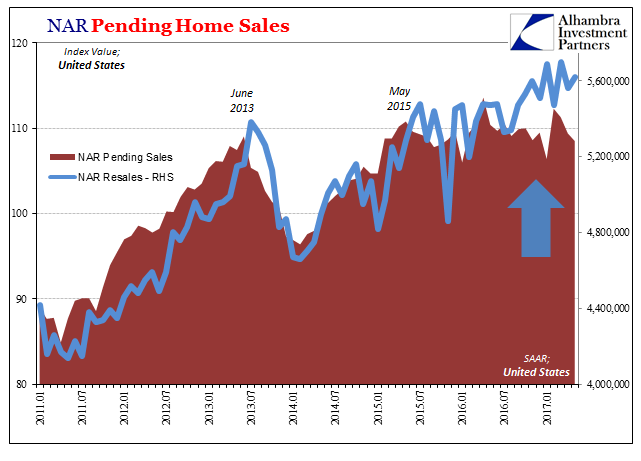

| The National Association of Realtors (NAR) reported today that pending home sales declined for the third straight month. As with so many other accounts, it’s not really the downside that is relevant but how instead there has been little to no growth for quite some time now. The NAR’s index value, which is how the organization reports the level of pending sales, was 108.5 in May 2017. That’s up 42% from the low in 2010, but also slightly less than the peak in June 2013. |

US Pending Home Sales, July 2010 - June 2017 |

| The immediate issue appears to be inventory, meaning the lack of it. In a separate report on resale activity, the NAR continues to estimate declining numbers of houses available for sale even though the real estate market in terms of price seems to be healthy. The change in inventory coincides, as you might expect, with the level of pending sales. The inflection for both occurs in the middle of 2015. |

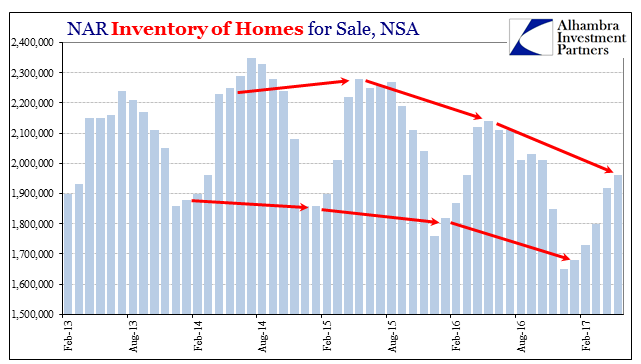

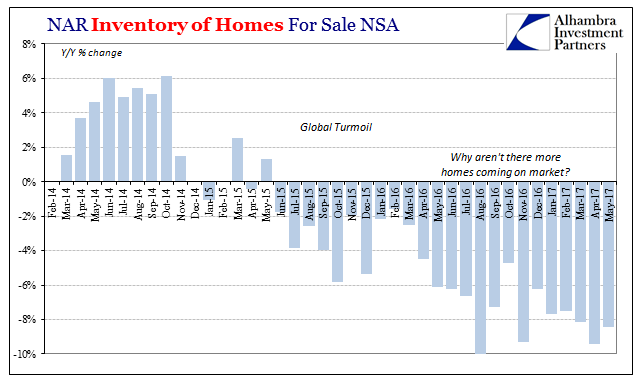

US Inventory of Homes for Sale NSA, February 2013 - June 2017 |

|

It is neither a housing correction nor anything like a bubble collapse. Rather it seems to be hesitation. Potential home sellers around summer 2015 appear to have grown more sensitive and cautious at the margins. Those people who might have otherwise been happy to sell and likely move up in size or price suddenly became reluctant to do so. The timing is the easy part, especially put into the context of that period. Janet Yellen and every economist in the media reassured the public as often as they could there was nothing to worry about, economy as well as finance. Oil prices had already crashed, there was crazy stuff going on in Europe (Switzerland especially), and then China, but none of that was supposed to matter. The US unemployment rate was low and getting lower, the BLS suggested by its accounts the “best jobs market in decades”, and, as noted earlier today, the contraction in manufacturing was dismissed as a mere 12% problem. It doesn’t appear as if, at the margins, the public was listening too much – and you can’t blame them. But that isn’t enough by itself to produce this stall in housing. If it was just financial drama in the stock market or even currencies, by the middle of 2016 these people would likely have shaken all that off and put it behind them; actual reflation. Instead, this doubt, concern, or apprehension has only lingered long afterward. It suggests, strongly, economic consequences of a downturn that wasn’t supposed to happen. |

US Inventory of Homes for Sale NSA, February 2014 - June 2017 |

| The majority of those appear to have hit the labor market after-the-fact. The actual trough of especially the manufacturing recession occurred last February, continuing by some measures to maybe May 2016. The BLS data, however, as well as additional figures for national income show that though the immediate contraction may have ended the effects remain with us.

It’s not supposed to happen this way, which is another reason why caution in real estate (autos, or just consumer spending in general) isn’t truly a mystery. A downturn that for most was totally out of the blue that also “unexpectedly” continues to produce weakness despite all assurances otherwise would quite rationally produce widespread caution especially about major, life-altering changes. Even for people not directly hit with a cut in hours or who fail to get much of a raise might become apprehensive in this environment. Judging by both inventory as well as the pending sales index, resale activity appears to be since late last year a bit ahead of the rest of the market. That likely means some significant weakness ahead in real estate. It may already be in progress in terms of home construction, but unless something changes relatively soon the bulk of the real estate market might be heading for a downward adjustment at perhaps the most inconvenient time for further “reflation” sentiment. |

US Pending Home Sales, January 2011 - June 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: consumer spending,consumers,currencies,economy,Federal Reserve/Monetary Policy,Housing market,Inventory,Markets,newslettersent,Real Estate,resales