Summary:

Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections.

Focus below is on the Bank of Canada and ECB meetings and tax reform in the US.

The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform.

US and German 2-year rates are diverging the most since the late 1990s and US-Canada 2-year spread moving in US favor.

There are many economic reports that will vie for investors’ attention. The flash PMI readings for the eurozone may be the most contemporaneous data, while the UK and US are the first G7 countries to report Q3 GDP. Japan will provide September CPI figures, and the both Sweden’s Riksbank and Norway’s Norges Bank hold policy meetings.

Spain’s reassertion of its authority over the secessionist-minded Catalonia will draw attention, and investors will digest the results of the Japanese national elections. Abe’s gamble with a snap election appears to have paid off, and the government is seems set to have retained its super-majority. Japan’s election concludes an unlikely twelve-month period where all of the G5 countries held national elections. The Czech Republic election results seem consistent with the shift to the right by the Visegrad Group, as well as many countries in western Europe.

We focus on three developments that may have the broadest impact. The first is the Bank of Canada meeting, which is not often thought to have global implications, especially given that policy will remain on hold. However, the reason we think it is important is that the Bank of Canada with two rate hikes this year as seen as the epitome of “end of divergence” meme that seemingly became consensus.

The Bank of Canada hiked the overnight lending rate by 25 bp in July and again in September. Initially, the market moved to price in a hike on October 25. As recently as mid-September the market was discounting more than a 50% chance of a hike at this month’s meeting and a nearly 75% chance of a hike by the end of the year.

Guided by official comments and some softer data, the market has reconsidered. Interpolating from the Overnight Index Swaps, Bloomberg estimates that the market is now discounting less than a one-in-five chance of a hike in the week ahead and a little more than a one-in-three chance of a hike this year.

The rate hikes that were delivered were not the beginning of a monetary tightening cycle like the Fed has entered. The two rate hikes were the taking back of the precautionary cuts delivered in 2015 as the economy coped with the drop in oil prices and the terms of trade shock.

United KingdomIf the Bank of England hikes rates early next month, as the market expects (~80% probability), it will look more like the Bank of Canada’s move than the Fed’s. The Bank of England cut rates, and eased policy in other ways, around last year’s referendum. With the economic activity moderating, and price pressures expected to peak soon, and the significant pass-through of higher rate to households, a sustained campaign to normalize monetary policy does not appear to be at hand. Canada illustrates another broader issue, and that is the significance of interest rate differentials, which is a way to quantify a dimension of divergence. On a purely directional basis, the US dollar-Canadian dollar exchange rate is highly correlated with the two-year interest rate differential. Over the past 60 sessions, the two move in the same direction a little more 90% of the time. The US dollar fell against the Canadian dollar from early May’s high close to CAD1.38 to near CAD1.21 in early September. The greenback has recovered in recent weeks and moved toward CAD1.2625 before the weekend. About a week after the US dollar peaked in early May, the US two-year premium peaked near 65 bp. As the dollar was tumbling, the differential swung to a discount of 25 bp by early September. The US premium, now a little more than 11 bp has been restored, and the US dollar appears set to recoup its earlier losses. Another broad point that the Canadian dollar helps illustrate is market positioning. We use the non-commercial positioning in the futures market as a proxy for short-term speculative, momentum and trend followers. This market segment is going into the meeting with a substantial long bias. The net long position of almost 74k contracts is nearly the most in five years. The gross long position of 94.5k contracts is about 10% below its recent peak, which itself was the highest since 2012. |

Economic Events: United Kingdom, Week October 23 |

EurozoneThe ECB meeting is the second event with broad implications. Many observers cited the ECB’s tapering as evidence that the forces of divergence were exhausted. A new convergence was declared, but it has not materialized. The US two-year premium over Germany is at its widest since 1999. The consensus call in until a few weeks ago had been for the ECB to bring down its monthly asset purchases to 40 bln euros a month from 60 bln and extend the purchases for six months. We had thought a large reduction would maximize the flexibility to end the program. Based it seems on mostly unsourced reports, the market now expects a larger reduction of the purchases, but for the duration to be extended for nine months. There is a debate over what is more important, the monthly purchases or the duration of the program. We are inclined toward the latter because in the current context, the signaling effect (forward guidance) is particularly important. Due to the sequencing that the ECB has outlined, favoring no rate hikes until after the purchases are complete, the longer the purchases, the more distant is the first rate increase. The market appears to have given up on ideas of an ECB hike next year. The euro may be sensitive to signals that the ECB wants to push expectations out further into 2019. Perhaps the different markets may respond differently to the trade-offs. The coupon curves may be more sensitive to quantities rather than the duration of the program. In the first instance, if the purchases are scaled back to 20 bln euros, it might be a bit disappointing. In the second instance, with coming maturities can average 10-15 bln euros a month, whose proceeds will be recycled, we suspect that some emphasis on gross purchases could be part of the signaling effect. Some look for the ECB to try to secure greater flexibility its purchases, and abandon monthly targets and instead focus on the overall size. The Financial Times recently reported: “Officials think there are about 300 bln euros worth of eurozone bonds left they could buy. They would prefer to commit to purchases of slightly less than 300 bln euro to have some room to speed up should conditions deteriorate.” We are not completely persuaded. After all, the ECB has changed the modalities several times, to include corporate bonds, for example, and it has increased the universe of other non-sovereign issuers. There is some thought the ECB could tweak the other assets that it is buying, including asset-backed securities and corporate bonds. Nevertheless, if the total net amount of bonds the ECB commits to buy is more than 300 bln euros, the market’s response may be more dramatic. While providing an end date of its purchases is possible, the ECB likely will try to maximize its flexibility. When it reduced its purchases from 80 bln euros a month to 60 bln euros starting this past March, it argued it was not tapering because there was no termination date. By the same logic, don’t be surprised if the ECB refrains from discussing its re-scaling as tapering. The ECB may also choose not to show its entire hand at this meeting, holding back details of either its purchases, new initiatives, reinvestment of maturing proceeds, or modify the terms of the existing targeted long-term repo operations (TLTRO) for the next meeting. While these may be important for individual participants and in some market segments, investors are unlikely to wait for such details before judging the ECB’s stance. The speculative positioning in the futures market is heavily biased in favor of the euro. The net long position of a little more than 90k contracts is less than 10% from its six-year high set earlier this month. The gross speculative long position reached a record high of a little more than 200k contracts in early August. It stood at almost 187k contracts as of Tuesday, October 17, the end of the latest CFTC reporting period. The gross short speculative position is a little larger than 96k contracts. The three-year low set in June was 85.2k contracts. Recall that at the end of last year, the speculative short euro position was 200k contracts. |

