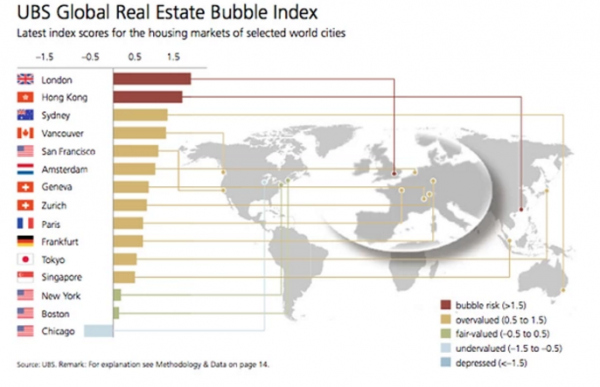

| Two years ago, when UBS looked at the world’s most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. |

UBS Global Real Estate Bubble Index - Click to enlarge |

What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank’s Global Real Estate Bubble Index, it found that eight of the world’s largest cities are now subject to a massive speculative housing bubble. And while perpetually low mortgage rates are clearly to blame for the rapid ascent of home prices, Chinese money laundering operations clearly seem to also be playing a role as their favorite markets of Vancouver, Toronto and Sydney all made this year’s list.

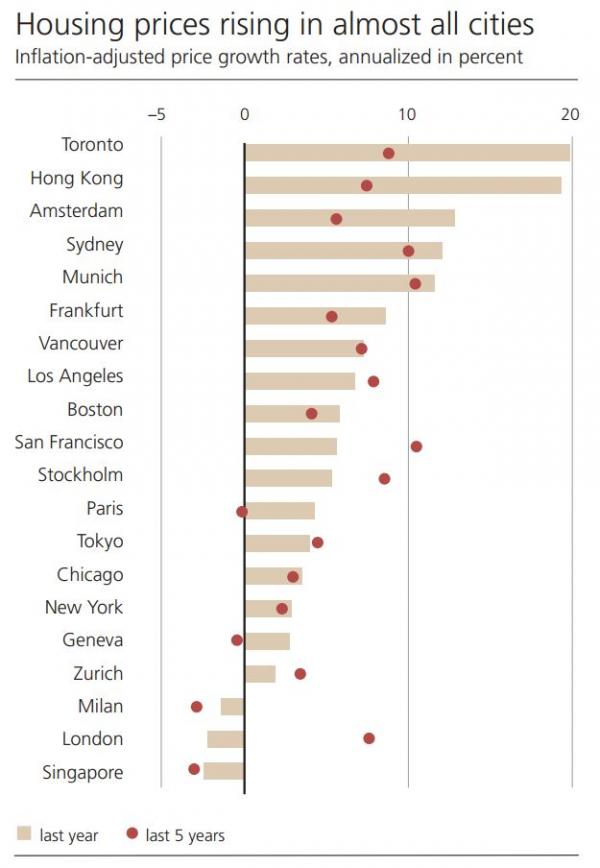

Bubble risk seems greatest in Toronto, where it has increased significantly in the last year. Stockholm, Munich, Vancouver, Sydney, London and Hong Kong all remain in risk territory, with Amsterdam joining this group after being overvalued last year. Valuations are stretched in Paris, San Francisco, Los Angeles, Zurich, Frankfurt, Tokyo and Geneva as well. In contrast, property markets in Boston, Singapore, New York and Milan seem fairly valued, while Chicago remains undervalued, just as it was last year.

Price bubbles are a regularly recurring phenomenon in property markets. The term “bubble” refers to a substantial and sustained mispricing of an asset, the existence of which cannot be proved unless it bursts. But recurring patterns of property market excesses are observable in the historical data. Typical signs include a decoupling of prices from local incomes and rents, and distortions of the real economy, such as excessive lending and construction activity. The UBS Global Real Estate Bubble Index gauges the risk of a property bubble on the basis of such patterns.

