Swiss Franc |

EURCHF - Euro Swiss Franc, April 26(see more posts on EUR/CHF, ) |

GBP/CHFLast week Theresa May called a snap General election due to take place on 8th June. Historically a snap election has caused the currency in question to weaken, however on this occasion Sterling strengthened. It was a shrewd move by May to call an election while the competition is so weak. A conservative government is seen as the safe bet for the UK economy and this caused a surge in investor confidence which in turn strengthened the pound. Following the triggering of article 50 trade negotiations will be vital to the value of the pound. Theresa May has indicated of late that it may be possible to use the blue-print from current EU deals with other nations for the UK. Essentially, copy and pasting existing deals to greatly reduce the time scale on negotiations. She has however admitted negotiations could well exceed the two year target. Poor Sir Ivan Rogers, former EU ambassador had resigned before her statement due to the unrealistic target stating it could take as long as a decade to complete trade negotiations. I am of the opinion we have seen the worst levels for GBP/CHF for the foreseeable future when GBP/CHF struck 1.19 in November last year. I am of the opinion Sterling is undervalued and as trade negotiations become more apparent the pound will have the opportunity to strengthen. With Trump in power my job could now become distinctly tougher. His unpredictability and rash decisions are sure to cause significant volatility during his tenure. The North Korean situation demonstrates this. He already has the USS Carl Vincent aircraft carrier heading towards the Korean peninsula, let us hope it is simply posturing. During times of conflict investors move their funds into safe haven currencies and with the US currently at the forefront of any potential conflict the Swiss Franc could well be the destination of choice. If the situation escalates expect the Swiss Franc to strengthen. |

GBP/CHF - British Pound Swiss Franc, April 26(see more posts on GBP/CHF, ) |

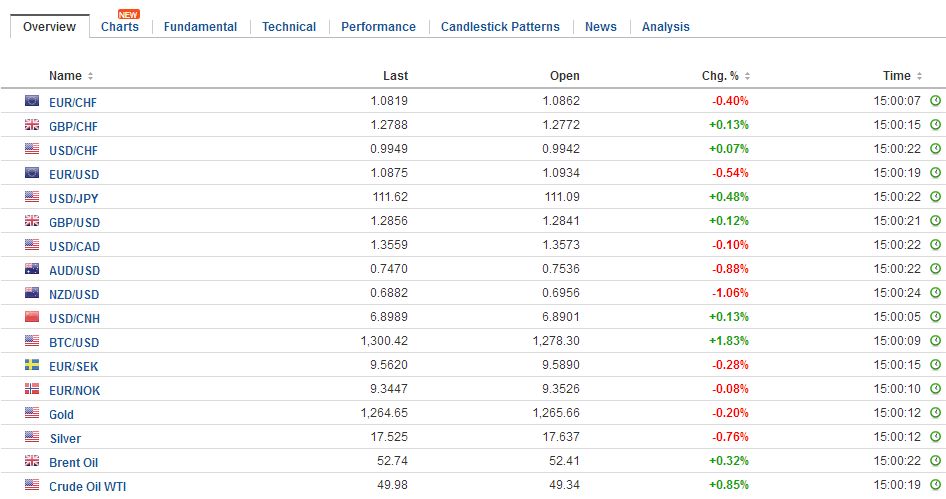

FX RatesThe US dollar was marked down in response to the French election and saw some follow through selling yesterday, but the momentum had slowed, and now it is stalled. The greenback is posting upticks against nearly all the major currencies. There is a good reason to be cautious. We have mentioned it before, but think it is important that speculator in the futures market had a record gross long euro position, according to Bloomberg data. The dollar overhang that may have helped cap it at the start of the year is no longer the case. |

FX Daily Rates, April 26 |

| The euro made a marginal new high (~$1.0950) in Asia before backing off a half cent in the European morning. Initial support is seen near $1.0880. The gap from Monday’s sharply higher opening is a key part of the technical picture. There has not been a serious attempt to close the gap yet.

The dollar-bloc currencies have traded heavily in recent data. The Australian dollar is flirting with support around $0.7500, though the low from earlier this month was seen near $0.7470, three-month lows. Similarly, the New Zealand dollar is testing support at $0.6900. The low for the year was set in early January near $0.6885. |

FX Performance, April 26 |

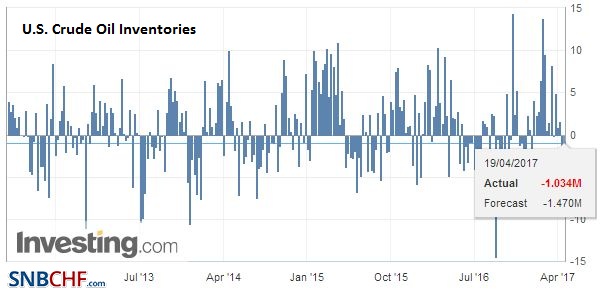

United StatesThe June light sweet oil futures contract snapped a six-day losing streak yesterday but is back on the downside today. API estimated oil inventors rose nearly 900k barrels, while expectations were for a draw down. Gasoline inventories swelled by 4.45 mln barrels, nearly 10-times more than expected. The Bloomberg survey has the median forecast for a 1.1 mln barrel fall in the DOE’s estimate and a 140k increase in gasoline inventories. After moving below $50 a barrel last week, it has not been able to resurface above it. Yesterday’s low was near $48.85. The low from the last month, which is also the low for the year, was another dollar lower.

