| According to Edmunds.com, in June 2017 the average length of a new vehicle loan has been stretched to a record 69.3 months. JD Power says that incentives last month were running at more than 10% of MSRP, the eleventh time over the past twelve months where manufacturers have so heavily discounted. And yet, the auto industry would have us believe that the problem is one of fleet sales rather than of consumers. |

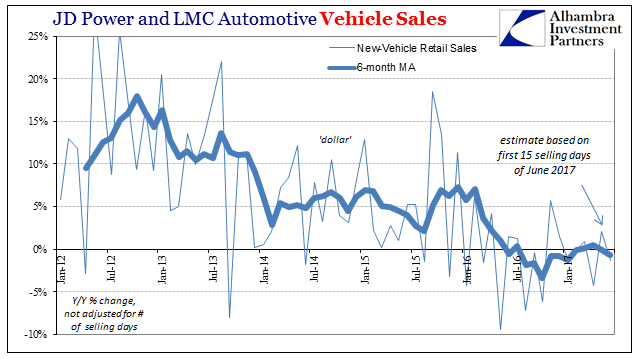

US JD Power and LMC Automotive Vehicle Sales, January 2012 - January 2017 |

|

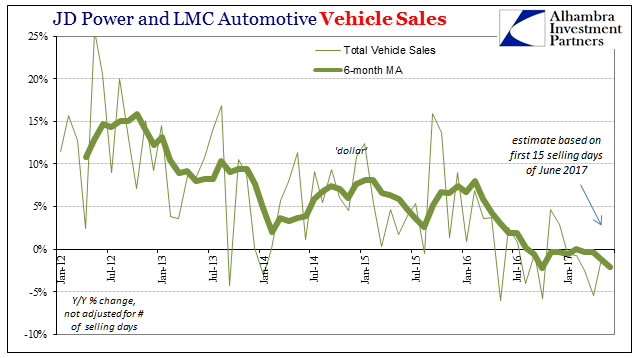

US JD Power and LMC Automotive Vehicle Sales, January 2012 - July 2017 |

| Because one segment is weaker than the other does not necessarily mean that both aren’t weak. By “economic fundamentals” GM’s economist is surely referring to the unemployment rate, the a variable that has yet to prove itself in projecting the right economic trend. Retail spending on automobiles for the first half of 2017 is expected to be down 1% from the same six months in 2016. That’s not a good cyclical indication, even more concerning when factoring the incentive aid as well as loan jiggering to make payments as low as possible. |

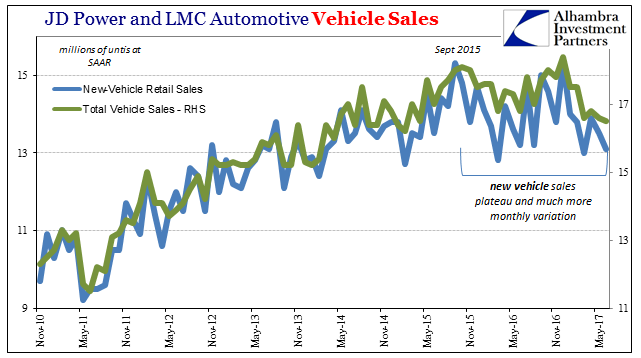

US JD Power and LMC Automotive Vehicle Sales, November 2010 - July 2017 |

| The auto segment is perhaps the sharpest cyclical signal of the US economy right now. Vehicle sales and finance escaped the 2012 slowdown largely on trend, remaining one of the few actually strong parts of an otherwise faltering “expansion.” It wasn’t until the full effects of the “rising dollar” that consumers, as well as fleet customers, finally pulled back – not into recession but at least of sudden caution. |

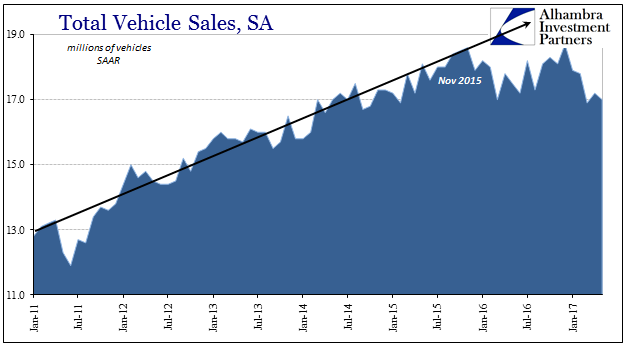

US Total Vehicle Sales, January 2011 - July 2017(see more posts on total vehicle sales, ) |