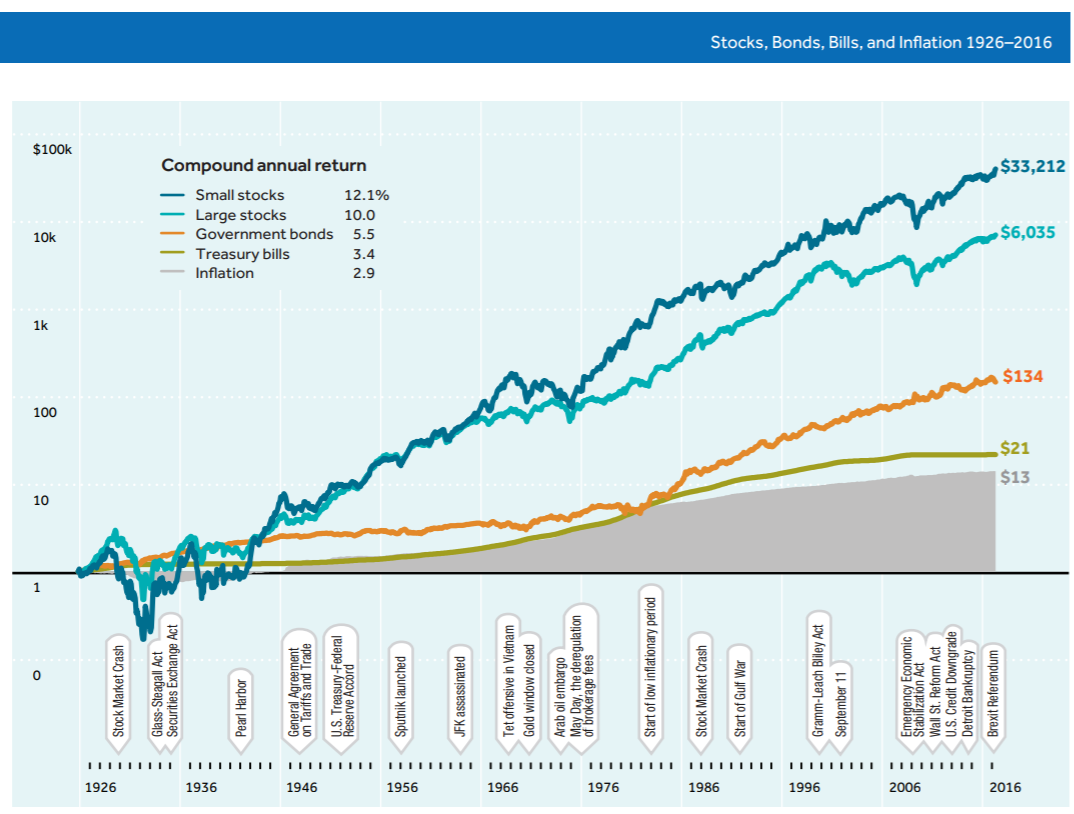

|

- Click to enlarge |

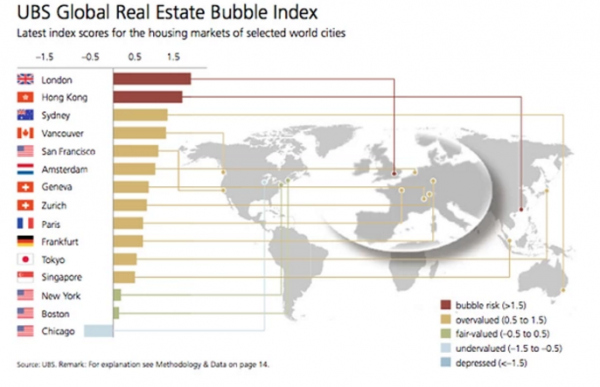

As UBS points out, artificially low interest rates in Europe, for example, have kept mortgage payments below their 10-year average despite real prices surging 30% since 2007.

Falling mortgage rates over the last decade have made buying a home vastly more attractive, which increased average willingness to pay for home ownership. In European cities, for example, the annual usage costs for apartments (mortgage interest payments and amortization) are still below their 10-year average, despite real prices escalating 30% since 2007. In Canada and Australia, too, a large part of the negative impact of higher purchase prices on affordability was cushioned by low mortgage rates.

