Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

- Latest developments show risks in crypto currencies

- Confusion as bitcoin may split tomorrow

- SEC stepped into express concern over ICOs

- ICOs have so far raised $1.2 billion in 2017

- ICOs preying on lack of understanding from investors

- Physical gold not vulnerable to technological risk

- Beauty and safety in simplicity of gold and silver

Forks and ICOs solves bitcoin v gold debate

There is still a huge amount of noise in the bitcoin and cryptocurrency space but there have been a few developments of late which have pushed the space further into maturity.

From what I can tell from dinner party conversations people who are vaguely aware of bitcoin now know that there are two terms they need to throw into the chat in order to sound like they know what they are talking about. These two terms are ICO and Fork.

Price is also a major talking point at present. As ever the price of bitcoin remains volatile and headline-worthy.

This week will mark a point in cryptocurrency history as the most powerful of cryptocurrencies, bitcoin will experience a major technical change and the US regulator SEC has just made a significant announcement about fundraising in the space.

We have written previously about how bored we are with the bitcoin vs gold debate, but for those who still like to peddle it then they would do well to see how these latest developments put the issue to bed.

The break-up of the year

For a long time there has been a debate about the scaling of the bitcoin network. What is ultimately a required software upgrade has caused many arguments and fall-outs in recent years.

Pressure has been ramping up within the bitcoin community as to how certain problems can be resolved. The discussion may seem like something which is just technical but has at times become philosophical and political.

The main items up for debate are as follows:

Bitcoin is currently limited in the number of transactions it can process. Today, it can only process up to 1MB of transactions roughly every 10 minutes.

Owing to this limit, transactions take longer to approve during times of heavy use.

As all users pay a fee to miners to make transactions, this limitation on space has increased average fee costs.

Increasing the block size makes network nodes more costly, as node operators must store the entire copy of the blockchain as computer files.

Ultimately, the above comes down to the fact that the bitcoin network has failed to address problems associated with its current block size which are long wait times and high fees for transactions.

The debate has become so heated for obvious reasons – bitcoin was delivered to the world with a fairly strong set of principles.

However many believe that these principles either have to change in order to protect the future of the currency, or that the software must be upgraded in order to protect the principles.

A solution (called SegWit2x) had seemingly been reached, a week or so back. However not everyone was in agreement. As a result, last week a separate group of users announced that on August 1st they will split from off from bitcoin and create a new cryptocurrency called Bitcoin Cash.

This will likely cause a fork in the bitcoin network and result in two versions of the Bitcoin blockchain and two separate digital currencies. At this point there is likely to be a taking of sides by companies that operate within the bitcoin space.

The main difference between Bitcoin Cash and bitcoin is the block size. Bitcoin Cash will have a block size of 8MB, compared to Bitcoin’s 1MB block size. In theory Bitcoin Cash’s larger block size could prompt investors to flee Bitcoin in favour of the new currency. This would be negative for the original Bitcoin’s price.

Already I have received multiple emails from companies telling me which version they will be supporting and their reasons why.

So far it looks like the original bitcoin will be gaining the initial surge of support due to the unpredictability of something which was only announced a few day ago.

However, bitcoin owners will also end up with Bitcoin Cash (and a futures market is already open for the new currency) so we will watch this development with some interest.

What this whole drawn-out scenario will do, however, is serve as a reminder to regular crypto buyers and observers that no cryptocurrency is entirely without counterparties that can affect and arguably impact the future of your assets and the future value of them.