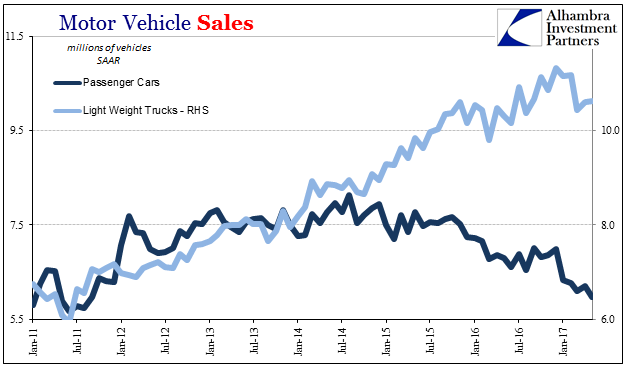

| For the month of June 2017, the (mostly) domestic carmakers reported another down comp: Ford -5% year-over-year; GM -4.7%; FCA -7.4%. The results from foreign manufacturers were only marginally better: Toyota +2.1%; +2.0%; Nissan Honda +0.8%. Almost all of the declines are due to car sales. Light trucks and SUV’s have sold better over the last few years, but not nearly enough to fully offset the sudden consumer distaste for cars. And now truck sales have in 2017 been pressured, too. |

US Motor Vehicle Sales, January 2011 - July 2017(see more posts on motor vehicle sales, ) |

| It seems to indicate another angle of what is largely eurodollar erosion and the economic unevenness that results from it. While it is easy to attribute the decline in car sales to the oil price crash, the decline could also be macro in nature. Cars tend to be purchased at the low end by the lowest income tiers, and if the economy overall struggles to generate consistent growth it is typically the worse off who become even worse off. |

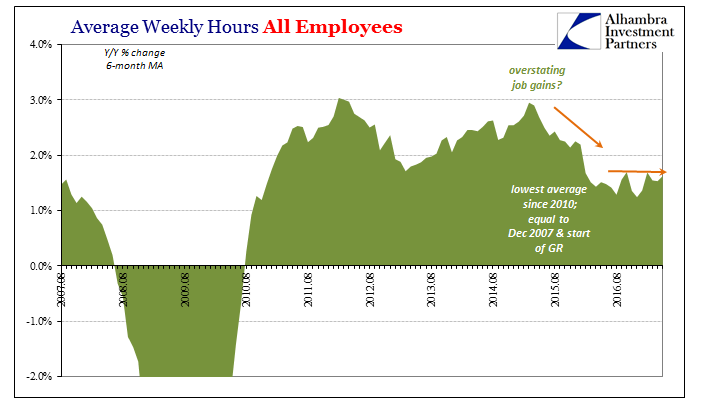

US Average Weekly Hours, August 2008 - July 2017 |

| Even if this broad segment of the labor force did not experience a cut in hours or the worst case in unemployment, the eruption of “global turmoil” could very well have induced enough uncertainty for these people to put off buying (meaning leasing) a new or even used car. If it was strictly a change in preferences due to the price of gasoline, we would expect to see closer to a one for one change car to truck. Instead, US consumers at the margins are increasingly forgoing autos in both segments for reasons beyond anticipated fuel costs. |

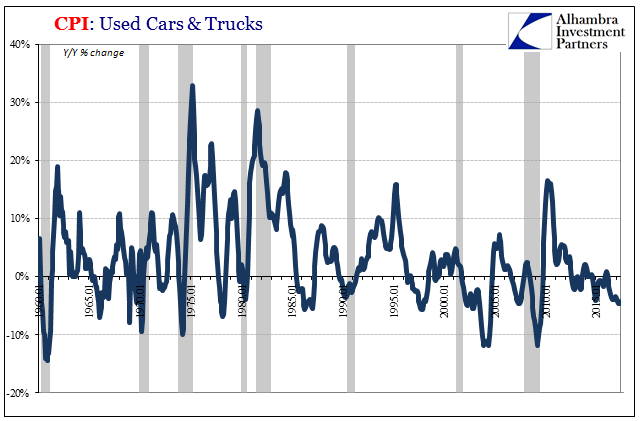

US Consumer Price Index: Used Cars and Trucks, January 1960 - July 2017(see more posts on U.S. Consumer Price Index, ) |

| The price behavior of used cars can tell us a lot about these kinds of cyclical conditions. The CPI’s measure of used car prices is a good fit with recession, not perfect but matching up consistently with at least periods of macro weakness (including several near-recessions). Carmakers have admitted their concern over what may be a glut of leased vehicles hitting the used car market in the years (even months) ahead, and while that will be a major factor for them it could be even more so given that the used car market isn’t exactly robust right now.

In other words, lower demand from consumers for all types of vehicles plus whatever may result from the supply of anticipated leasing transformation could mean a still lower downside risk to the auto segment than is currently figured. Production rates have already declined to a significant but not yet severe degree. With inventories still rising, it has the potential for putting together and combining all the wrong factors at the same time; a perfect confluence of negative trends that in cyclical terms might contribute much more than just the current minor economic drag. |

US Consumer Price Index: Used Cars and Trucks, January 1960 - July 2017(see more posts on U.S. Consumer Price Index, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: Auto Production,Auto Sales,currencies,economy,Federal Reserve/Monetary Policy,Ford,industrial production,industry,Markets,motor vehicle sales,newslettersent,total vehicle sales,U.S. Consumer Price Index