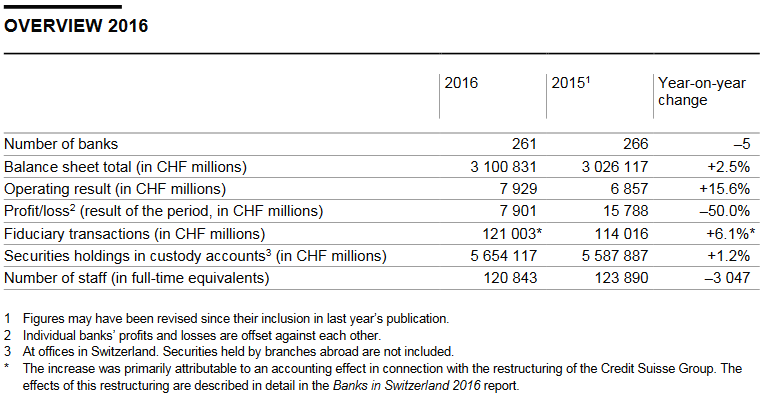

Results from the Swiss National Bank’s data collectionSummary of the 2016 banking yearIn 2016, 226 of the 261 banks in Switzerland reported a profit, taking total profit to CHF 11.8 billion. The remaining 35 institutions recorded an aggregate loss of CHF 3.9 billion. The result of the period for all banks was thus CHF 7.9 billion. The aggregate balance sheet total rose by 2.5% to CHF 3,100.8 billion. On both the assets and the liabilities side s, domestic business grew in importance compared to foreign business. On the assets side, domestic mortgage loans continued to rise (up 2.7% to CHF 949.3 billion). On the liabilities side, customer deposits registered an overall increase (up 2.7% to CHF 1,770.6 billion). At the end of the year under review, customer holdings of securities in custody accounts amounted to CHF 5,654.1 billion (up 1.2% ). Fiduciary funds administered by banks increased to CHF 121.0 billion. The number of staff employed by banks declined by 3,047 to 120,843 employees (full-time equivalents). The decrease affected staff both in Switzerland (down 1,660 employees) and abroad (down 1,387 employees). |

Overview 2016 Source: www.snb.ch - Click to enlarge |

Income statement

Of the 261 banks, 226 recorded a profit amounting to a total of CHF 11.8 billion . A total of 35 banks recorded an aggregate loss of CHF 3.9 billion. The aggregate result of the period was thus CHF 7.9 billion, which was half as much as in the previous year. However, in making this comparison, it must be noted that in 2015, the big banks generated especially high extraordinary income of CHF 10.7 billion, which was also reflected in the aggregate result of the period for all banks. In 2016, the extraordinary income in the big banks category subsided sharply to CHF 2.2 billion.

The gross result from interest operations fell by CHF 0.7 billion to CHF 24.1 billion. Interest income remained virtually unchanged, while interest expenses increased. Commission business and services declined again (down CHF 1.5 billion to CHF 20.9 billion). The result from trading activities and the fair value option came to CHF 6.2 billion, while the other result from ordinary activities amounted to CHF 11.4 billion. Personnel expenses increased by CHF 0.2 billion to CHF 26.1 billion; total operating expenses advanced by CHF 1.2 billion to CHF 46.0 billion. Thus in 2016, the operating result came to CHF 7.9 billion (2015: CHF 6.9 billion).

The pro fit/loss (result of the period) item is calculated by adding extraordinary income (CHF 3.0 billion) and the changes in reserves for general banking risks ( CHF –0.6 billion) to the operating result, and deducting extraordinary expenses (CHF 0.1 billion) and taxes (CHF 2.3 billion). At CHF 7.9 billion, the result of the period was at the same level as the operating result.

Balance sheet

In the year under review, the aggregate balance sheet total for all banks in Switzerland rose by CHF 74.7 billion to CHF 3,100.8 billion (up 2.5%). Large increases were registered by the big banks (up CHF 30.6 billion), stock exchange banks (up CHF 16.3 billion), cantonal banks (up CHF 15.8 billion), and Raiffeisen banks (up CHF 12.9 billion). The strongest decline was recorded by the foreign -controlled banks (down CHF 13.5 billion). On both the assets and the liabilities side s, the share of domestic business grew in import ance compared to foreign business.

Overall, liquid assets climbed by CHF 51.1 billion to CHF 520.0 billion (up 10.9%). As in the year before, domestic liquid assets rose sharply (up CHF 61.5 billion to CHF 460.4 billion), while foreign liquid assets declined (down CHF 10.3 billion to CHF 59.6 billion). The growth in Switzerland primarily reflects the rise in sight deposits held by banks at the SNB (up CHF 60.6 billion to CHF 447.0 billion) in connection with the SNB’s foreign currency purchases.

Domestic mortgage loans continued to rise, amounting to CHF 949.3 billion (up 2.7%) by the end of 2016. Thus, as in 2015, they represented more than 30% of the aggregate balance sheet total. Apart from the big banks category (down 0.3% to CHF 260.6 billion), all bank categories registered an increase in domestic mortgage claims, especially the cantonal banks (up 4.3% to CHF 342.9 billion) and Raiffeis en banks (up 4.3% to CHF 164.9 billion). Sundry loans, which are reported in the balance sheet under amounts due from customers, receded by CHF 21.0 billion to CHF 573.3 billion. They thus accounted for approximately one -fifth of the aggregate balance sheet total. The main reason for the decrease was the decline in amounts due from foreign customers (down CHF 27.5 billion to CHF 415.1 billion). Amounts due from domestic customers, by contrast, rose by CHF 6.5 billion to CHF 158.2 billion.

Amounts due in respect of customer deposits registered an increase of 2.7% to CHF 1,770.6 billion, with domestic deposits accounting for the largest part of this increase (up CHF 40.9 billion to CHF 1,135.7 billion). Amounts due in respect of customer deposits from abroad rose by CHF 6.5 billion to CHF 634.9 billion. Amounts due in respect of customer deposits represented somewhat less than 60% of the aggregate balance sheet total in 2016.

Employment

Banks reduced their staff numbers – in terms of full-time equivalents – to 120,843 (down 3,047 or 2.5%). The number of staff employed in Switzerland declined to 101,382 (down 1,660 or 1.6%) and the number abroad decreased to 19,461 (down 1,387 or 6.7%). At 38.5%, the proportion of employed women remained almost unchanged.

Further information

The Banks in Switzerland 2016 report and the Overview of reporting banks in Switzerland 2015/2016 can be downloaded via the SNB’s website at www.snb.ch, Statistics, Statistical publications.

The data, and the methodological basis and explanatory notes, are now available on the SNB’s data portal: data.snb.ch. Users can retrieve data in the form of configurable tables and access comprehensive datasets.

The printed version of the report may be obtained from the SNB libraries.

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent