Monthly Archive: November 2017

Stories making the Swiss Sunday papers

Good news from the Swiss watchmaking industry, plans to ban under-18s from solariums because of health risks and a warning that the Swiss railway system could face chaos in December. The Swiss watchmaking industry has made a turnaround following a three-year dip. Nick Hayek, CEO of the Swatch Group, told the NZZ am Sonntag newspaper that his company recorded a massive increase in turnover over the past two months, resulting even in production...

Read More »

Read More »

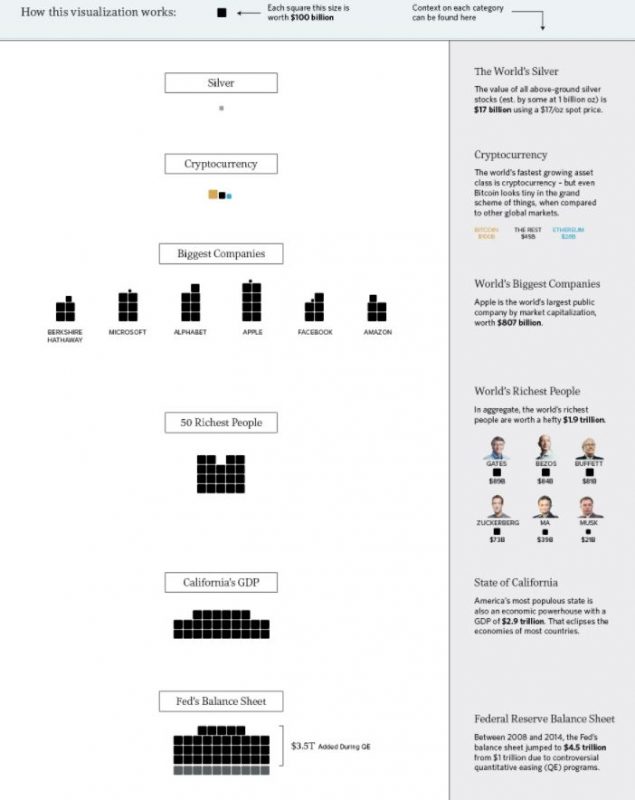

Money and Markets Infographic Shows Silver Most Undervalued Asset

Money and Markets Infographic Shows Silver Most Undervalued Asset. Silver remains severely under owned and under valued asset. Entire silver market worth tiny $100 billion shown in one tiny square. “All of the World’s Money and Markets in One Visualization”. Must see ‘Money and Markets’ infographic shows relative size of key markets: silver bullion, gold bullion, cryptocurrencies/ bitcoin, largest companies, 50 richest people, Fed balance sheet,...

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the week firm, and capped off a good week overall. Best performers last week for ZAR and KRW, while the worst were TRY and IDR. Until we get higher US rates, the dollar may remain under modest pressure. This would help EM maintain some traction, though we remain cautious.

Read More »

Read More »

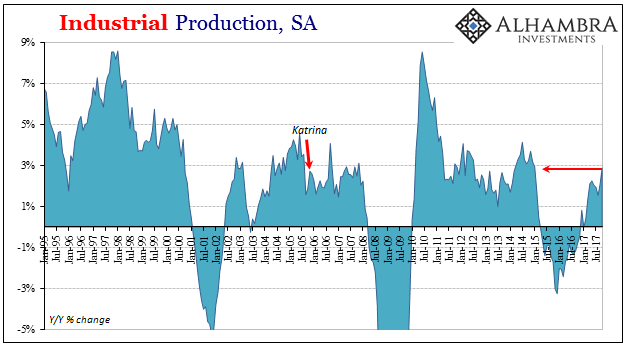

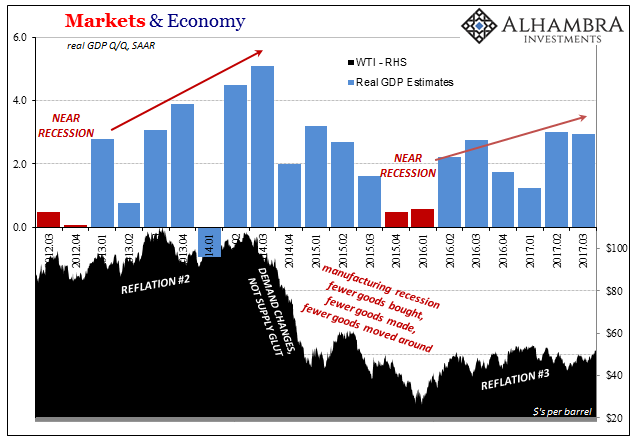

Industrial Production Still Reflating

Industrial Production benefited from a hurricane rebound in October 2017, rising 2.9% above October 2016. That is the highest growth rate in nearly three years going back to January 2015. With IP lagging behind the rest of the manufacturing turnaround, this may be the best growth rate the sector will experience. Production overall was still contracting all the way to November 2016, providing the index favorable base comparisons that won’t last past...