SEC, ICO and more acronymsIf you’ve been catching up with the latest series of House of Cards then ICO might sound like a reason for bitcoin to be banned outright as it is the fictional equivalent of ISIS. But ICO in the real world is a very different thing, it stands for Initial Coin Offering. |

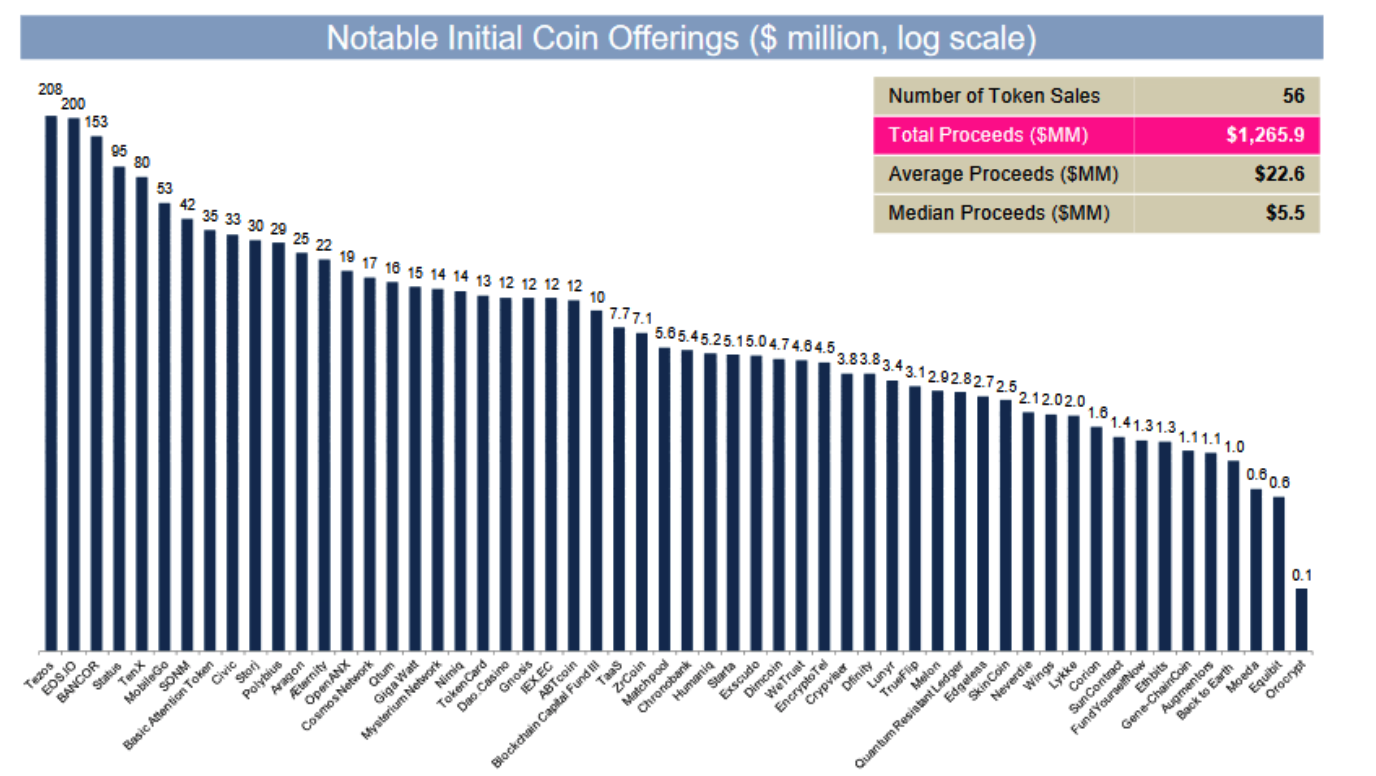

Notable Initial Coin Offering An ICO is defined as ‘An unregulated means by which funds are raised for a new cryptocurrency venture. ... In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, but usually for Bitcoin.’ - Click to enlarge |

| According to Autonomous NEXT, ICOs have raised $1.2 billion in 2017 alone. Given Ethereum raised ‘just’ $18.9 million in its 2014 ICO this shows phenomenal hype (or promise) in the space is growing rapidly.

