tax, mortgage deduction – State and local tax, including property tax, deduction limited to USD 10,000 (it is unlimited currently) Child tax credit – Doubled to USD 2,000 from USD 1,000 currently (single filers and married couples). USD 400 of the additional USD 1,000 is ‘refundable’ (i.e. paid in cash if the tax filer has zero taxes to pay) Alternative minimum tax – Alternative minimum tax kept, but income exemption levels raised ( to USD 109,400 for married couples, up from USD 84,500 currently) – Estate tax maintained , but basic exclusion thresholds doubled to USD 10m per person (until January 2026). Health-care – Excise tax for those who do not have essential coverage reduced to zero, starting in 2019 Tax bill: closing in on the final voteThe conference committee set up to reconcile the two different versions of the tax bill (House, Senate) concluded its work on 14 December, sending a final bill for approval to the two chambers. The two houses cannot put forward amendments, so the conference’s text is the one that will ultimately be enacted if the votes in both chambers are favourable. The focus is particularly on the Senate , where the Republican majority is slim (52-48). Almost all Republican Senators must be on board or the bill could fail, given the uniform opposition from Democrats. However, the Republican leadership is confident it has the votes in Senate. Importantly, Republican Senator Bob Corker, who voted against an earlier version of the bill (on fears it would raise the deficit too much), said he would support the final version. Senator Marco Rubio, who pushed successfully for a bigger child tax credit, said he would vote for the bill too, after some (strategic) opposition. Senator Susan Collins, who had concerns about the healthcare provisions, said she would also back the bill. While most bills need 60 votes in the Senate, and therefore some Democratic votes too (for instance, bills to extend the federal budget), Republican leadership chose the reconciliation process for the tax bill . This is a process whereby a simple majority is allowed in Senate, but the bill cannot grow the federal budget deficit after a period of ten years. This mechanism is the source of the slightly awkward result of the tax bill , which sees most provisions for corporates (including the lower tax rate of 21% from 35%) being permanent, but most provisions on the individual side ‘sunsetting’ (terminating) before the ten-year window ends. Lawmakers believe that these individual provisions will not be allowed to terminate, betting that subsequent Congress will decide to extend the provisions. Flash back: How we got hereThe Republican camp has moved the bill through Congress in an efficient manner in recent weeks. A key reason for the bill’s success has been precisely the rapidity with which it moved through Congress, taking many tax lobbyists by surprise. However, the biggest ingredient for success was probably a ‘wake-up call’among Republicans that they lack ‘deliverables’ ahead of next year’s mid-term elections, while they have seen several electoral setbacks lately. The biggest blow was the Democratic victory in the Senate election in Alabama, which will reduce the Senate majority to 51-49 from January 2018. This follows other recent electoral setbacks, particularly at the state level in New Jersey and Virginia (which are crucial ‘swing’ states). In that context of rising political pressure, the Republican Party managed to set aside its deep-seated divisions and unite in extraordinary manner around the tax bill. The lack of Democratic support to the bill is perhaps one of its key fragilities. Whereas the Reagan era’s tax reform was conducted with support from some Democrats (especially the ‘Southern Democrats’), this time the Republican camp went solo, as Democrats have been united in their opposition. They have sought to undermine the bill as a “gift to the rich”, promising to overturn it in coming years if they took back Congress. Importantly, it remains questionable whether the current tax bill is sustainable over the longer run, as there is a risk that Democrats could undo the tax changes if they make gains in subsequent elections. |