Economic Events: Eurozone, Week October 23 |

United StatesUS tax reform is the third force with broad implications. The rise in the long-end of US curve last week, with the 10-year yield increasing 11 bp and the nine bp rise in the 30-year yield appear to have been driven expectations around US fiscal policy. We succinctly summarize in nonpartisan terms where the process is and what to expect going forward. The new development last week was that the Senate passed a 2018 budget. It is different than the House version in that it anticipates a loss of revenue (tax cuts) that will increase the deficit by $1.5 trillion over the next 10 years. Part of the reason is that unlike the House that offered a little more than $200 bln in spending cuts and other offsets. To proceed to tax reform, both houses of Congress must approve the same budget. The reconciliation process typically takes weeks. This time could be different. A parliamentary maneuver allows a shortcut. As early as next week, the House may simply vote on the Senate’s version. Once the budget is passed, Brady, the chair of the House Ways and Means Committee will reportedly release a detailed tax reform bill. His committee will vote on it, and with 2/3 Republicans, it is not much of a hurdle. The bill would then face a vote in the entire House. The Republicans can afford to lose 22 member votes at the most. Speaker of the House Ryan has suggested a floor vote could be held in early November. The Senate is working its own version. The Republican majority on the Senate Finance Committee (chaired by Hatch) is a narrower 14-12. The Republican majority in the Senate is 52-48. Vice President Pence casts a vote in a tie, so in the Senate, the Republicans can loss two votes and still pass tax reform. It is on the floor votes that health care reform faltered in the House and Senate. The recurring problem is not obstructionist tactics from the minority Democrats, but the inability of the Republican leadership is cross the divide within their party. As all of the House members face election next year, it may be easier to maintain party discipline than in the Senate, where only eight sitting Republican Senators will defend their seats, though one (Corker) has indicated intentions on stepping down. These Senators immediate challenge stems from a potential primary challenge threatened by Steve Bannon. The gulf between those Republican Senators who want significant tax cuts even if it means greater deficits and those who have been critical of deficit spending throughout their careers may be too difficult to bridge. While there are many components to the tax reform, part of the challenge is that there are few constituents that are concerned about more than one two components, which make larger compromises more difficult. Toward the end of last week, reports emerged that suggested that under consideration was limits on tax-free retirement savings (e.g., 401k). The problem is that because of the disparity of income and wealth, many people and households cannot benefit from the financial incentives to save. So these types of inducements, which Obama saw in the college saving programs (529B), contribute to the disparity. However, Obama was forced to back off quickly, and many middle-class families use pre-tax dollars to save for retirement, and there are more regressive taxes that can reconsider. That said, a shift from pre-tax to post-tax savings front loads tax receipts for the government. All else being equal, it would make for a smaller deficit. The change may initially squeeze household cash flow, and consumption, but the underlying rate of savings, adjusted for anticipated tax obligation may not be altered on the medium term. To conclude, the challenges that bedeviled the health care debate cast a cloud over tax reform and that lies ultimately in the narrow majorities that are majorities in party affiliation and little else. Finishing the 2018 budget is the first step, and that is possible in the days ahead. Then details of the House tax plan will be published. The floor vote is where the challenge lies, but the Senate obstacles may be more formidable. While some parts of the tax reforms seem stimulative, others like removing the state and local tax deductions, and/or further limiting tax incentives for retirement savings, seem to raise the effective tax burden on middle-class households that drive consumption. |

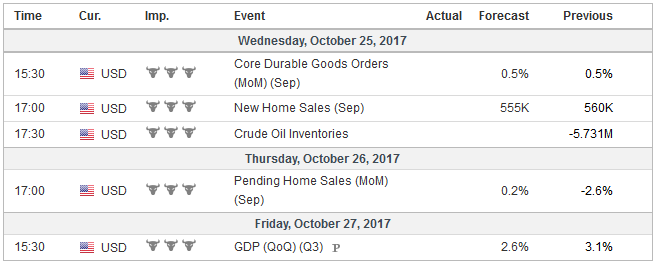

Economic Events: United States, Week October 23 |

Switzerland |

Economic Events: Switzerland, Week October 23 |

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$CAD,$EUR,Bank of Canada,ECB,Interest rates,newslettersent,tax reform