The hype has even grabbed the attention of that expert-investor and cool-head that is Floyd Mayweather ahead of his big fight with Irish MMA champion Conor McGregor. McGregor is thought to be a bigger fan of gold than cryptos and has tweeted about bringing “more gold back to Dublin.” When you see this sort of thing it is an example of hype and suggests valuations may be frothy and on the speculative side. An ICO is really just a promise about the future of a cryptocurrency and the underlying technology. Most of them are attempts to bring innovation to the fintech space. However concerns have been raised over the lack of due diligence being carried out by investors’ and some ICO projects are playing on this. ICOs are the offering of crypto tokens which are bought by investors. This then funds ventures in the space. Inevitably the majority of them will fail, but many show great promise as we have seen with Ethereum. ICOs are almost certainly here to stay. Not only are we seeing a similar movement of people from traditional banking into ICOs as we did in the early days of blockchain tech. But we have also seen the SEC feeling the need to get involved. As we have seen with bitcoin, this network effect of growing stakeholders is justifying the ongoing existence and development of ICOs. Last week the SEC issued a guidance note that tokens issued by an Ethereum project called The DAO were securities. “The Commission applied existing U.S. federal securities laws to this new paradigm, determining that DAO Tokens were securities. The Commission stressed that those who offer and sell securities in the U.S. are required to comply with federal securities laws, regardless of whether those securities are purchased with virtual currencies or distributed with blockchain technology.” This means that all ICOs may be subject to regulations. This announcement was received relatively positively in the crypto space, however some experts believe the SEC are showing a lack of understanding as to how these things work: Blockchain engineer Elaine Ou pointed out on Twitter, ICO’s are “Untraceable, international, [have] no central authority, [and] funds can’t be frozen. The SEC ICO warning is the best ad for ICO’s.” What it ultimately shows, however, is that the blockchain space continues to impress with innovation and the amount of money it attracts. However, it is all extremely new, there is a lot of hype and open to a number of threats as well as opportunities. There will be significant creative destruction in the space. |

|

Conclusion – Beauty and safety in simplicity of gold and silverMany people bought bitcoin in the early days and have just sat on it. Happy in the knowledge that it didn’t cost them much and they’ll wait and see what happens to it. Most of these people check-in with the price and whilst the volatility might scare them they are ultimately delighted with the long-term price performance. The bitcoin price has (of course) felt the impact of the recent changes and debates. However the overall crypto space remains relatively resilient as the market-cap has remained fairly constant in the last week. However, the bitcoin price has faltered. The problem is that this so-called hard fork has got a lot of people worried. It has reminded bitcoin holders of the presence of counter-parties in the network, who are able to make decisions about your assets without your say so, whether they are the bitcoin miners or the regulators. Many googled terms include ‘will I still have my bitcoin after the hard fork?…What will happen to my bitcoin?…Will I own bitcoin cash as well as bitcoin?’ There is confusion and with confusion comes doubt which is never good for price. The ultimate lesson from all of this debacle is that bitcoin and other cryptos are not worthy substitutes for gold and silver, no matter how much some would like to push this idea. The joy of owning physical gold which is segregated and allocated in your name is that no-one can announce that they don’t like how gold is mined so they’re changing what you own. It cannot be manipulated in such a way. If you own gold coins or gold bars, it cannot disappear. It cannot be diluted or suffer a company take over or be hacked. It cannot be affected by alternative versions of it. Gold is gold and silver is silver. They do not change and are immutable. There is both beauty and safety in this simplicity. |

Balance Sheet Rise with ECB |

Tags: Australia,Bank of England,Bitcoin,Blockchain,Cryptocurrencies,Digital currency,Economics of bitcoin,Ethereum,European central bank,European Union,Fail,Finance,Futures market,India,International Monetary Fund,Jim Rickards,money,newslettersent,Reuters,Sovereigns,Switzerland,Twitter,U.S. Securities and Exchange Commission,Volatility,Yen,yuan