Read More »

Read More »

Great Graphic: Euro Approaching Key Test

Euro is testing trendline and retracement objective and 100-day moving average. Technical indicators on daily bar charts warn of upside risk. Two-year rate differentials make it expensive to be long euros vs. US. Beware of small samples that may exaggerate seasonality.

Read More »

Read More »

Swiss still richest, according to Credit Suisse

The Credit Suisse 2017 Global Wealth Report, shows total global wealth rose 6.4% to USD 280 trillion in 2016, taking it to the its highest level since 2007, before the financial meltdown in 2008. Globally, average wealth per adult was USD 56,540. In Switzerland, the same figure was USD 537,600 (CHF 533,000), close to ten times the global average, placing Switzerland in the lead, if Iceland – with unreliable data – is ignored.

Read More »

Read More »

Swiss Government stays mum on EU Negotiations Strategy

The seven-member Federal Council has refused to reveal its position on future negotiations with the European Union over CHF1 billion (little over $1 billion) in voluntary ‘cohesion’ payments destined for central and eastern European countries.

Read More »

Read More »

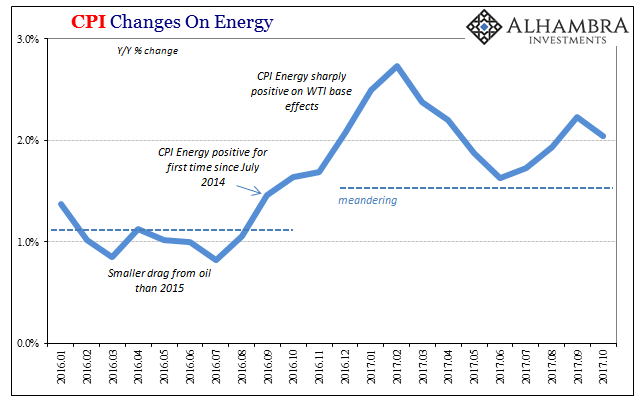

Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found.

Read More »

Read More »

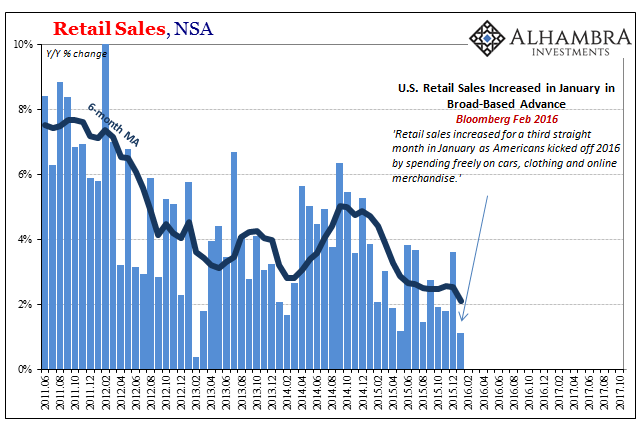

Retail Sales (US) Are Exhibit #1

In January 2016, everything came to a head. The oil price crash (2nd time), currency chaos, global turmoil, and even a second stock market liquidation were all being absorbed by the global economy. The disruptions were far worse overseas, thus the global part of global turmoil, but the US economy, too, was showing clear signs of distress.

Read More »

Read More »

Emerging Markets: What has Changed

Moody's raised India's sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever. The head of South Africa’s budget office resigned.

Read More »

Read More »

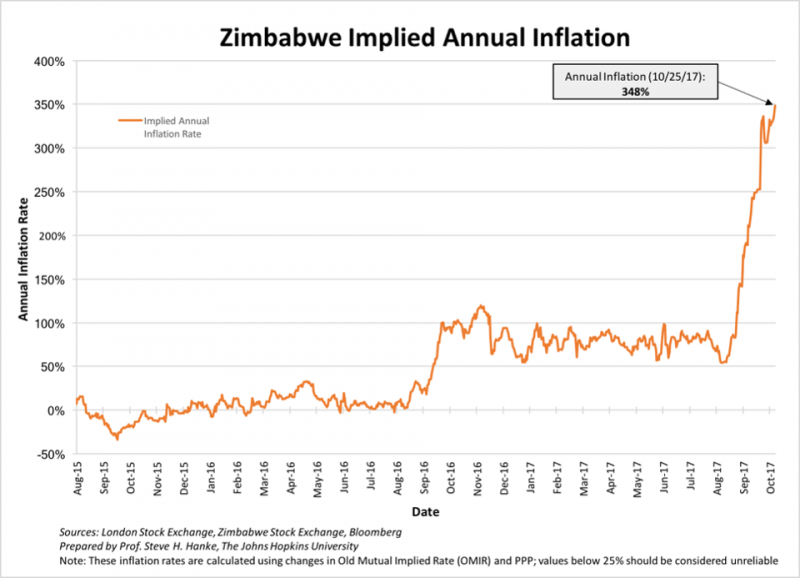

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

Swiss HSBC settles French tax fraud dispute

With a payment of €300 million (CHF350 million), the Swiss subsidiary of British bank HSBC has settled its tax fraud dispute with the French authorities. Investigations by the French government revealed that many French taxpayers had hidden their assets with help from HSBC’s private bank.

