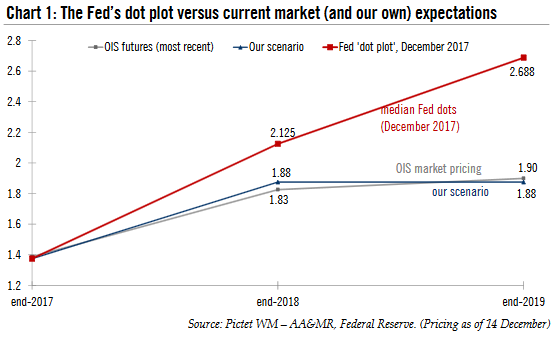

| The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.

A salient take -away from the meeting was the Fed’s relative caution about Congress’s tax-cutting plan. Even though the 2018 GDP growth forecast was raised from 2.1% to 2.5%, an upgrade Yellen said only partly reflected proposed tax cuts, Yellen stressed that the impact of the tax cuts would “not be gigantic”. She said that to expect growth to accelerate to 4%, as president Trump claimed would occur, was “challenging”. Instead, she worried about the ongoing increase in federal debt, made worse by the tax cuts. She also seemingly did not believe the tax cuts would materially boost inflation. Our Fed scenario is unchanged. With incoming Fed Chair Jerome Powell, who takes over in February, likely to be in the same vein of thought as Yellen, we think the Fed will continue hiking rates until they reach around 2%. This means hikes in March and June, in our view. There is a risk of a September rate hike if the impact of tax cuts on business and market confidence is stronger than anticipated – the Fed could ignore low inflation for an additional quarter. Still the more the Fed rate goes up, the more difficult it will be to ignore the ongoing persistence in low core inflation, in our view. We therefore think the Fed could pause the rate hiking cycle from June (or potentially September) onwards. |

The Fed's Dot Plot, 2017 |

Yellen was steady in her thinking. Powell is in same vein.While the 13 December press conference was Yellen’s last, she continued to express confidence in the prism through which she sees the US economy and in her monetary-policy thoughts. We think Powell will be in the same vein as Yellen, which is why we expect some continuity with the Yellen Fed next year, and therefore a shallow rate-hiking cycle. One of the core tenets of Yellen’s thinking is a deep belief in the Phillips curve linking a tight labour market to stronger inflation, a belief that was also in vogue under her predecessor Ben Bernanke. While Yellen repeated her recent remarks that this year’s low core inflation was a bit mysterious, she continued to express confidence that core inflation would ultimately rise as the labour market tightens further. She hinted that slow wage growth lately could reflect the fact the labour market is still not at full employment. |

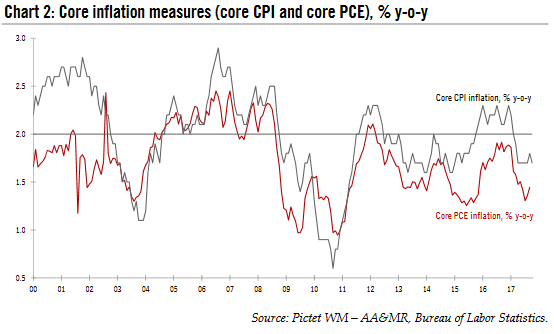

Core Inflation Measures, 2000 - 2017 |

| However, this view that inflation is transitory has started to divide the Federal Open-Market Committee in the wake of the persistence of low inflation data. November core CPI inflation data, released before the Fed meeting, was again below 2%, at 1.7% y-o-y, down from 1.8% in October. Two regional Fed officials, who tend to be more ‘pragmatic’ and less theoretical than Yellen, Neel Kashkari (Minneapolis Fed) and Charles Evans (Chicago Fed), dissented at the meeting, preferring to keep rates on hold. This is probably due to their need to see more concrete evidence that the theory works and that core inflation will indeed rise.

