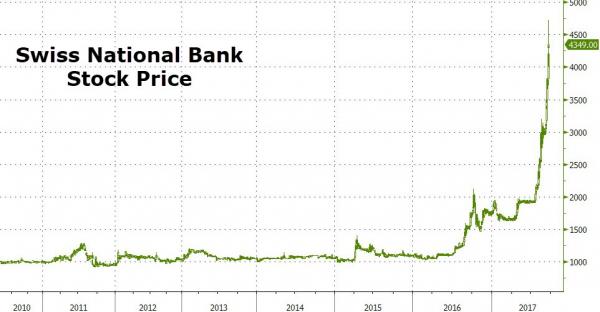

| The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. |

SNB Stock Price, 2010 - 2017(see more posts on Swiss National Bank Stock, ) |

| That sounds like a ‘tulip’ bubble-like ‘fraud’… |

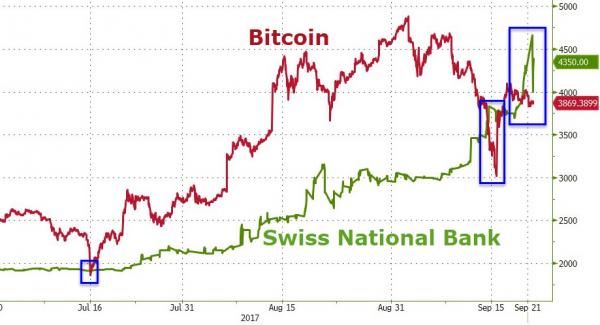

Bitcoin and SNB, 2013 - 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) |

| The SNB is up over 120% in Q3 so far – more than double ‘bubble’ Bitcoin… |

SNB and Bitcoin, Jul 2017 - Sep 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) |

Let’s check with the markets ultimate arbiter of what’s fraud and what’s real – JPMorgan CEO Jamie Dimon:

In fact, The SNB farce is now hitting the mainstream media… WSJ notes The SNB is a rarity among rarities. Only a handful of central banks – including Japan and Belgium as well as the Swiss – have private shareholders. |

Bitcoin and SNB, Jul 2017 - Sep 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) |

…those looking for a good reason behind the rally, or trying to judge whether the stock is fairly valued, will likely be disappointed.

While the SNB does release monthly data on its balance sheet and quarterly profit, it doesn’t issue the reams of financial metrics that most listed companies do. The central bank also isn’t covered by analysts in the same way as commercial banks or companies.

UBS economist Alessandro Bee, who covers the SNB as a central bank and not as a stock, said he sees no particular reason why the stock rose.

There are only 100,000 shares outstanding and the stock is thinly traded, which can exaggerate price moves. On an average day, about 174 SNB shares are traded, compared with nearly 12 million for Credit Suisse AG.

* * *

So Jamie – is The Swiss National Bank a fraud?

Tags: Belgium,Bitcoin,Business,central banks,Credit Suisse,economy,Finance,Financial crises,Jamie Dimon,Japan,JPMorgan Chase,money,newslettersent,Swiss National Bank,Swiss National Bank Stock,UBS