| The Bank of Canada “raised rates” again today, this time surprising markets and economists who were expecting more distance between the first and second policy adjustments. The central bank paid typical lip service to being data dependent. It has a vested interest if you, as any Canadian reader, believe that to be a fact.

But what we really find in Canada is what we find everywhere else. The end of the “rising dollar” period simply removed any more excuses for not doing them. In a binary world of recession/not recession, the latter condition is always expected to be some shade of robust. In fact, that is the formula for most commentary; rate hikes + not recession = totally awesome. It can be no other way: |

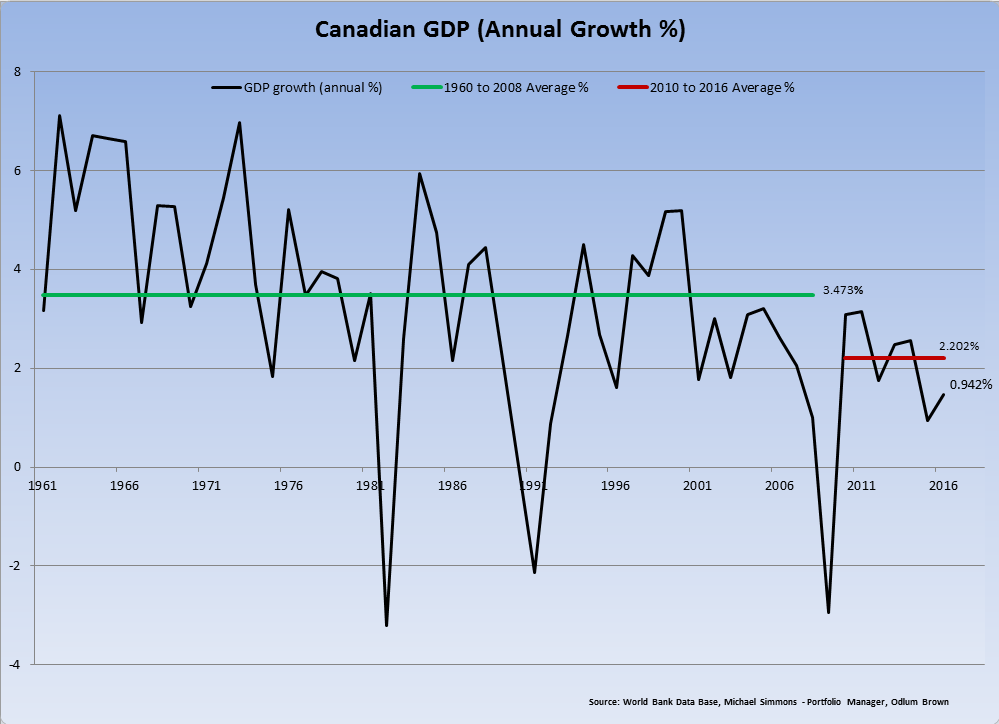

Canadian GDP, 1961 - 2016(see more posts on Canada Gross Domestic Product, ) |

Well, not quite, as Michael Simmons from Odlum Brown easily illustrates. The Bank of Canada is acting not on the appearance of any immediate upside but in its view the lack of further (apparent right now) downside. Hardly a ringing endorsement, another example of why markets like government bonds and eurodollar futures are doing the opposite of “rate hikes.”

There hasn’t actually been a time in recent memory where any government official of any country or any political persuasion hasn’t declared “a very positive set of economic indicators” no matter what they were doing. When the Bank of Canada reduced its overnight rate twice in 2015, it did so despite what it declared a very positive set of economic indicators, thought it didn’t refer to them as that specifically.

The oil price shock is occurring against a backdrop of solid and more broadly-based growth in Canada in recent quarters. Outside the energy sector, we are beginning to see the anticipated sequence of increased foreign demand, stronger exports, improved business confidence and investment, and employment growth.

That was written in the official press release announcing the Canadian central bank’s first rate reduction in January 2015. The sun is always shining for a central banker. If you didn’t have much or any actual exposure to real economic conditions all these years you really might wonder what all the fuss has been about. To the mainstream, the economy is only some level of great.

You might argue, as BoC officials have and will continue to, that they are preparing for the economy of the future, the one that “should be” once all these “transitory” factors finally disappear. The economy that “should be”, however, hasn’t ever been where waiting for it year after year has proved quite dangerous, based instead on (as I demonstrated earlier) some fundamental misreading of money as well as its effects on the economy, the global economy.

They raise rates (Fed, BoC, BoE) or threaten to normalize in other ways (ECB QE) because they don’t know what else to do. It’s been ten years and being stuck in “stimulus” without anything stimulated is a really bad place for any central bank, but especially so for all of them philosophically grounded in the ironically named rational expectations regime.

Tags: Canada,Canada Gross Domestic Product,currencies,economy,Federal Reserve/Monetary Policy,Markets,newslettersent,rhino