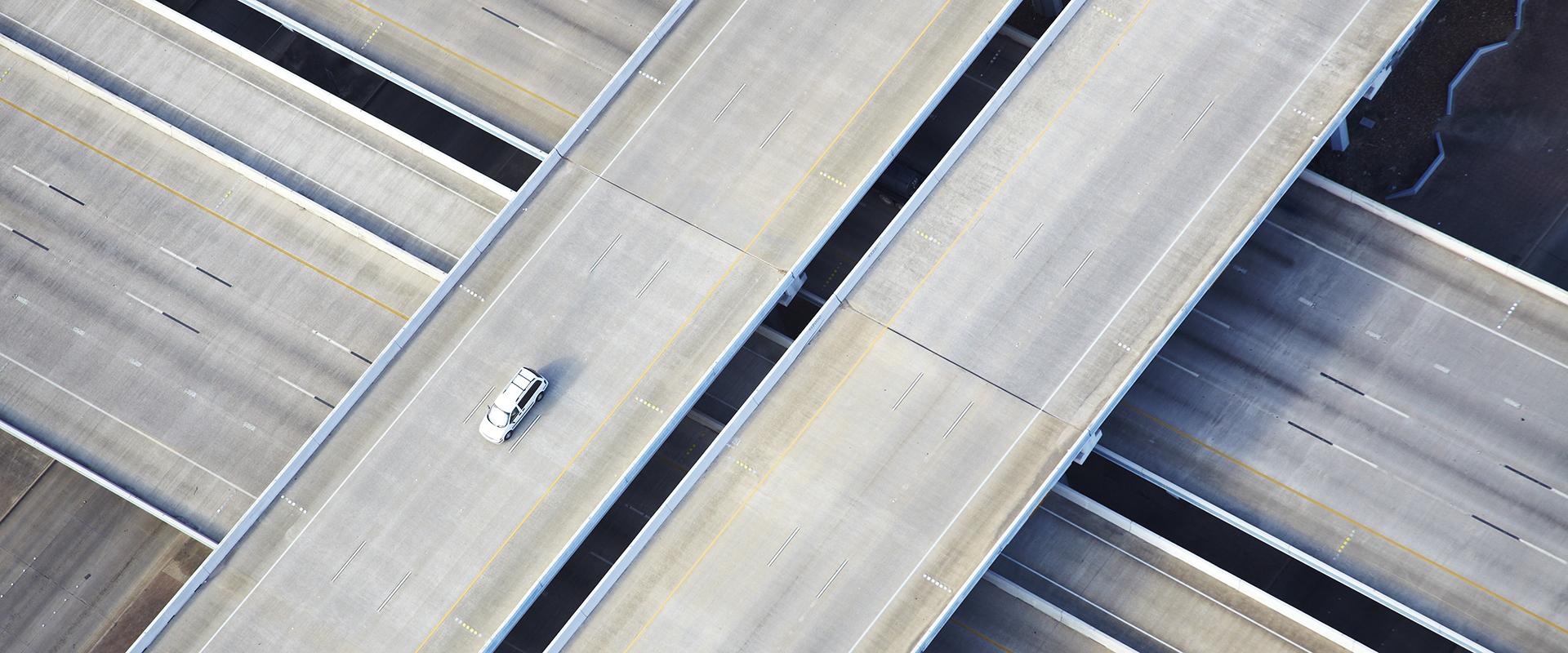

Another important parameter for the Fed’s reaction function is the belief that not only is the theoretical real neutral rate depressed , but also that it is not rising – dampened by ongoing sluggishness in productivity and the structural headwinds affecting the US economy (including poor demographics). The real neutral rate was – 0.2% in Q2 2017 according to the closely watched gauge by Laubach and Williams. We think this neutral rate estimate is key to assessing the extent of rate hiking in coming years. It is difficult to envisage a significant push-up in productivity given the late-stage phase of the business cycle. This , along with low core inflation, explains why we think the Fed will start to consider pausing rate hikes later in 2018. |

Productivity Growth, 1980 - 2017 |

Valuation anxietye scalating, but Yellen played them downYellen was adamant to say that rising frothiness in financial markets was not a worry, and was certainly not the major driver for the December rate hike and future rate hikes in 2018. That said, we think these financial-stability worries are in fact playing a more important role in the Fed’s reaction function than Yellen wants to admit. Rising frothiness may tilt many Fed officials to be more disdainful of low core inflation. While not a worry, Yellen still spent quite some time discussing these issues. Yellen noted that some valuation metrics were indeed “elevated” and some ratios, like price-to-earnings ratios, were at the high end of historical ranges. But she remained calm, saying that high valuation does not mean over-valuation. Furthermore, she said that economists (with the implication: as she is) are not very good at judging valuations. She also explained that the macro backdrop was conducive to strong financial markets, since growth both at home and abroad were doing well, and that she “feels good about the economic outlook”. Still, she said that, while not a major concern, rising financial-market frothiness was on “the list of risks”. Yellen was similarly cool-headed about the recent developments in Bitcoin and other cryptocurrencies. She noted that Bitcoin plays only a small role in the US payment system, and that the core banks of the US financial system have no significant exposure to it. Financial-stability risks remained “limited”, she concluded. |

Evolutuion of the Median Forecast, Jan 2012 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Macroview,newslettersent