- North Korea threatens to reduce the U.S. to ‘ashes and darkness’

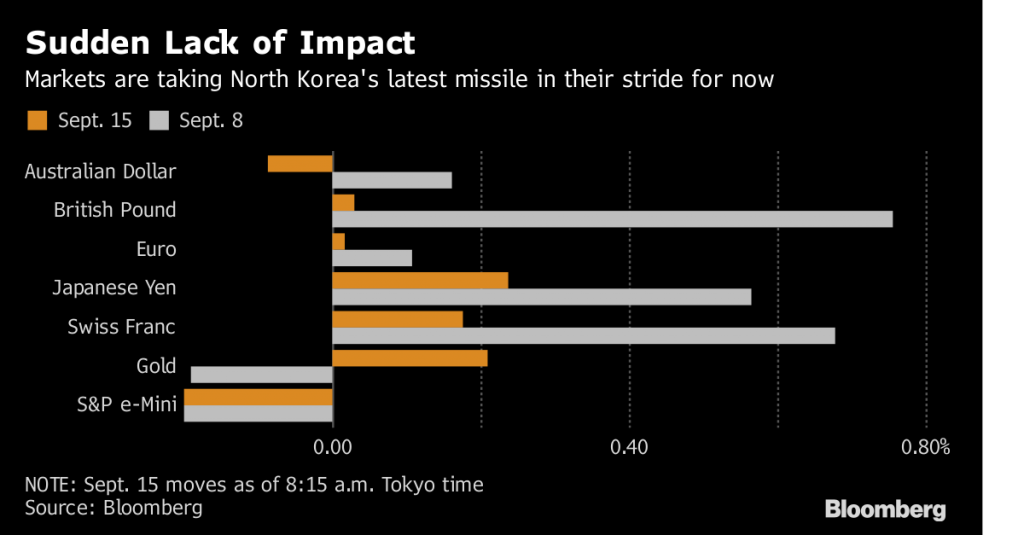

- Markets becoming used to ongoing provocations from North Korea

- Russia and China continue to support watered down versions of sanctions on Kim’s regime

- Both NATO and Russia running war games on one another’s borders

- Putin says Russia will “give a suitable response” to NATOs threatening behaviour

- Gold set to climb as fears over economy and war will drive safe haven demand

Tensions are coolest they’ve been since Cold War

Russia and China are clearly not happy with Kim’s nuclear ambitions. However it seems that currently it is more important for those classed as anti-Western to work together and thereby gain more influence in the international order.

Russia has its own problems with sanctions. It has been under them since the U.S. and European Union sanctions for its annexation of Crimea in 2014, its continued invasion of eastern Ukraine, and the shoot-down of Malaysian Airlines Flight 17 in July 2014.

It is perhaps the case that helping North Korea stand firm against the U.S and the U.N. is perhaps as much a matter of principle as it is strategic.

Refusing to give into Western calls for tougher sanctions on Pyongyang is perhaps more a statement of Putin’s insistence that he will not give in to demands regarding his own military activities in both Crimea and Ukraine.

This week Russia is hosting large scale military drills on the border of three NATO countries. The drills (known as Zapad 2017) have been happening every year since 1999.

They have been growing in size since, especially as relations between Moscow and Washington grow every frostier.

The Moscow Times explains:

Along with Zapad 2017 and defence of North Korea, Putin has been chest beating for some time now. It has carried out major propaganda operations across the West, tested other countries’ airspace, and supposedly hacked the US and French elections (watch out Germany). In response NATO has taken several steps to warn Russia off. It has sent four multinational battalions to rotate around the Baltics and Poland. In 2016 NATO members deployed around 30,000 troops in Poland, this was apparently its largest military exercise in eastern European since the end of the Cold War. Zerohedge explains that Zapad isn’t the only war-game going on:

|

Putin's Fictional War |

Where is the risk with China?

China might not be warming up the tanks on NATO borders but it certainly yields significant economic power, despite what the U.S. might think.

As we explained last week:

Currently Trump is relying heavily on China to cool things down with Kim Jong-Un of maniacal despot fame.

In Keen’s latest book China is one of the countries he believes is a debt junkie. The country’s credit-driven expansion has accounted for more than half of global growth since 2008. Why? Because it dealt with the collapse of the Western credit bubble in 2008 by fuelling a bubble of its own.

Today Chinese banks have $35tn of assets on their balance sheets – a fourfold increase since 2008. In the last decade private debt as a proportion of the country’s annual economic output (GDP) has increased from 120% to 210%.

Its financial system could almost be a mirror to those seen in the US and UK in the run up to the financial crisis. It has a large shadow banking system and special investment vehicles that take assets off balance sheets.

How does this relate to Trump, North Korea and the next financial crisis? Trump needs China on side when dealing with Kim Jong-Un. However, last week Beijing said that in the event of war between the two nuclear powers it would sit on the sidelines.