Average of Trump’s “favourable” polls, Jun 2016 - Dec 2017 |

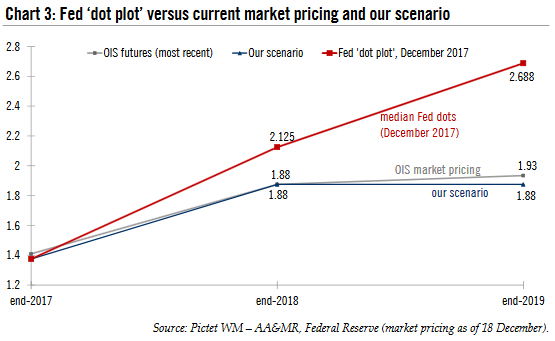

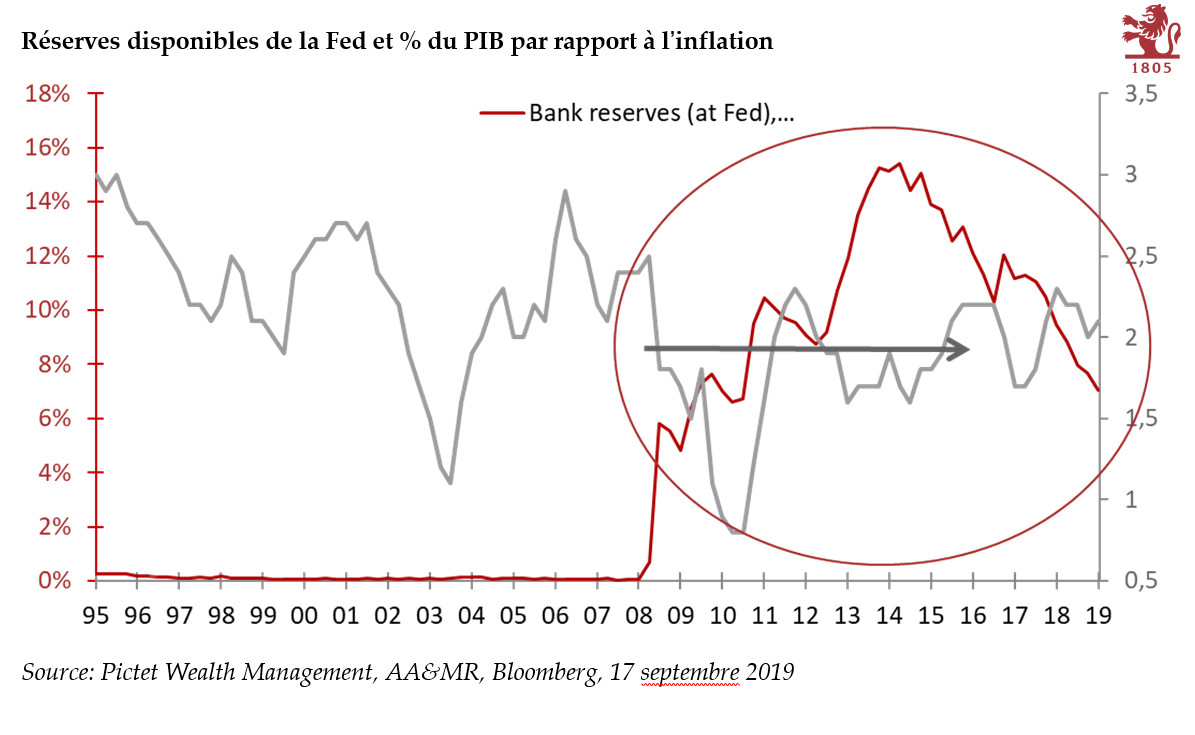

Economics – Good for the US economy, but how good?Tax cuts are in theory good for consumption and investment. They keep more money in taxpayers’ pockets, which is then available for spending. And they lower the cost of capital for corporates. However, in practice, there are a few caveats. The US consumer is more debt than income driven, and how consumer confidence fluctuates is key (as this determines willingness to borrow). Meanwhile, US corporates have been notoriously stingy on investment in recent years despite very low borrowing costs (as the Fed has maintained very low interest rates), and it remains to be seen whether further lowering the cost of capital will prompt them finally to open their purses and invest. In the end, much could be down to general confidence, and confidence in economic prospects, which are hard to gauge. The good news is that both business and consumer confidence have been at elevated levels lately, boding well for activity in the first half of 2018. Another issue is the rise in federal debt, and the risk that public debt may ‘crowd out’ the private sector. Still, we think the ongoing rise in debt is more an issue for the long term rather than one with immediate consequences. It is important to stress that the tax bill comes at a time of accelerating global growth, which is also reverberating positively on the US economy. For instance, exports to China (the third-biggest US export market) are up 13.2% in nominal terms so far this year (January to October). Exports to South Korea (seventh biggest market) are up 15.3% in the same period, and exports to Brazil (tenth biggest market) are up 24.6%. Another positive factor for the US economy is increased oil production in a context of global oil prices creeping higher (partly helped by OPEC’s decision to curtail its production). This is having a large impact not only in the ‘downstream’ sectors and on suppliers, but also geographically, in Texas – the epicentre of the recent oil boom. After falling to 8. 4mb/d in July 2016, oil production has rebounded sharply – reaching a new high of 9.78mb/d in the week ending 8 December. Texas’ real GDP was up 2.9% y-o-y in Q2 (last data available). The bold tax cuts, particularly on the corporate side, pose upside risk to our US 2018 GDP growth forecast, now at 2.0%. Additional upside risks come from stronger growth at the global level, and the good momentum in the oil industry. The tax cuts could also extend the US business cycle, which is now approaching the longevity of the drawn-out cycle of the 1990s. We believe there are also some slight upside risks to our inflation pro file from the tax cuts, as stronger growth means the output gap could narrower than previously thought. The Joint Committee on Taxation estimated that the Senate bill, which will add a cumulated USD 1.5tn of debt over the next ten years, would increase growth by a cumulated 0.8 point over the period. With most of the impact being front loaded, this means an assumption of a boost of circa 0.2-0.3 point on each year’s growth in the early years. The well-established University of Pennsylvania model puts a more measured