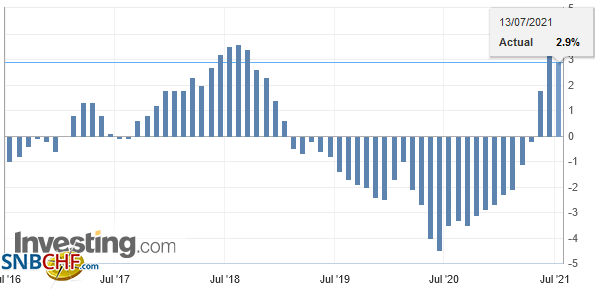

Swiss FrancSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. CHF Speculative PositionsLast data as of July 11: The net speculative CHF position has risen from -0.1K short to 0.2K contracts long (against USD). Speculators are long EUR against both USD and CHF. We wonder how long this will be the case, given that we expect Euro zone inflation to fall under 1% from December 2017 onward. With the slightest of gross position adjustments, speculators now have a net long Swiss franc position for the first time since the end of last year. |

Speculative PositionsChoose Currency source: Oanda |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

It may prove to be among the largest weekly adjustments to speculative positioning in the currency futures this year. In the CFTC reporting week ending July 11, speculators added 34.2k contracts to their gross short position, lifting it to 152.9k contracts. This gross short position is the largest in two years. The gross long position was trimmed by almost 3k contracts to 40.8k. The net short speculative position jumped to 112.1k contracts from 75k in the previous week. The bearishness toward the yen was matched by the bullish sentiment toward the other currency futures. Speculators reduced gross short positions in all of the other currency futures we track. The bulls preferred the Canadian dollar the most. They added grew their gross long position by 11.8k contracts to 46.1k, while squeeze the bears to cover 19k contracts, leaving 54.7k. The net short position was reduced for the seventh consecutive week, and could very well have switched to a net long position, given the surge following the Bank of Canada meeting a day after the reporting period ended. The other significant position adjustment was the short-covering in sterling. The gross short position fell by 11k contracts to 70.8k. It is been more than halved since late April. The gross long position of 46.6k contracts (a lost of 7.4k contracts on the week) is near the 12 week average. Although the euro gross positions were changed by less than 5k contracts, the net long position edged to a new six-year high of 83.8k contracts. The record was set in May 2007 around 120k. Interestingly, the record net short yen position was record a month later near 188k contracts. Among the currencies we track, speculators are only net short the yen, sterling and the Canadian dollar. Speculators have built their largest net long Mexican peso position in four years (97.9k contracts). Speculators in the 10-year Treasury note market mostly stood pat. The bulls trimmed 2.2k contracts leaving a gross long position of 822.7k contracts. The bears added 3.7k contracts, which lifted the gross short position to 565.7k contracts. These adjustment caused the net long position to fall by 6k contracts to 257k. The bears, perhaps sensing the near-term tide was changing, covered almost 22k contracts. The gross short position stands at 271k contracts. The bulls liquidated a little less than 5k contracts, giving them a gross long position of 629k contracts. The net long position increased by 17k contracts to 358k. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Full story here Are you the author?

Previous post See more for Next postTags: Commitment of Traders,newslettersent,Speculative Positions,USD/CHF