| – Yahoo admits every single one of 3 billion accounts hacked in 2013 data theft – Equifax hacking and security breach exposes half of the U.S. population – Some 143 million people vulnerable to identity theft – Deloitte hack compromised sensitive emails and client data – JP Morgan hacked and New York Fed hacked and robbed – International hacking group steals $300 million – Global digital banking and financial system not secure |

|

| Imagine there was a chemical disaster at a factory. The surrounding water and air supply are affected over hundreds of miles. Thousands of people, if not more, are affected.

There would be a national response. Governments would step in to ask why this had happened, how it was going to be dealt with and how it would be prevented. More importantly, those affected would be notified with immediate effect. The responsible company would not set up a website inviting potential victims to log on with personal details in order to find out if and how badly they have been affected. And if the company did do this then people and the government wouldn’t stand for it. Imagine that another disaster happens a few months later, at another company. But it turns out the dangerous chemicals have been leaking into the environment for possibly the previous three months. No-one knows the extent of the damage. There would be uproar. Yet there seems to be little reaction when the equivalent happens in the cyber world. Just this week, less than a month after the Equifax announcement, Yahoo have admitted all 3 billion accounts were compromised four years ago … four years ago … This is just another example of repeated data breaches that have compromised the personal data and lives of billions of people. The list of respected and powerful institutions that have been hacked grows by the day and includes – Equifax hacking and security breach exposes half of the U.S. population There are now numerous examples of slow responses from hacked companies, cover-up missions and a lack of responsibility and accountability. We are sleep walking into a cyber financial collapse. No-one knows to what extent the information that has been stolen will be used in the future. But we may soon be looking at the cyber-equivalent of Chernobyl or Bhopal’s Union Carbide disaster. |

|

| This could go on for years. Each time someone tries to open a bank account, get a mortgage, even travel abroad they could face problems. Yet these companies leave it to us to manage and governments seem to be behind the curve and not on top of these real challenge.

The difference between the cyber-attacks and those that happen in manufacturing plants is that there are consumer protection laws and we are offered some level of compensation and some companies are rightly crippled for serious mistakes. When it comes to Yahoo, Equifax or a large bank, it seems all that happens is that regulators slap them with a minimal fine. They even get some praise if they offer us protection in future, as happened with Equifax. Long-term, there seem to be little awareness about how we and our data including our financial data and digital deposits and wealth will be protected in the future. Even more worrying is that there is a lack of awareness of how real the cyber risks are to our modern digital banking, financial and monetary systems. Terror-threat level raised Less than a decade ago we used to worry about cyber-attacks purely in relation to money being taken from our accounts. This was as bad as we imagined things could get. We thought we could wake up one day and find our savings had disappeared. That was scary enough. It happened to many people. But we didn’t appreciate how the threat could escalate further. Fast-forward over the last decade and we have been confronted with central banks being hacked via the SWIFT system and billions of identities taken like candy from a baby, from the apparent secure systems of financial services companies and banks. We now have to face the reality that this threat extends beyond an inconvenience for individuals and instead is a real threat to governments and our international banking systems. To many in the public this might not seem like such a bad thing. Perhaps its better that governments and big banks are targeted, with their endless pots of money and resources. |

|

| But where does it end?

There’s an unseen world war that is being quietly fought in recent months and years. There are no clear battle lines, few rules of engagement, and no end in sight. It not a typical war involving armies rather it is a cyber war, with nations fighting each other for dominance in cyberspace. The United States, Russia, China and many others are employing professional hackers as “cyber soldiers.” Call it cyber terrorism or cyber war. US military leaders warn of the growing progress of Russia, China, and North Korea in cyberspace. The Pentagon has ramped up its own efforts in what it calls the “cyber domain” and released a new cyber strategy in April 2015. It is not a secret that the likes of Russia and Iran support cyber terrorism or cyber war (depending on your perspective) that give them leverage over the U.S. and other western nations. Russia was relatively open about their attack on Estonia and there are rumours of support in attacks on other nations. It is not beyond the realms of imagination that anti-Western governments could soon have western nations banks and institutions by the proverbial cojones either by holding billions of personal details to ransom or (arguably worse) disable and collapse our vulnerable financial and monetary systems. We already see Russia and China preparing systems that allow them to operate beyond dollar hegemony. They are preparing for this … as should we. |

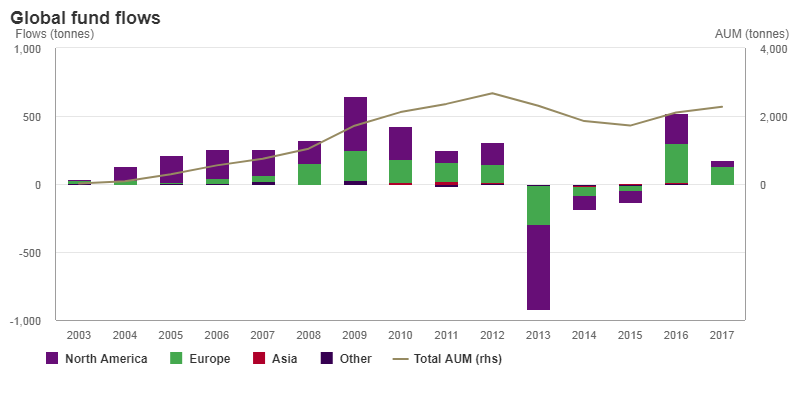

Global Funds, 2003 - 2017 |

Conclusion

The threat posed by cyber attacks, cyber terrorism and cyber war to our increasingly complicated, technologically dependent financial system is something we have covered numerous times and it becomes more clear by the day.

We live in a time where the majority of our interactions, whether financial transactions such as withdrawing cash or selling gold, depend on single interface websites and the internet. Few can really appreciate on what scale we are at risk.

The cyber attacks of the last five years should help us realise the scale of the risks.

Not only must we consider how our banks and utility providers are protecting our information but also reevaluate how we are securing those assets designed to protect us from such disasters.

Consider digital gold providers. These are the companies that do not have a direct interaction with clients either through the phone or face-to-face. It is all done through online websites.

Investors should look to hold their gold with bullion dealers who do offer such interactions. Those providers who allow clients to have outright legal ownership of physical gold and silver coins and bars outside the banking system.

This is vital because those who hold gold and silver in this way are far better protected from any cyberattacks on the horizon. Physical coins and bars cannot be made to disappear and if owned in the right way mean that you can sell at any time and are not dependent on pricing and liquidity from one company’s website as is the case with gold vault platforms and increasingly the case with online banking.

It goes without saying that we hope these cyber risks do not cripple the financial and monetary system. But in the same way we are the midsts of a debt-crisis no-one saw coming, we believe it is prudent to take the necessary measures to protect your wealth.

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent