Preventing the Last CrisisClear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism. |

The terrible scourge of bruxism and its potentially terrifying consequences. Curious skepticism can lead to the darnedest things, which is why Big Brother strongly recommends that citizens remain in a medication and cable TV-induced apathetic stupor. - Click to enlarge To make this happy outcome easier to achieve, stagnation in real wages was successfully introduced a number of moons ago; forced to work to exhaustion just to keep their heads above water, citizens tend to be more docile in their shrinking free time. |

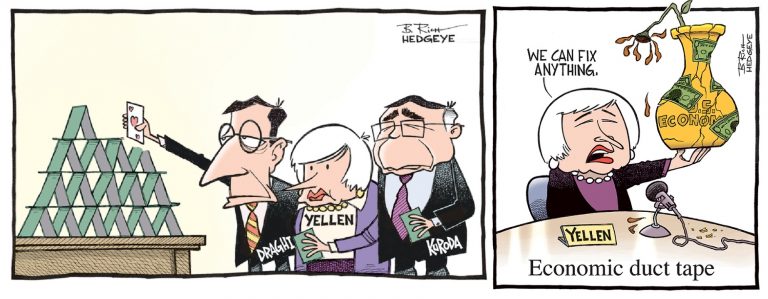

| Nonetheless, these are small prices to pay for the simple delight that comes when a central planner opens their mouth and inserts their foot. Last Friday, for example, Fed Chair Janet Yellen gave a speech to her friends and cohorts at the annual central banker’s powwow in Jackson Hole, Wyoming. There she patted herself and the financial regulatory community on the back for what she believes has been a successful execution of financial regulations:

How Yellen knows the reforms have made the system safer is unclear. Like France’s impenetrable Maginot Line, the regulations Yellen lauds are backward looking. They are suited to preventing the last crisis while ignoring new and greater threats amassing just beyond the horizon. No doubt, the greatest of these mounting threats are of the Fed’s own making. After adding $4 trillion to the Fed’s balance sheet and dropping the federal funds rate to near zero for many years they’re now in the early stages of their great endeavor to ‘normalize’ monetary policy. But, alas, it’s no longer a normal world. Years of abnormal monetary policy has fabricated an abnormal world. Surely something will break before things are bent back into place, assuming they ever get there. |

|

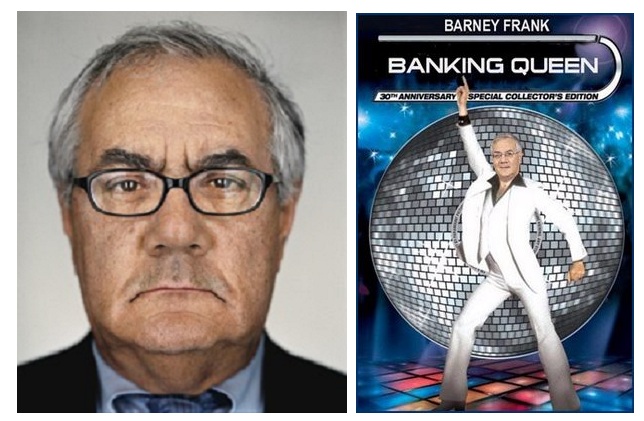

Dead WrongThe reforms Yellen was referring to include the Dodd-Frank Act. The Frank part of the regulation, if you recall, is former Congressman, and overall repulsive being, Barney Frank. Despite being out of office for over four years, Frank’s grubby finger prints continue to besmirch the economy. The Dodd-Frank Act, which was rolled out in response to the 2008 financial crisis, has turned out to be a classic case of knee-jerk regulatory overkill. President Trump has promised relief to certain aspects of the Dodd-Frank Act’s suffocating regulatory regime, including stress test and capital requirements. These requirements force banks to keep more capital on their books as opposed to investing it in interest-earning assets. |

Das abominable Frank, who lives on in the Act named after him. After aiding and abetting the very lending practices that brought Fannie Mae and Freddie Mac to their knees, he was somehow held to be the go-to person to work out a new set of regulations for the financial industry. He and Dodd created a telephone book-sized monstrosity of regulatory guidelines, which via implementation of administrative law by the bureaucracy has by now grown into several hundred telephone books of rules. - Click to enlarge The main effect of this was that the banking industry has become even more concentrated and so-called too-big-to-fail banks have grown even larger. They certainly are not happy with numerous aspects of the new regulations, but on the other hand, they no longer need to fear competition from upstarts, as compliance with this jungle of laws has essentially become unaffordable for institutions below a certain size threshold. |

| The rules also dictate how banks allocate their assets between highly liquid securities and illiquid loans – with greater preference for the former. Rolling back capital and stress test requirements would directly reduce compliance costs for banks and financial institutions. It would also give banks greater autonomy in how they manage their lending operations.

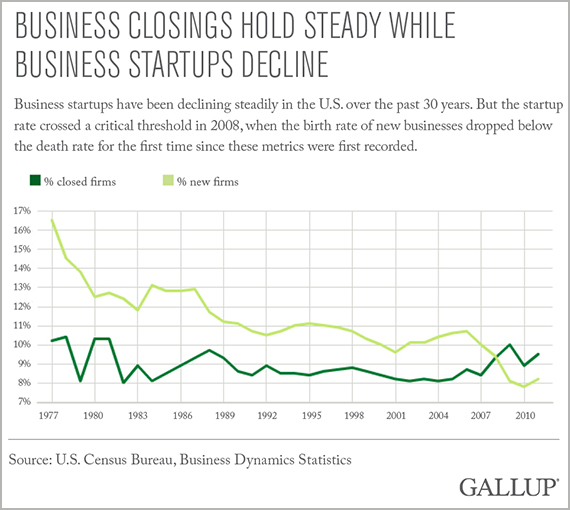

But Fed Chair Yellen, a dyed-in-the-wool central planner, has a very narrow focus. In her world, more control via more regulations always provides for a more stable financial system. Yet she’s dead wrong. The new financial reforms that were instituted following the 2008 financial crisis have had the adverse effect of constraining economic growth. U.S. gross domestic product growth has lagged behind asset price and debt growth. Moreover, more businesses are vanishing than are being created. Barney Frank’s maze of regulations has made it harder for small businesses and entrepreneurs to access the capital needed to grow and create jobs. |

We were unable find more recent data than those depicted in the above chart, so we cannot comment on the current situation, but shortly after the GFC, business closing did begin to exceed the number of new start-ups. Note that this trend has been in place for a long time – and it goes hand in hand with the growth on regulations in the Federal Register. - Click to enlarge The longest interruption occurred during the Reagan administration, which is not a coincidence: it was the only time in the entire post-war era in which the number of regulations in the Federal Register actually declined. This is of course precisely what one should expect – it is not rocket science. Unfortunately the political and bureaucratic elites are so far removed from the real world in their echo chambers that they apparently don’t understand even the most simple cause-effect chains. We should add, Mr. Bernanke also echoed the false claim that the mortgage credit market – one of the most tightly regulated sectors of the economy – somehow suffered from “too little regulation”. It should be obvious that his aim was to deflect blame from where it should have been rightfully placed: the loose monetary policy of the Federal Reserve and the system-immanent drawbacks of a fiat money-based fractional reserve banking system that can expand the supply of money and credit willy-nilly. |

How to Make the Financial System Radically SaferAt the same time, the new financial reforms haven’t minimized risk. Moreover, they’ve set taxpayers – that’s you – up for a future fleecing. Congressman Robert Pittenger elaborated this fact in a Forbes article last year:

What gives? Regulations, in short, attempt to control something by edict. However, just because a law has been enacted doesn’t mean the world automatically bends to its will. In practice, regulations generally do a poor job at attaining their objectives. Yet, they often do a great job at making a mess of everything else. Dictating how banks should allocate their loans, as Dodd-Frank does, results in preferential treatment of favored institutions and corporations. This, in itself, equates to stratified price controls on borrowers. And as elucidated by Senator Wallace Bennett over a half century ago, price controls are the equivalent of using adhesive tape to control diarrhea. |

The dangerous conceit of the clueless… the house of cards they have built is anything but “safe” and they most certainly can not “fix anything”. Listening to their speeches that seems to be what they genuinely believe. A rude awakening is an apodictic certainty, but we wonder what or who will be blamed this time. Not enough regulations? - Click to enlarge The largely absent free market? As they say, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” (this quote is often erroneously attributed to Mark Twain: we think it doesn’t matter whether he created it, it is often quite apposite and this is a situation that certainly qualifies). |

The point is that planning for future taxpayer-funded bailouts as part of compliance with destructive regulations is asinine. In this respect, we offer an approach that goes counter to Fed Chair Janet Yellen and the modus operandi of all central planner control freaks. It’s really simple, and really effective.

The best way to regulate banks, lending institutions, corporate finance and the like, is to turn over regulatory control to the very exacting, and unsympathetic, order of the market. That is to have little to no regulations and one very specific and uncompromising provision:

There will be absolutely, unconditionally, categorically, no government funded bailouts.

Without question, the financial system will be radically safer.

Chart by: Gallup

Chart and image captions by PT

MN Gordon is President and Founder of Direct Expressions LLC, an independent publishing company. He is the Editorial Director and Publisher of the Economic Prism – an E-Newsletter that tries to bring clarity to the muddy waters of economic policy and discusses interesting investment opportunities.

Full story here Are you the author? Previous post See more for Next postTags: central-banks,newslettersent,On Economy