boost of c. 0.1 point on growth in the initial years. That being said, this model assumes an elevated ‘crowding out’ due to rising federal debt, which may look excessive. Recent history has shown that despite the gross debt-to-GDP ratio exceeding 100% after the financial crisis, long-term interest rates have remained low and financial conditions have been exceptionally loose despite the Fed’s tightening. Fed: Not really ‘afraid’ of the tax cutsThe Fed’s view of the tax changes was measured as it met on 12-13 December. While the Fed raised its end-2018 GDP growth forecast to 2.5% y-o-y from 2.1%, Chair Janet Yellen said this was only partly due to the tax cuts, which should not have “not a gigantic” impact on growth, although she also stressed the elevated uncertainty around the cuts’ impact on the economy. A subtext is that the Fed wants to stay voluntarily ‘behind the curve’, being reluctant to tighten pre-emptively, which would somewhat undermine the tax cuts’ effect. In other words, the Fed will be more backward-looking than forward-looking, and will wait for the data to adjust its stance , in our view. The Fed kept its end-2018 inflation forecasts unchanged, for headline and core PCE inflation (both at 1.9%). This meant that it saw limited impact from the narrower output gap – or it may just have been backward looking, taking note of recent weaker-than-expected core inflation. Yellen – who was doing her last press conference, as she will soon hand over to Jerome Powell – was unclear about disentangling the supply and demand side of the tax cuts. Still the bottom line is that the Fed, while slightly more optimistic about growth, crucially sees only a limited impact from the tax cuts on inflation. This helps to explain why it kept its rate hiking profile unchanged from its September meeting’s (i.e. three rate hikes next year).Another interesting aspect of the Fed’s forecasts is that it maintained the longer-run estimate for the Fed rate at 2.8%, implying that the tax changes would not necessarily boost the supply potential of the economy, and productivity, more than it envisages now. Productivity is a key input to the theoretical neutral rate, which the Fed uses to estimate its longer-run or ‘terminal’ rate in the hiking cycle. The real neutral rate has been hovering close to 0% in recent quarters, failing to pick up as the Fed had expected initially. |

Future Fed ‘Dot Plot’ Versus Current Market Pricing, 2017 - 2019 |

Our scenario is for two hikes in March and June, but the tax cuts and the additional growth risks from domes tic tailwinds raise the possibility that the Fed could hike more than we currently think. The Fed could give more importance to business confidence than to core inflation, which we expect to remain subdued in the near term. That said, we will watch wage growth closely, as stronger wage growth could lead to additional inflationary pressures. How business leaders plan to ‘distribute’ the tax cuts will be important in that respect.

In other words, we will reassess the inflation profile to see if the tax cuts might lead to wage pressures – very limited up to now – and further narrowing of the output gap, in turn boosting inflation more than we expect.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newslettersent