| – Physical gold is “the true currency of the last resort” – Goldman Sachs – “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar” – Trump and Washington risk bigger driver of gold than risks such as North Korea – Recent events such as N. Korea only explain fraction of 2017 gold price rally – Do not buy gold futures or ETFs rather “physical gold in a vault” [is] the “true hedge”Editor: Mark O’Byrne |

|

| What’s increasing the demand for gold? Is it Kim Jon-Un’s calls for nuclear war? Trump’s tough tweets on government and trade and unleashing “fire and fury” on North Korea? The threat of World War III? Possibly not, according to Jeff Currie of Goldman Sachs. This is more to do with the market mechanics underlying such events.

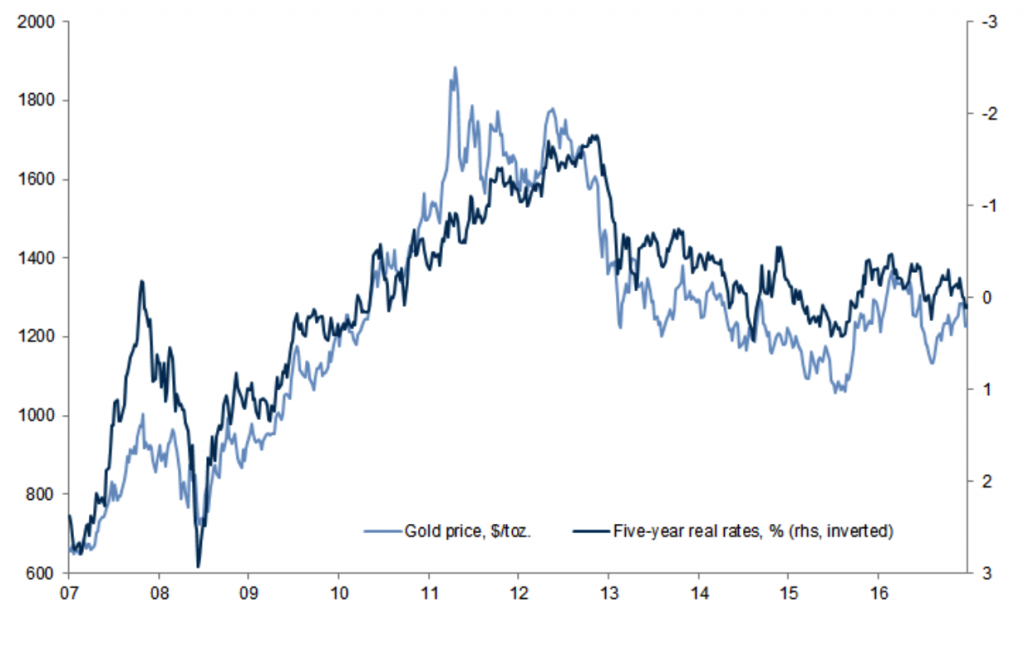

Currie released a note arguing that gold’s strong performance of late is less to do with the current perceived risk in the geopolitical sphere and instead from the currency debasement that arises from central banks printing money. In light of this, investors should be buying up gold. Goldman’s Currie refers to gold as the ‘geopolitical hedge of the last resort’. This is the case ‘if the geopolitical event is extreme enough that it leads to some sort of currency debasement’ and especially so ‘ if the gold price move is much sharper than the move in real rates or the dollar.’ Read on to see in exactly what form Currie believes you should be investing in gold. It has become too easy to pin gains on geopolitics As we have repeatedly pointed out, the gold price jumps following events such as North Korea testing missiles or Hurricane Harvey or a declaration from Trump. However these jumps are not frequently sustainable. What is going on in the U.S. and global markets and economy which really provides long-term support for the every-strengthening gold price. Currie writes:

It is too easy to pin gold’s rise on geopolitical events. Instead, argues Currie, these events are only really impacting gold if they lead to ‘actual currency debasement.’ Instead, the recent rally has been down to the decline in the U.S. dollar and lower real interest rates. |

Gold Price & Five-year rates, 2007 - 2016(see more posts on gold price, ) |

All about that (de)base

Bigger things to worry about than Korea Interestingly gold’s move this year has had far more to do with President Trump than it has to do with North Korea. Currie argues that Kim Jong-Un might only be responsible for 15% of the yellow metals’ move. 85% of the price rise can be accounted for by the fact that the Trump risk premium is reflected in both real interest rates and a weaker US dollar. |

Gold price & USD based Gold value, Sep 2016 - 2017(see more posts on gold price, ) |

This does not mean that gold will no longer be classed as a hedge against geopolitical risk (as well as currency debasement). But, in the current climate gold is reacting more to Trump risk and the ongoing devaluation of monetary assets.

|

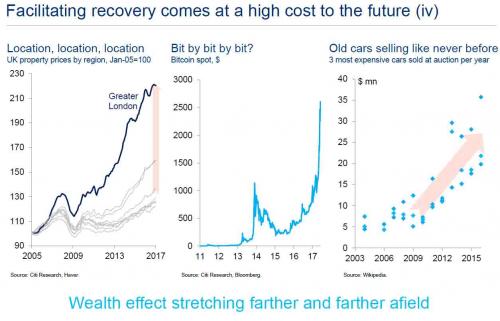

Facilitation recovery |

Learn from Lehman

In conclusion, gold is still very much as we have argued – a hedge against geopolitical risk and currency debasement.

Investors must consider gold-market liquidity when using gold to protect themselves. Goldman Sachs argue that liquidity in the gold market is

crucial when deciding to hedge via physical gold in a vault versus COMEX gold futures.

Investors should not assume that during a geopolitical event liquidity will not be a problem:

Using a gold futures contract as the basis of the hedge makes the implicit assumption that market liquidity will not be a problem in the realization of a geopolitical event.

Goldman Sachs strongly advise that investors buy physical gold as opposed to ETFs or Comex Futures. Their logic for this? The liquidity event that was the collapse of Lehman Brothers.

The importance of liquidity was tested during the collapse of Lehman Brothers in September 2008. Gold prices declined sharply as both traded volumes and open interest on the exchange plunged. After this liquidity event, investors became more conscious of the physical vs. futures market distinction and began to demand more physical gold or physically-backed ETFs as a hedge against black-swan events.

Therefore owning physical gold bullion coins and bars in the safest vaults in the world will again be the primary way to protect yourself and your wealth in the event of a geopolitical crisis and liquidity crunch.

Full story here Are you the author? Previous post See more for Next post“The lesson learned was that if gold liquidity dries up along with the broader market’s, so does your hedge—unless it is physical gold in a vault, the true “hedge of last resort.”

Tags: Daily Market Update,gold price,newslettersent