Read More »

Read More »

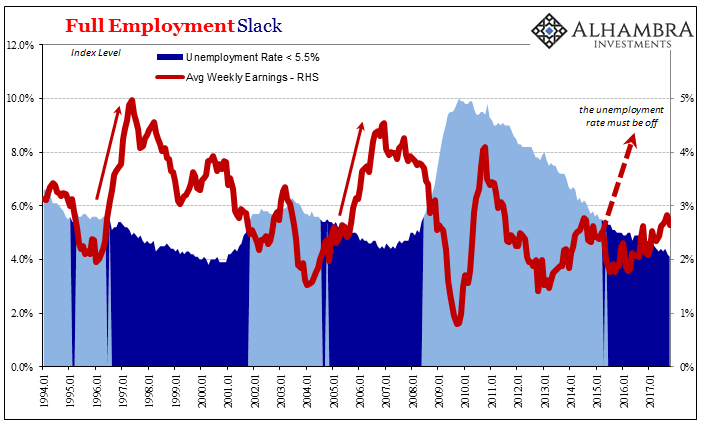

What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery.

Read More »

Read More »

Business Cycles and Inflation – Part I

Incrementum Advisory Board Meeting Q4 2017 – Special Guest Ben Hunt, Author and Editor of Epsilon Theory. The quarterly meeting of the Incrementum Fund’s Advisory Board took place on October 10 and we had the great pleasure to be joined by special guest Ben Hunt this time, who is probably known to many of our readers as the main author and editor of Epsilon Theory.

Read More »

Read More »

FX Daily, November 17: Euro, Yen and Sterling Regain Footing

The US dollar is trading with a heavier bias against the euro, sterling, and yen, but is firmer against the Antipodean currencies and many of the actively traded emerging market currencies. This mixed performance is the story of the week. The US 2-10 yr yield curve is flattening further today with the two-year pushing above 1.70% for the first time since the financial crisis. The 10-year yield is slipping toward the middle of this week's...

Read More »

Read More »

Switzerland asked to aid Mauritian inquiry into Basel-based Dufry

Switzerland’s federal prosecutor’s office is handling a request for mutual assistance in an investigation involving the Basel-based duty-free group Dufry. The request was sent by the government of Mauritius, which according to reports in two Swiss newspapers is looking into the details of an exclusive agreement reached between Dufry and two Mauritian airports.

Read More »

Read More »

Swiss Top Global Wealth Ranking

The average fortune of a Swiss adult is $537,600 (CHF528,000), according to the 2017 Credit Suisse Global Wealth Report. Switzerland continues to top the Credit Suisse global list for wealth per adult, followed by Australia ($402,600), the United States ($388,600) and New Zealand ($337,400).

Read More »

Read More »

UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

UK debt crisis is here – consumer spending, employment and sterling fall while inflation takes off. Personal debt crisis coming to fore – litigation cases go beyond 2008 levels. October consumer spending fell by 2% in October, the fastest year-on-year decline in four years. Britons ‘face expensive Christmas dinner’ as food price inflation soars. Gold investors buying physical gold due to precarious UK and US outlook

Read More »

Read More »

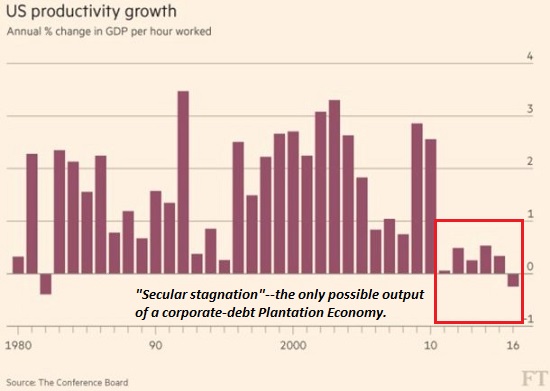

Is This Why Productivity Has Tanked and Wealth Inequality Has Soared?

Needless but highly profitable forced-upgrades are the bread and butter of the tech industry. One of the enduring mysteries in conventional economics (along with why wages for the bottom 95% have stagnated) is the recent decline in productivity gains (see chart).

Read More »

Read More »

Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have pushed oil investors to buy...

Read More »

Read More »