|

U.S. Crude Oil Inventories, March 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

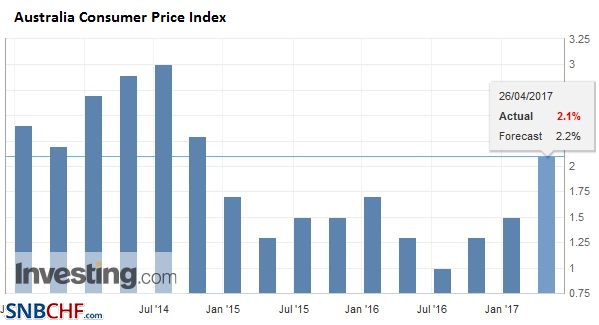

AustraliaThe only data of consequence today has been the Q1 Australian CPI figures. The 0.5% headline increase was a touch softer than expected. The year-over-year pace increased from 1.5% in Q4 16 to 2.1%, which also was on the soft side of expectations. It underscores the RBA’s decision to stand pat. Many have not given up ideas that the RBA may still have to ease policy later this year. |

Australia Consumer Price Index (CPI) YoY, April 2017(see more posts on Australia Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Eurozone

The eurozone preliminary April CPI will be reported the day after the ECB meets. The pace is expected to pick up after the soft March figures. The core rate may return to levels around last year’s 0.9% average. Even when it was there, Draghi was disappointed with the of momentum.

Yesterday, “ECB sources,” said played up the possibility of a change in June. These sources have their own ax to grind. Who are such sources? It would not be Draghi or his allies. It would most likely be the hawks, who have resisted the unorthodox measures at nearly every step in the process. At the BOJ and Federal Reserve, we have noted that the power of appointment rather than a direct challenge to the independence of the central bank is how the elected officials will influence the monetary policy. There is no such mechanism at the ECB.

By citing the June meeting days before the April meeting would seem to suggest that the “sources” recognize that they have little chance of resisting Draghi now. Indeed, we suspect the risk is that Draghi is more dovish than the euro longs expect. Macron’s entry to the second round of the French election, and the likelihood that he wins removes some downside political risk, but it does nothing about the lack of traction in prices.

Many observers have bought the line from the hawks that the ECB can change its stance shortly. Recall, some German and Austrian officials have floated the idea of a rate hike before the end of the asset purchases; a different sequence than the Federal Reserve. Draghi and others pushed back, though it was not until the March core CPI came out at 0.7%, after bottoming in 2015 at 0.6% that the hawks had been silenced.

United States

The light economic calendar will give US President Trump an uncluttered stage for his tax plan announcement. Some of the thunder apparently has already been stolen. Reports indicate he will seek to cut corporate taxes to 15% and offer a repatriation of offshore earnings (~$2.6 trillion) at a 10% rate. One of the drivers of the stock market’s advance in recent days is the strong earnings being reported. American companies are enjoying record profits. As some central banks reduce their Treasury holdings, US corporations excess savings (over investment) makes them important investors in the US Treasury market.

The controversial border adjustment tax (BAT) is not expected to be included. If it is, it would likely elicit a strong market response. Many economists have argued it such a tax would “automatically” boost the dollar. We have been skeptical of what we see is an oversimplification and misuse of purchasing power parity, and a mistakenly quaint sense of what drives the foreign exchange market (capital flows not trade flows).

The border adjustment tax, as conceived by House Republicans, would raise around $1 trillion, like the reform of health care, and the combined $2 trillion finance tax reform. However, health care reform has not been delivered, and the compromises being discussed, raise considerably less than previously anticipated. Similarly, without the BAT the risk is that the deficit and debt levels grow, which in turn may exert upward pressure on yields.

Trump has been in office for nearly 100 days. His strategy is to make a bold claim and then compromise back, as has happened in China, the origin of steel for the Keystone Pipeline, and who will finance the wall he wants on the Mexican border. The tax ideas he will present today should be seen as a negotiating position.

Canada

We think the market may be exaggerating the pressure on the Canadian dollar coming from the trade tensions with the US. Lumber and dairy cover a small part of the bilateral trade, and the capital flows are many times more than the trade flows. We also think that so far the Trump Administration has not shown a sustained effort in any one area. Canada will soon be off the radar screen. Is that not what the performance of the Mexican peso shown? As we noted yesterday, with our expectation of additional Fed hikes, we look for the US dollar to trend higher, including against the Canadian dollar. However, we expect the Canadian dollar to outperform the Mexican peso after more than a 17.5% drop since the start of the year.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$AUD,$CAD,$EUR,Australia Consumer Price Index,ECB,EUR/CHF,FX Daily,gbp-chf,newslettersent,NZD,Taxes,U.S. Crude Oil Inventories