Trump now has to decide how to handle China as the country clearly has its limits in how much it will help. The most obvious option would be to impose economic sanctions for example, slapping tariffs on steel imports. It could also put China in a negative light in terms of its dealings in markets such as going back to Trump’s old rhetoric branding the country as a currency manipulator or accusing it of facilitating illegal piracy businesses.

Should sanctions be imposed then a trade war would inevitably erupt. This eruption would firmly put a pin in China’s bubble and ripples would be sent out across the world.

Is the market slowly waking up to the risks?

Last week we brought you the news that Goldman Sachs is warning of bubbles. This week they have reissued their warning of ‘blue sky’ views on the state of the world.

“We believe it is the right time, when markets look at the blue sky with sunglasses and when the trend and carry is your friend, to recommend downgrading risk assets,” the SocGen analysts wrote.

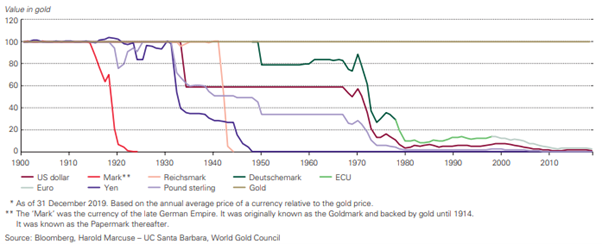

We also explained yesterday about Russia and China’s monetary moves behind the scenes. Whilst the West distracts themselves with economic sanctions, interest rate hikes and booking stock markets the BRICs are finding ways to manage as far away from the system as they can.

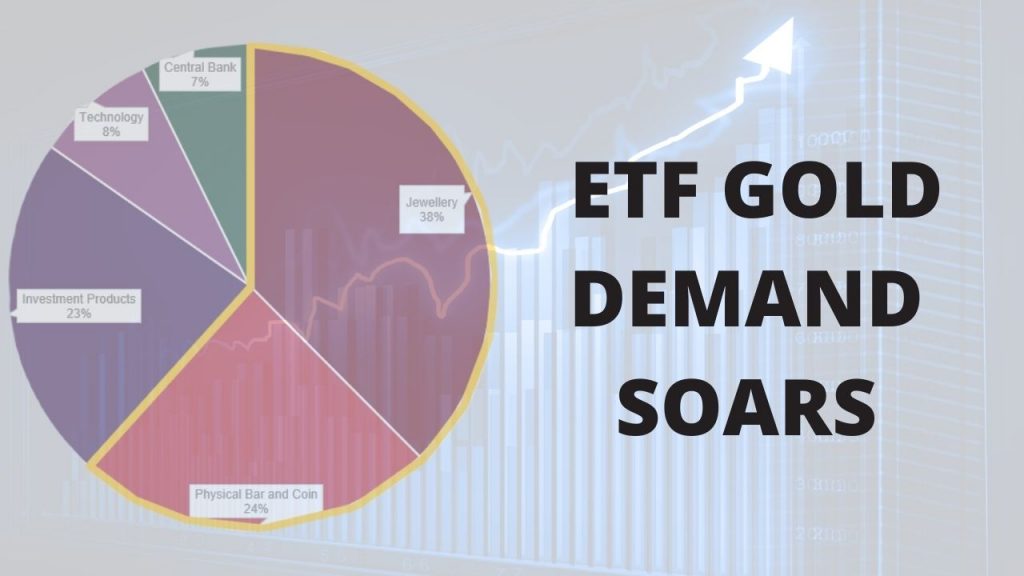

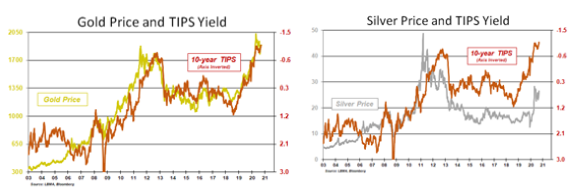

What does this mean? Those doing much of the provoking, Russia and China, are fully aware of what comes with potential nuclear war and financial weapons – destruction of currencies and strength in gold.

Unfortunately Western markets aren’t picking this up (as you can see from the opening chart). Everything reacted slightly this morning to the North Korea news but otherwise fell back thanks to news regarding the US inflation data.

Buy gold before everyone wakes up

Gold has fallen back slightly this morning. However over the year it is one of the best performing assets. There is certainly a rising undercurrent of uncertainty and concern for how the next few months will play out.

As always, we still do not have a crystal ball to tell you how this will end. It may end in nuclear war, it may end with Russia invading Eastern European countries or it may end with a stock market crash.

The geopolitical disasters are of course preventable. However, the cracks in the financial system have been brewing for some time and there is little that can be done to fix them.

Dramas with North Korea, Russia war-games and Chinese economic concerns are just more pressure on an already crumbling wall.

Countries know this, this is why they’re buying gold and facilitating gold markets. Investors would be wise to follow their lead instead of following market complacency.

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent,Vladimir Putin