The intuition is that the national and global growth of high-wealth households creates continued excess demand for the best locations. So, as long as supply cannot increase rapidly, prices in the so-called “Superstar cities” are supposed to decouple from rents, incomes and the respective countrywide price level. The superstar narrative has received additional impetus in the last couple of years from a surge in international demand, especially from China, which has crowded out local buyers. An average price growth of almost 20% in the last three years has confirmed the expectations of even the most optimistic investors.

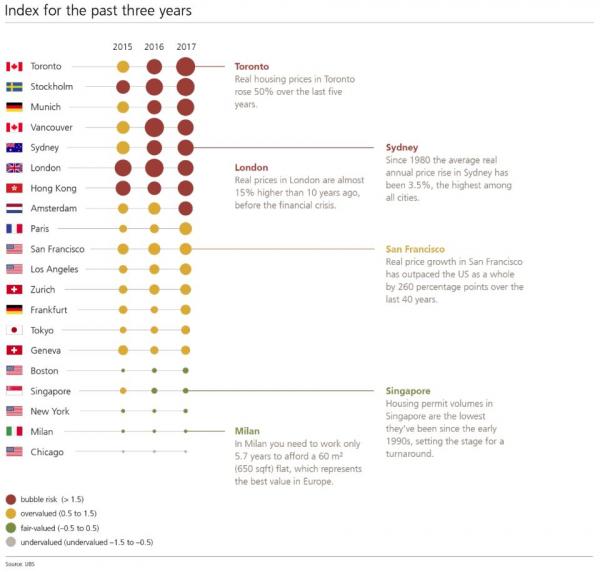

|

Index for the past three years - Click to enlarge |

Of course, at some point even artificially low interest rates can’t offset 10%-20% annual real home price increases, which imply a doubling of prices every 4-7 years.

Annual price-increase rates of 10% correspond to a doubling of house prices every seven years, which is not sustainable. Nevertheless, the fear of missing out on further appreciation predominates among home buyers. After all, the price increases appear rational, for three reasons.

First, financing conditions in many cities are now more attractive than ever before. Second, the global increase in wealthy households seemingly creates constant demand for the most attractive residential areas. Third, building activity cannot keep pace with this demand.

Expectations tend to be prone to exaggerations in boom phases. The optimistic projections of the trends outlined above create ever-greater price fantasies. However, should sentiment change or interest rates increase, a correction is practically inevitable. In the past, rising interest rates almost always triggered a crash in housing markets. In addition, the dependence of prices on international flows of capital represents an incalculable risk. Plus, once demand fell, even the low growth in supply would no longer provide an anchor.

|

Housing Prices - Click to enlarge |

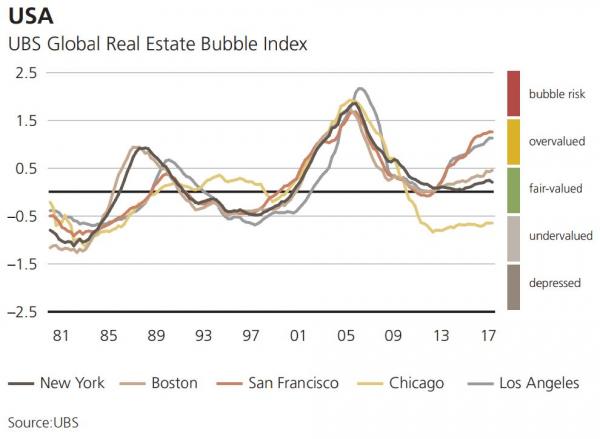

| Meanwhile, the U.S. has managed to avoid UBS’s bubble territory, and a repeat of the 2007 housing crisis, for now…even though markets like San Francisco and Los Angeles look set to give it another try… |

US UBS Global Real Estate Bubble Index, 1981 - 2017 - Click to enlarge |